- United States

- /

- Commercial Services

- /

- NYSE:RBA

Will the CTO Departure Disrupt RB Global's (RBA) Technology-Driven Market Strategy?

Reviewed by Sasha Jovanovic

- On November 20, 2025, Chief Technology Officer Nancy King departed RB Global, Inc., with Chief Operations Officer Steve Lewis assuming her responsibilities on an interim basis.

- This shift in technology leadership occurs as RB Global continues to spotlight its omnichannel marketplace structure and its technology-driven asset lifecycle management across a global platform.

- We will examine how this leadership transition may influence RB Global’s technology execution and overall investment outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

RB Global Investment Narrative Recap

To invest in RB Global, you need confidence in the company's ability to scale its omnichannel marketplace and maintain a leadership position in digital asset management, especially as technology and operational synergies drive results. The recent interim transfer of technology leadership to the COO is not expected to materially impact the key short-term catalyst, ongoing digital innovation to support higher transaction volumes, or magnify the biggest risk, which remains subdued transaction volumes amid macroeconomic uncertainty.

Among RB Global's recent announcements, its November expansion of remarketing services for U.S. government fleet vehicles stands out, directly tying into the catalyst of boosting transaction volumes and demonstrating the breadth of asset types served by its platform. These service extensions continue to be central as the company aims to deliver on revenue opportunities and further embed technology into its operations.

By contrast, it remains important for investors to be aware of the risk posed by evolving transaction volumes, as even temporary leadership changes can...

Read the full narrative on RB Global (it's free!)

RB Global's narrative projects $5.7 billion in revenue and $913.2 million in earnings by 2028. This requires 8.6% yearly revenue growth and a $535.9 million increase in earnings from $377.3 million today, representing roughly a 1.4x increase.

Uncover how RB Global's forecasts yield a $122.70 fair value, a 25% upside to its current price.

Exploring Other Perspectives

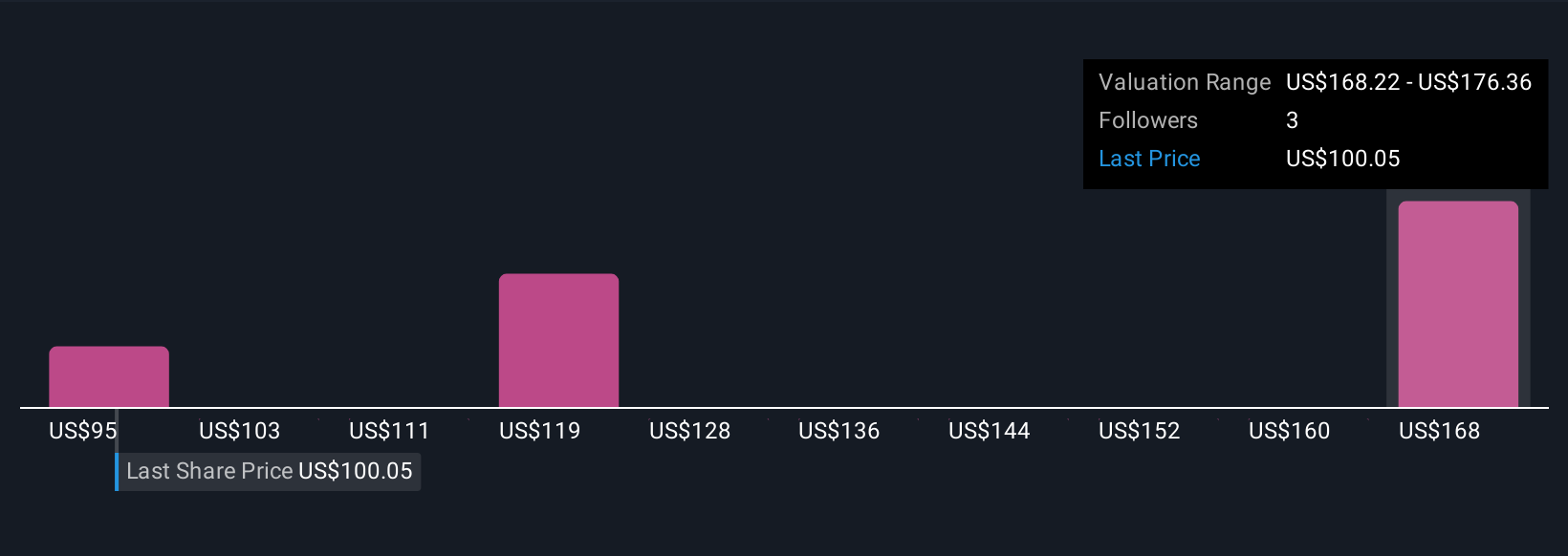

Three unique fair value estimates from the Simply Wall St Community range from US$95 to US$181.81 per share. Some see upside potential, yet others flag the challenge of sustaining higher digital asset volumes as a critical issue for RB Global’s future success, you can explore many views across the spectrum.

Explore 3 other fair value estimates on RB Global - why the stock might be worth just $95.00!

Build Your Own RB Global Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RB Global research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free RB Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RB Global's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBA

RB Global

Operates a marketplace that provides insights, services, and transaction solutions for buyers and sellers of commercial assets and vehicles worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success