- United States

- /

- Commercial Services

- /

- NYSE:RBA

RB Global (NYSE:RBA): Valuation in Focus Following Jarislowsky Fraser Stake and New Growth Initiatives

Reviewed by Simply Wall St

RB Global (NYSE:RBA) has caught the eye of investors after Jarislowsky Fraser, a respected Montreal-based fund, disclosed a new $195.6 million stake. This move highlights growing interest, with investors paying attention to new expansion efforts and improving fundamentals.

See our latest analysis for RB Global.

RB Global’s recent momentum has been shaped by notable events, including the high-profile investment from Jarislowsky Fraser and IAA’s push into Latin America through its new alliance in Guatemala. While the share price has pulled back 5% over the last month, the underlying narrative is one of growth. The company has posted a robust 12.6% year-to-date price return and a standout 21.2% total shareholder return over the past year, which points to persistent long-term strength and rising investor confidence in its evolving digital marketplace strategy.

If you’re interested in what else might be driving strong gains and high insider conviction, now’s a great time to discover fast growing stocks with high insider ownership

The question now is whether RB Global’s recent pullback signals an undervalued opportunity, or if the market has already priced in its impressive growth and future expansion plans. Is there still room for upside?

Most Popular Narrative: 17.1% Undervalued

With RB Global's fair value narrative pegging the stock at $122.70, compared to a last close of $101.76, attention is turning to the bold projections fueling this valuation. The next few years are set to be pivotal, with major shifts in strategy and sector dynamics expected to play out.

Strategic global expansion and technology investments are enhancing operational efficiency, supporting higher transaction volumes, and driving long-term revenue and margin growth. Growing demand for sustainability and expanded value-added services are boosting service revenues and strengthening RB Global's positioning in the pre-owned asset marketplace.

Want to glimpse the financial moves behind this valuation leap? The narrative hinges on a sharp transformation in future profits and a trajectory that outpaces traditional sector norms. The details in this calculation might surprise you. Are you curious which big assumptions drive this fair value?

Result: Fair Value of $122.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustainability trends and uncertain macroeconomic conditions could reduce transaction volumes or delay expected gains. This could challenge the bullish case for RB Global’s growth.

Find out about the key risks to this RB Global narrative.

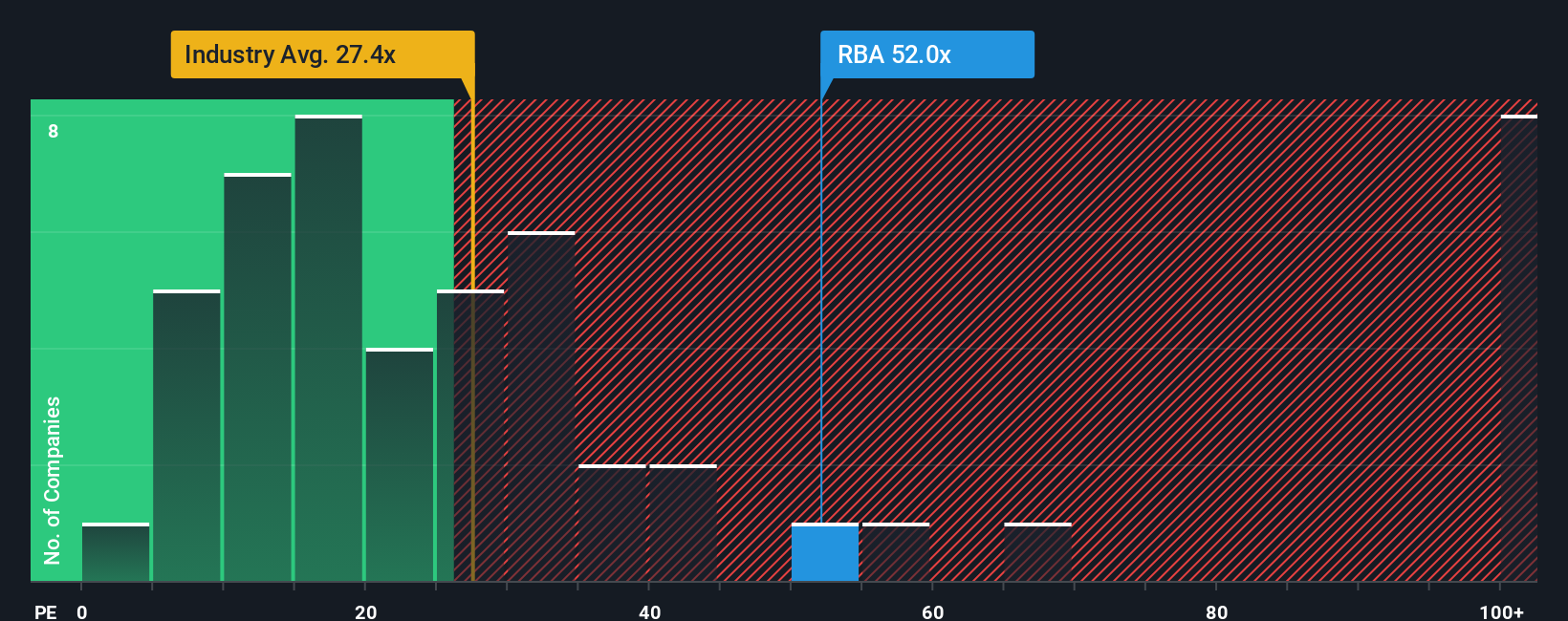

Another View: High Earnings Multiple Raises Caution

Looking at traditional earnings ratios, RB Global trades at 50.1 times its current earnings. That is noticeably higher than both the US Commercial Services industry average of 27.1 and its closest peers at 31.3. Even compared to its own fair ratio of 34.7, the stock still looks expensive. Could these elevated valuation levels limit near-term upside if sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RB Global Narrative

If you’d rather follow your own path or see things differently, dive into the data and shape a narrative that fits your insights in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding RB Global.

Looking for More Smart Investment Ideas?

Don't let great opportunities pass you by. Supercharge your portfolio with fresh investment angles and stay ahead of the curve using the Simply Wall Street Screener:

- Tap into the next wave of healthcare breakthroughs by researching these 33 healthcare AI stocks, which is driving advances in medical AI and life sciences.

- Unlock the potential for high yields by analyzing these 17 dividend stocks with yields > 3%, which consistently delivers yields above 3% and supports wealth-building strategies.

- Gain an edge in tech innovation by following these 27 AI penny stocks, which is at the forefront of artificial intelligence advancements and disruptive growth trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBA

RB Global

Operates a marketplace that provides insights, services, and transaction solutions for buyers and sellers of commercial assets and vehicles worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives