- United States

- /

- Commercial Services

- /

- NYSE:RBA

A Fresh Look at RB Global (NYSE:RBA) Valuation After Strong Q3 Results and Expanded Government Contract

Reviewed by Simply Wall St

RB Global (RBA) just delivered stronger third quarter and year-to-date numbers, showing steady growth in both revenue and net income. The company also landed an expanded government contract and declared its next quarterly dividend, all within the same week.

See our latest analysis for RB Global.

RB Global’s latest results arrived on the back of some renewed momentum. After a tough few months, the company’s share price has advanced 4.7% over the past week and is up 11.5% year-to-date. The one-year total shareholder return stands at just over 10%, and the remarkable 95% total return over three years demonstrates how the business has created value for investors well beyond its recent headlines.

If the combination of steady growth and new contracts has you exploring what else is out there, this could be the right time to discover fast growing stocks with high insider ownership.

With shares up so far this year and the company outperforming over the longer term, the real question now is whether RB Global’s growth and contract wins are fully reflected in its stock price, or if there is still a buying opportunity ahead.

Most Popular Narrative: 17.9% Undervalued

RB Global’s most widely followed narrative places its fair value well above the recent close, signaling fresh optimism from analysts despite a strong multi-year rally. The current price is still lagging the narrative fair value estimate, raising questions about what the market might be missing.

Strategic global expansion and technology investments are enhancing operational efficiency, supporting higher transaction volumes, and driving long-term revenue and margin growth. Growing demand for sustainability and expanded value-added services are boosting service revenues and strengthening RB Global's positioning in the pre-owned asset marketplace.

What’s fueling this compelling valuation? Behind it is an aggressive roadmap that leapfrogs traditional sector growth assumptions and banks on ambitious future profitability. Find out what growth levers and margin moves are included in these projections; this could change how you see the stock’s potential.

Result: Fair Value of $122.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macroeconomic uncertainty and challenges integrating new acquisitions could quickly shift expectations and undermine RB Global’s positive growth outlook.

Find out about the key risks to this RB Global narrative.

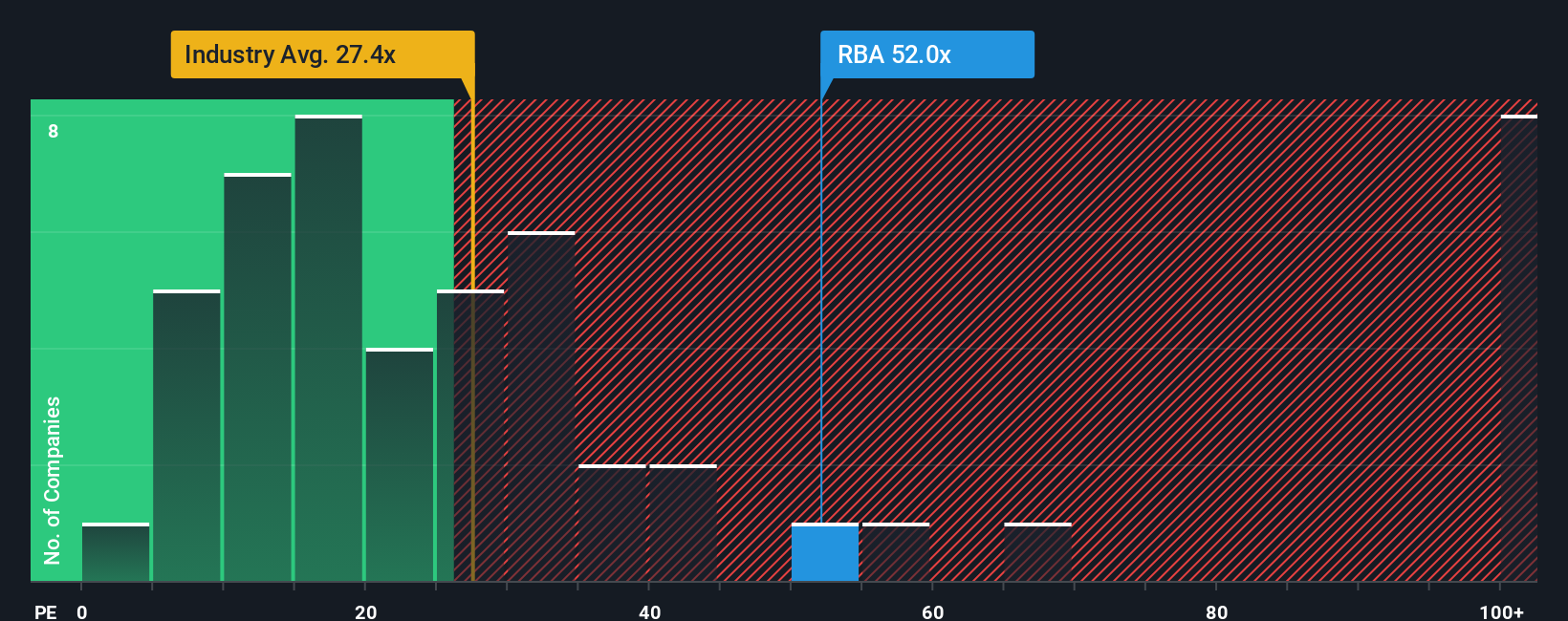

Another View: More Expensive Than Peers?

Looking at valuation from a different angle, RB Global trades at a price-to-earnings ratio of 47.8x, which is notably higher than the US Commercial Services industry average of 23.3x, its peer group at 28.7x, and the fair ratio of 32.2x that the market could move towards. This suggests the stock carries a valuation premium, introducing risk if future growth falls short. It also hints at high investor expectations. Could the current optimism be overextended, or is the premium justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RB Global Narrative

If you want to dig deeper or build your own perspective, you can easily explore the numbers and shape your own story in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding RB Global.

Ready for Your Next Move? Uncover More Exciting Opportunities

Smart investors keep their edge by staying ahead of the curve. See what you could be missing by using the Simply Wall Street Screener to find your next winning idea.

- Capture growth potential by scanning for these 27 AI penny stocks redefining industries through artificial intelligence and transformative automation trends.

- Lock in reliable income streams by checking out these 15 dividend stocks with yields > 3% with strong yields and consistent payouts above 3%.

- Stay at the forefront of fintech by pinpointing these 82 cryptocurrency and blockchain stocks at the leading edge of blockchain innovation and digital asset markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBA

RB Global

Operates a marketplace that provides insights, services, and transaction solutions for buyers and sellers of commercial assets and vehicles worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives