- United States

- /

- Professional Services

- /

- NYSE:PSN

Will Parsons' (PSN) Seat on $10B WEXMAC Contract Shift Its Defense Growth Narrative?

Reviewed by Sasha Jovanovic

- On October 24, 2025, Parsons Corporation announced it was awarded a seat on the U.S. Navy’s Worldwide Expeditionary Multiple Award Contract (WEXMAC), Territorial Integrity of the U.S. (TITUS) 2.1, a US$10 billion ceiling value IDIQ contract supporting military, humanitarian, and disaster relief operations over up to 10 years.

- This award gives Parsons the opportunity to compete for a wide range of critical logistics and civil support task orders, showcasing its expertise in delivering comprehensive solutions for defense and government clients.

- We'll examine how the opportunity to pursue high-value military logistics contracts under WEXMAC could influence Parsons' investment outlook.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Parsons Investment Narrative Recap

To be a shareholder in Parsons, you typically need to believe in the company's ability to capture continued growth from long-term U.S. government spending on infrastructure, national security, and tech-enabled defense solutions. The WEXMAC seat offers access to significant military logistics contracts, which could strengthen Parsons’ backlog and revenue visibility, but it does not immediately offset the risk of earnings volatility tied to federal budget cycles, a key short-term factor for investors to watch.

One announcement related to this outlook is the $665 million Hudson Tunnel Project extension, highlighting Parsons' deep involvement in major public infrastructure efforts alongside its defense work. This supports the thesis that broad government investment, both in civil and military sectors, is central to Parsons’ near-term catalysts, though it does not eliminate exposure to contract-driven revenue swings.

On the flip side, investors need to be aware that heavy reliance on U.S. government contracts brings heightened risk when...

Read the full narrative on Parsons (it's free!)

Parsons' narrative projects $7.4 billion revenue and $350.2 million earnings by 2028. This requires 3.7% yearly revenue growth and a $102.6 million increase in earnings from $247.6 million today.

Uncover how Parsons' forecasts yield a $90.00 fair value, a 7% upside to its current price.

Exploring Other Perspectives

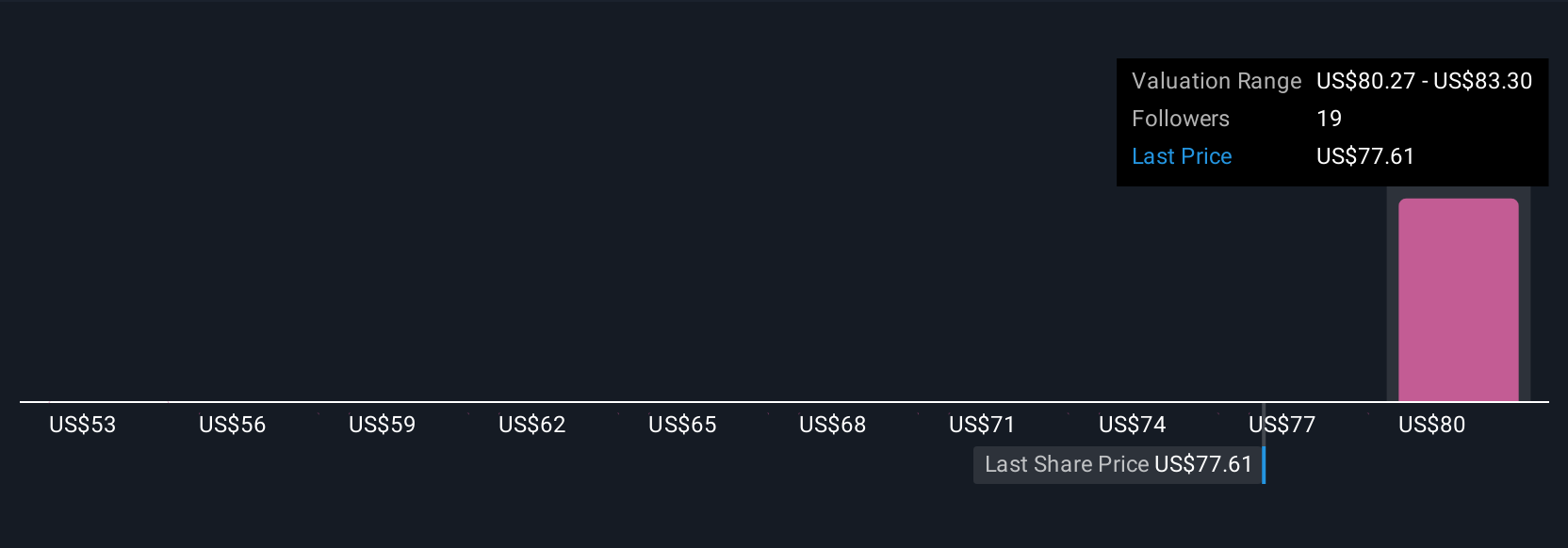

Three fair value estimates from the Simply Wall St Community range from US$81.71 to US$95.29 per share. Many see opportunity in Parsons’ expanding pipeline, but as competition intensifies for federal contracts, your expectations for sustainable growth should reflect a spectrum of possible outcomes.

Explore 3 other fair value estimates on Parsons - why the stock might be worth just $81.71!

Build Your Own Parsons Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Parsons research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Parsons research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Parsons' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSN

Parsons

Provides integrated solutions and services in the defense, intelligence, and critical infrastructure markets in North America, the Middle East, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives