- United States

- /

- Commercial Services

- /

- NYSE:RSG

How Republic Services’ Sustainable Push Impacts Its 2025 Valuation After a 170% Five-Year Rally

Reviewed by Bailey Pemberton

Thinking about what to do with Republic Services stock? You are not alone. Plenty of investors are debating whether it is a smart buy, stretched too far, or still hiding untapped value. The stock has quietly posted a sturdy 11.5% gain so far this year, outpacing the broader market and adding to an impressive 170.5% return over the past five years. That said, the last 30 days have brought a slight dip of 1.9%, reminding us that even steady growers experience a breather now and then. Over just the past week, Republic Services bounced back by 1.5% as fresh optimism returned to the shares.

One factor that has recently caught investor attention is Republic Services’ expansion into sustainable solutions. The company has ramped up its investments in recycling technologies and landfill gas projects, aligning with new regulatory tailwinds and corporate net-zero commitments. While this has not led to a dramatic shift in short-term risk perception, it adds to the long-term growth story underpinning the stock’s appeal.

If we turn to how Republic Services looks on a valuation basis, here is where the debate really heats up. The company earns a value score of 2 out of 6, which means it is currently undervalued in two out of six common checks. Coming up, we will break down what these valuation approaches really mean for your decision. And before we finish, I will show you a smarter, more nuanced way to think about valuing Republic Services that goes beyond the usual metrics.

Republic Services scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Republic Services Discounted Cash Flow (DCF) Analysis

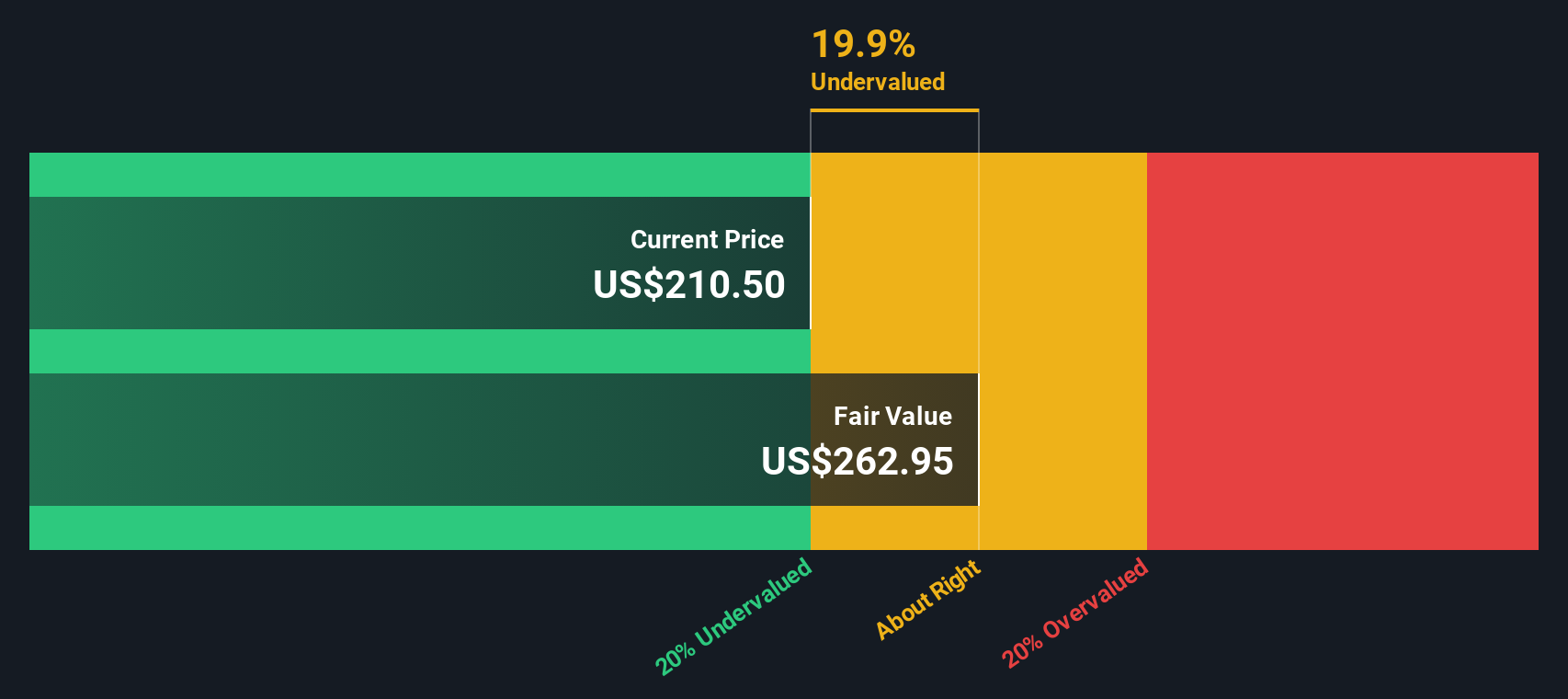

A Discounted Cash Flow (DCF) model estimates the fair value of a company by forecasting its future cash flows and discounting them back to today's dollars. This approach focuses on how much cash a business can generate in the future and what that stream of cash is worth in present terms.

For Republic Services, the current Free Cash Flow stands at $2.34 Billion. Analyst projections suggest steady growth, with Free Cash Flow forecast to reach around $3.41 Billion by 2029 and $4.61 Billion by 2035. Analysts provide estimates up to five years; further projections are calculated using industry models.

Based on these discounted future cash flows, the DCF analysis calculates an estimated intrinsic value of $263.18 per share. This implies that the stock is trading at a 15.2% discount to its intrinsic value, indicating it is undervalued versus what its future cash flow potential suggests.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Republic Services is undervalued by 15.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Republic Services Price vs Earnings

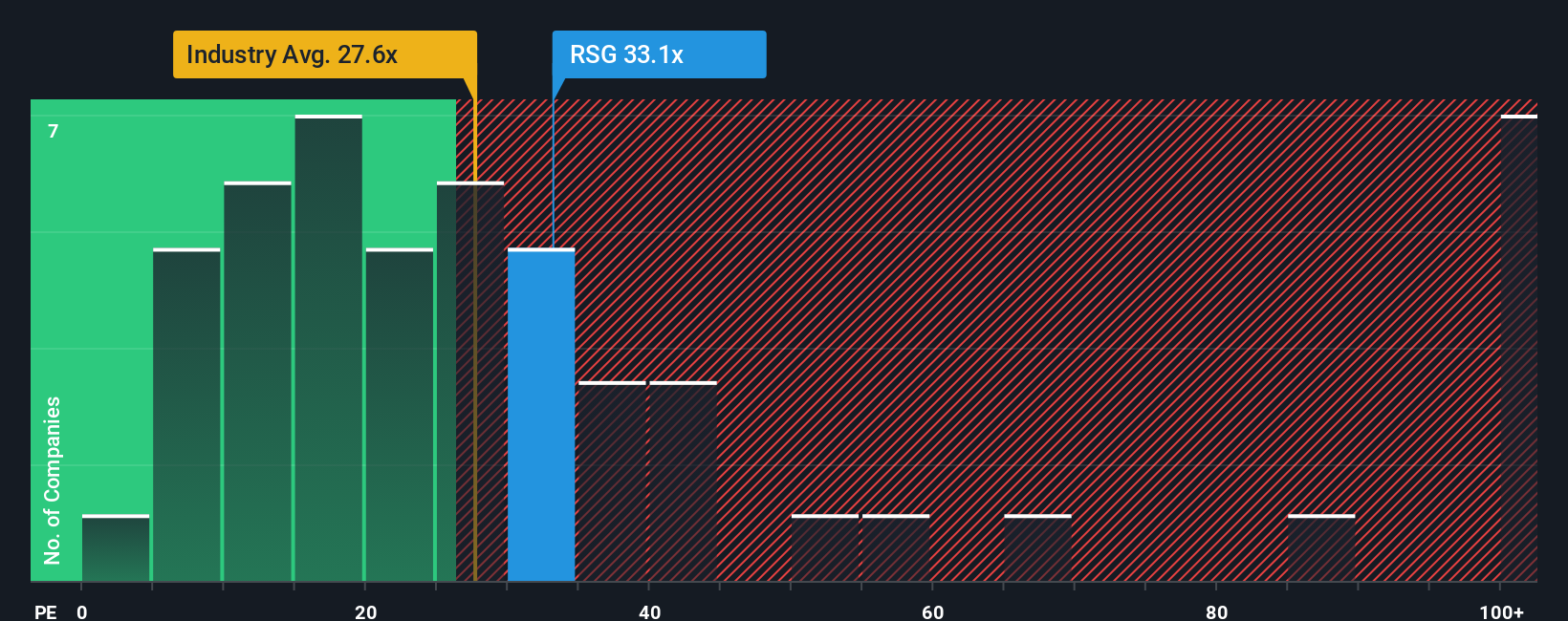

When analyzing profitable companies, the Price-to-Earnings (PE) ratio is often the go-to valuation metric. It measures how much investors are willing to pay for each dollar of a company’s earnings, making it straightforward to compare with similar businesses. Typically, companies that are growing rapidly or seen as less risky can support a higher PE, while slower growers or riskier firms warrant a lower ratio.

Republic Services currently trades at a PE ratio of 32.8x. To put this in perspective, the average PE for the Commercial Services industry stands at 27.1x, while its direct peers average around 47.4x. While Republic Services commands a slight premium to its industry, it remains far below many of its peers.

Rather than relying solely on broad averages, Simply Wall St calculates a “Fair Ratio” for each company. In this case, that is 31.3x for Republic Services. This custom benchmark considers not only the company’s earnings growth and risk profile, but also its industry, profit margins, and market cap. Because it reflects a more tailored and comprehensive view, comparing Republic Services’ current PE to this Fair Ratio gives investors a clearer picture of its relative value.

With Republic Services’ actual PE ratio so close to its Fair Ratio, the stock appears fairly valued by this measure.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Republic Services Narrative

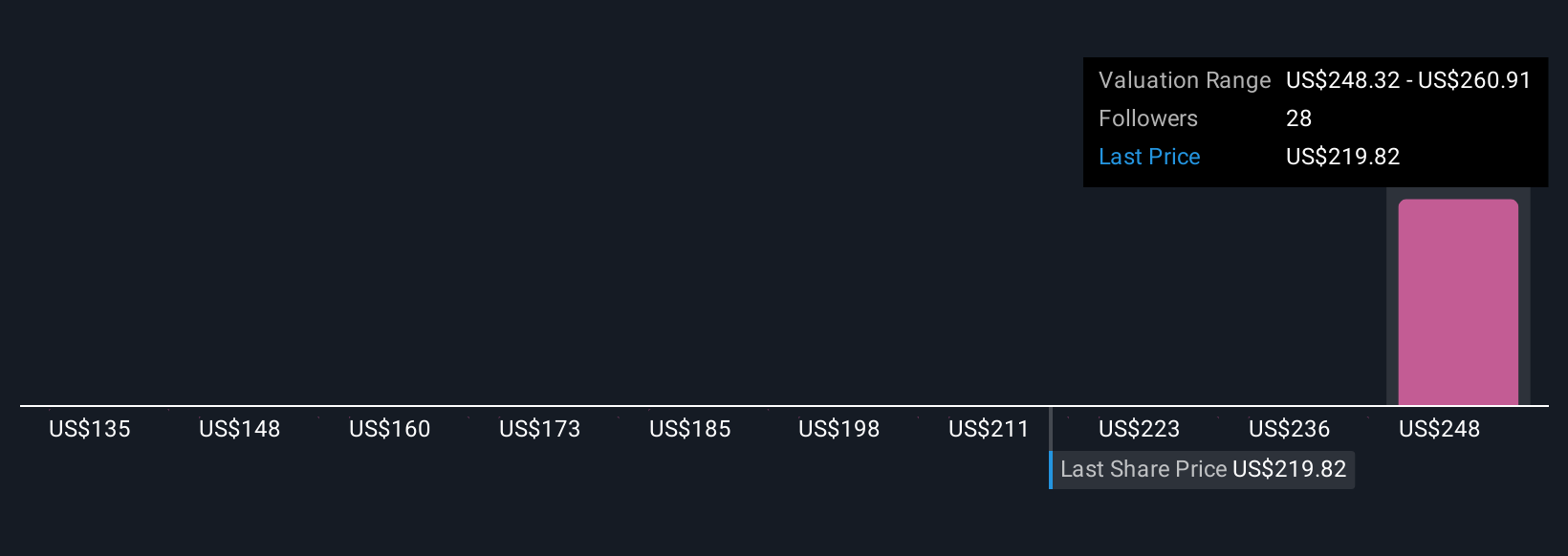

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply your story about a company, anchored in your unique outlook. It connects your assumptions about its future revenue, earnings, and profit margins with your own view of what the company is really worth. Narratives link the story behind Republic Services' business to a concrete financial forecast, which then leads to a personal estimate of fair value.

With Narratives, available on Simply Wall St's Community page, you do not need to be a finance expert. Millions of investors use this tool to define their thesis, compare it to the current share price, and quickly see whether Republic Services looks attractive or overpriced based on their own criteria. Narratives update dynamically as new information such as news or quarterly results comes in, allowing your view to stay in sync with real-world events.

For example, using Narratives, one investor might project robust growth from Republic Services' digital upgrades and sustainability efforts, assigning a price target as high as $290. Another might focus on stagnant industry volumes or integration risks, setting a much lower target near $189. Narratives empower you to make more informed, confident decisions based on your own research and beliefs, not just consensus estimates.

Do you think there's more to the story for Republic Services? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RSG

Republic Services

Offers environmental services in the United States and Canada.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives