- United States

- /

- Commercial Services

- /

- NYSE:ROL

Rollins (ROL): Evaluating Valuation After $1 Billion Equity Offering and Major Insider Sale

Reviewed by Simply Wall St

Rollins recently drew investor attention after completing a $1 billion follow-on equity offering and disclosing a major insider sale by a 10% owner. These events are significant, as they can shape short-term sentiment and affect stock performance.

See our latest analysis for Rollins.

This wave of insider selling and the billion-dollar equity raise came just as Rollins was gearing up for its appearance at the high-profile Baird Global Industrial Conference. Even after these headline events, the share price has been resilient, climbing nearly 26% year-to-date, and its 1-year total shareholder return stands at 17%. That momentum suggests investors see growth potential on the horizon, despite the shifting ownership dynamics and fresh capital injection.

If you’re looking to widen your search beyond the latest equity deals and insider moves, now is a good time to explore fast growing stocks with high insider ownership.

With Rollins’s share price trending higher even after significant insider selling and a major capital raise, the question remains: is the stock trading below its true value, or have optimistic investors already priced in future growth?

Most Popular Narrative: 5.9% Undervalued

With the most popular narrative pegging Rollins's fair value at $61.61, the stock seems to have a small upside compared to its $57.96 closing price. Investors are weighing this premium against ongoing confidence in the company’s recurring contracts and robust expansion plans.

The acquisition of Saela Pest Control is expected to add between $45 million to $50 million in revenue in 2025 and is anticipated to be accretive to earnings, signaling potential revenue growth and earnings enhancement. Continued strategic investments in sales staffing and marketing are expected to drive organic growth, particularly as the pest control season ramps up, which could lead to increased revenue.

Curious what ambitious growth scenario justifies these high expectations? The narrative hinges on future earnings expansion, bolder profit margins, and a premium multiple that may surprise. Get the inside track on the bullish blueprint that is driving this fair value call. What forecasts are hidden behind the headline number?

Result: Fair Value of $61.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing cost pressures and tougher industry competition could still challenge Rollins’s growth story and test the strength of its recurring business model.

Find out about the key risks to this Rollins narrative.

Another View: How Do Valuation Ratios Stack Up?

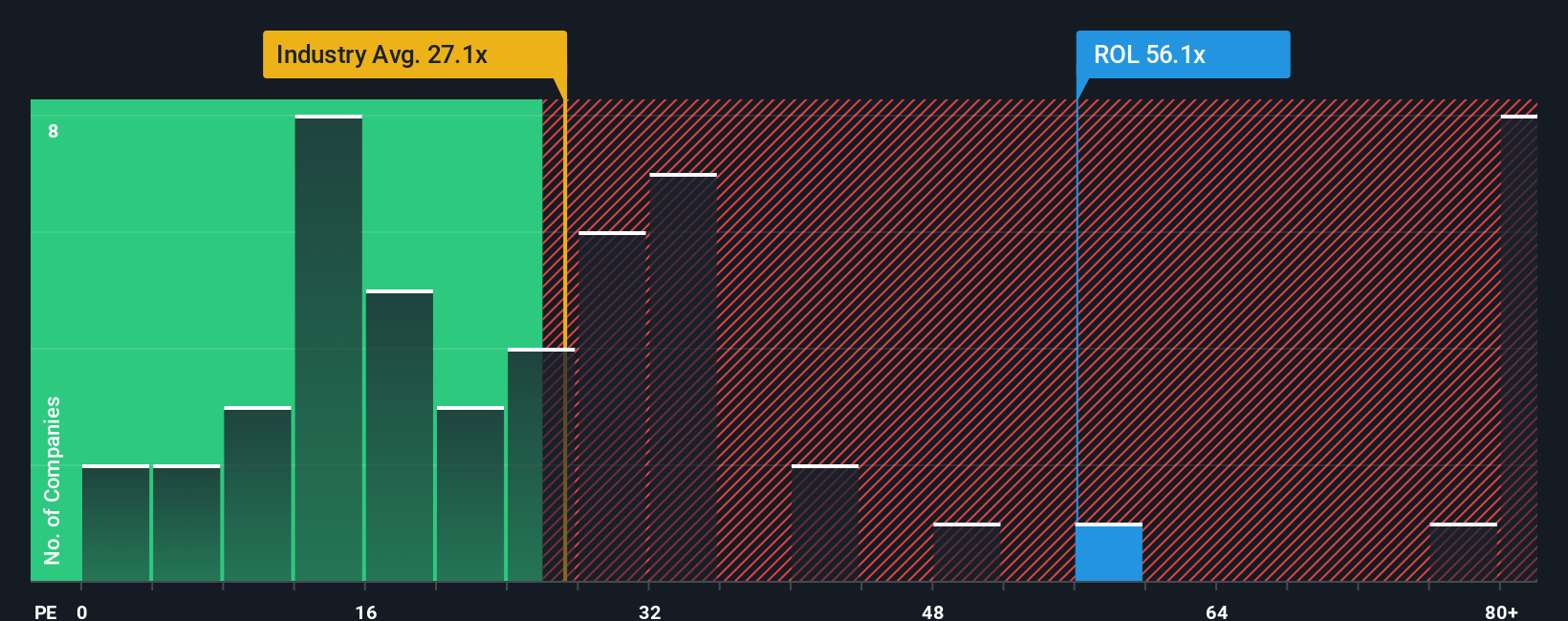

Looking at Rollins’s valuation through the lens of the common earnings ratio, the stock appears expensive, trading at 54.1 times earnings. That is far higher than both the US Commercial Services industry average at 23.9 and the peer group average of 38.7. The fair ratio, which the market could eventually target, sits even lower at 27.4. This big gap highlights a potential valuation risk if investor optimism fades. Might the multiple retreat, or will strong business performance justify the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rollins Narrative

If you want to challenge these assumptions or prefer to investigate the fundamentals for yourself, you can shape your own perspective. Create your narrative in just minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Rollins.

Looking for More Investment Ideas?

Act now to find fresh investment angles you might have missed. The right screener could put tomorrow’s big opportunities on your radar before the crowd.

- Unleash your potential for strong, steady income by checking out these 18 dividend stocks with yields > 3% with yields over 3% and consistent cash flows.

- Tap into the pioneering momentum of artificial intelligence with these 27 AI penny stocks transforming industries and creating next-generation growth leaders.

- Seize undervalued gems primed for a rebound by running through these 896 undervalued stocks based on cash flows based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ROL

Rollins

Through its subsidiaries, provides pest and wildlife control services to residential and commercial customers in the United States and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives