- United States

- /

- Commercial Services

- /

- NYSE:RBA

How Investors May Respond To RB Global (RBA) Expanding Into Latin America With New Vehicle Auction Alliance

Reviewed by Sasha Jovanovic

- In October 2025, IAA, a subsidiary of RB Global, announced a new Market Alliance in Guatemala with Auto Traders of America to operate a vehicle auction center, aiming to increase inventory visibility and provide tailored local services for buyers in Latin America.

- This expansion was complemented by Montreal-based Jarislowsky Fraser taking a new position in RB Global, with an investment of approximately US$195.6 million for about 1.8 million shares, reflecting significant institutional confidence in the company's global strategy.

- Let’s explore how this alliance with Auto Traders of America could strengthen RB Global’s international growth narrative and broaden its customer reach.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

RB Global Investment Narrative Recap

To be a shareholder in RB Global, you need conviction in the company's ability to translate international alliances and new markets into sustainable transaction growth, particularly as digital competition accelerates. While the new IAA alliance in Guatemala broadens RB Global’s reach and supports the company's global expansion catalyst, its immediate impact on overall transaction volumes and near-term revenue growth is likely not material; the biggest risk remains macroeconomic headwinds dampening partner and buyer activity, which could pressure short-term financial results if trends persist.

The recent expansion into Panama through IAA’s market alliance with Moto Leader Group closely parallels the Guatemala development. Both initiatives reflect the company’s focus on international growth as a key catalyst, even as volume trends and new partnership execution remain critical to watch in the coming quarters.

Yet, with partners facing cautious capital spending and macroeconomic volatility, investors should be aware that even promising new alliances may not fully offset challenges if...

Read the full narrative on RB Global (it's free!)

RB Global's outlook anticipates $5.7 billion in revenue and $913.2 million in earnings by 2028. This outlook assumes an annual revenue growth rate of 8.6% and an earnings increase of $535.9 million from the current earnings of $377.3 million.

Uncover how RB Global's forecasts yield a $122.70 fair value, a 21% upside to its current price.

Exploring Other Perspectives

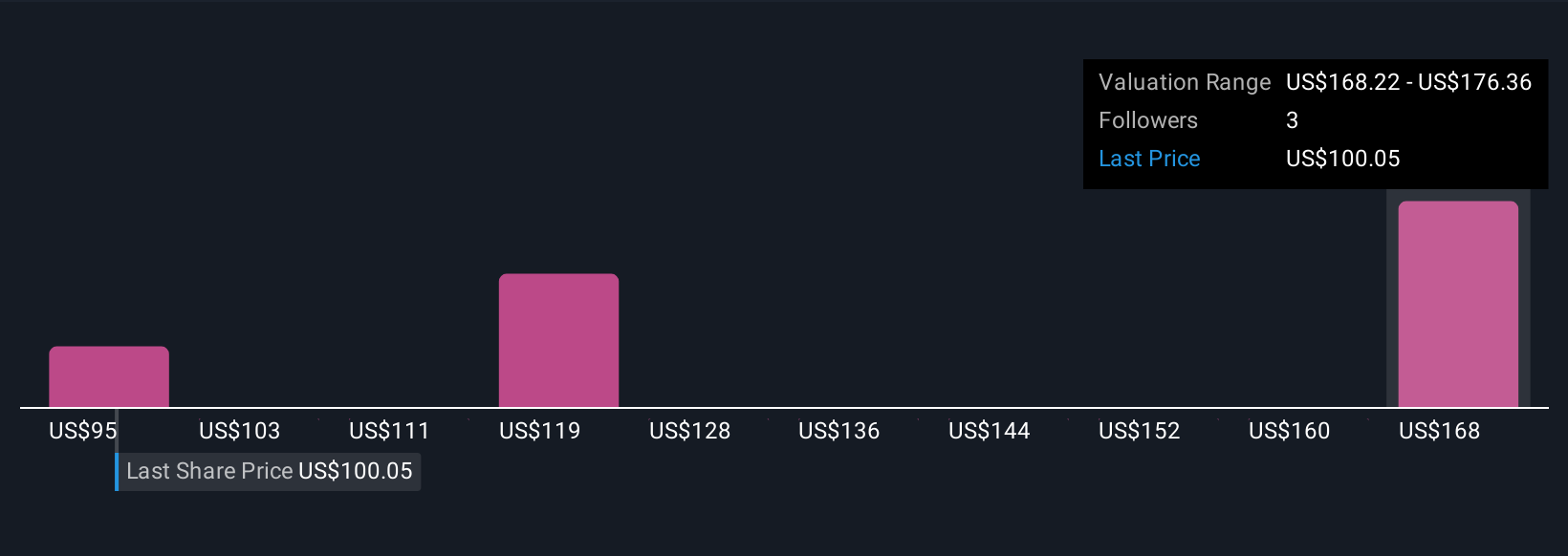

Three Simply Wall St Community contributors estimate RB Global’s fair value in a wide range from US$95 to US$176.73 per share. This diversity highlights how expanding alliances may drive optimism but macro headwinds continue to shape many outlooks on future growth and risk, so review several viewpoints.

Explore 3 other fair value estimates on RB Global - why the stock might be worth 7% less than the current price!

Build Your Own RB Global Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RB Global research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free RB Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RB Global's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBA

RB Global

Operates a marketplace that provides insights, services, and transaction solutions for buyers and sellers of commercial assets and vehicles worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives