- United States

- /

- Commercial Services

- /

- NYSE:ROL

A Look at Rollins’s Valuation Following Strong Q3 Results and Dividend Boost

Reviewed by Simply Wall St

Rollins (NYSE:ROL) caught the market’s attention after reporting impressive third-quarter results, with earnings topping expectations and revenue jumping 12% from last year. The company also boosted its quarterly dividend by 11%.

See our latest analysis for Rollins.

Rollins’ strong Q3 earnings and another hefty dividend hike have helped fuel positive investor sentiment. Shares have seen a 25% year-to-date price return and a robust 23% total shareholder return over the past year. The stock’s long-term momentum remains intact, and this latest burst of growth suggests the company continues to win market share and deliver value for shareholders.

If consistent gains like these have you rethinking what’s possible, it’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares already up substantially and profits continuing to outpace expectations, investors may wonder if Rollins’ current valuation still leaves room for upside or if the stock has already accounted for its next stage of growth.

Most Popular Narrative: 4.6% Undervalued

With narrative fair value set at $60.42 and the last close at $57.61, Rollins is viewed by the consensus as modestly undervalued. This narrow gap hints at optimism balanced by caution.

The company’s commercial division is experiencing double-digit recurring revenue growth due to strategic resource allocation, indicating a strong potential for revenue growth in this sector. Rollins' multi-brand strategy offers diversified revenue streams and competitive advantages, potentially leading to sustained revenue growth and consistent financial performance across economic cycles.

Curious how recurring contracts and a multi-brand play could position Rollins for reliable gains? The narrative’s fair value rests on a bold cash flow outlook. Find out which critical forecasts drive that high target. One key assumption might surprise you.

Result: Fair Value of $60.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, competitive pressures or any slip in operational execution could quickly challenge the bullish outlook and limit Rollins' ability to sustain its current momentum.

Find out about the key risks to this Rollins narrative.

Another View: Multiples Point to Caution

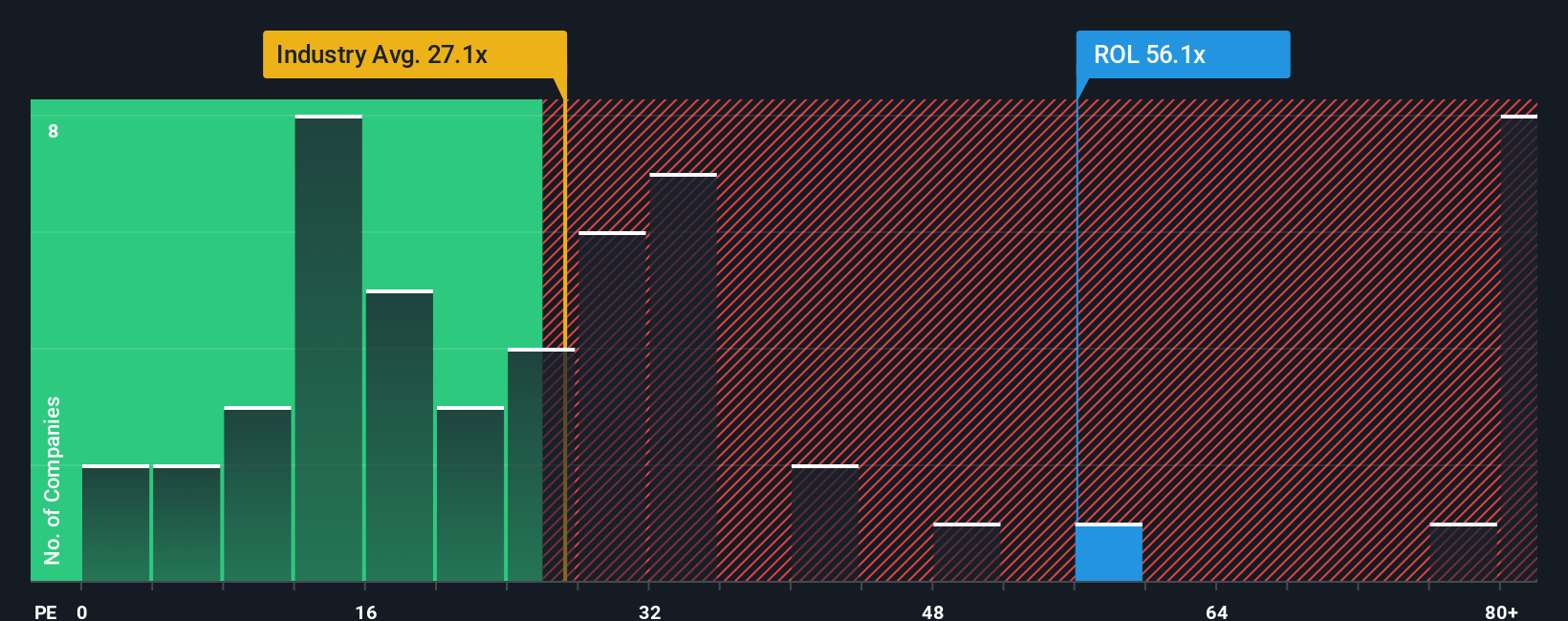

Looking at valuation through a price-to-earnings lens, Rollins trades at 54.1 times earnings, far above its peer average of 38.8 and the industry’s 22.3, as well as the fair ratio of 27.5. This substantial premium may reflect optimism, but also adds risk if growth fails to keep pace. Will the market reward this valuation or adjust expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rollins Narrative

If you see the story differently or want to dig into the numbers firsthand, you can build your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Rollins.

Looking for More Smart Investment Ideas?

Smart investors know every move counts and the right screening tools can reveal gems others overlook. Don’t miss out on strategies shaping tomorrow’s winners. Simply Wall Street can point you straight to standout opportunities.

- Start building your portfolio’s growth engine by backing AI breakthroughs powering innovation across industries with these 26 AI penny stocks.

- Secure long-term income streams when you tap into steady performers yielding over 3% through these 22 dividend stocks with yields > 3%.

- Get ahead of the crowd by uncovering undervalued picks driven by strong cash flows using these 840 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ROL

Rollins

Through its subsidiaries, provides pest and wildlife control services to residential and commercial customers in the United States and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives