- United States

- /

- Professional Services

- /

- NYSE:PSN

The Bull Case For Parsons (PSN) Could Change Following BlueFly Sensor Launch – Learn Why

Reviewed by Simply Wall St

- Earlier this week, Parsons Corporation introduced BlueFly, a lightweight and drone-agnostic search and rescue sensor that uses Bluetooth low-energy detection to support real-time situational awareness and data delivery for emergency response teams operating in remote environments.

- This newly unveiled technology, developed by QRC, a Parsons company, represents an effort to enhance both the effectiveness and speed of large-area search operations through advanced sensor integration.

- We'll explore how the BlueFly launch aligns with Parsons' focus on innovation in emergency response technology and its broader investment outlook.

Parsons Investment Narrative Recap

To believe in Parsons as a shareholder, you need to have confidence in the company's ability to innovate in critical infrastructure and defense, leveraging technology like BlueFly to stay ahead in high-growth markets. While BlueFly highlights Parsons' push into emergency response tech, it is not expected to materially impact the most important short-term catalyst: the ramp-up in major North American and Middle Eastern infrastructure projects. The largest risk remains uncertainty around key confidential federal contracts, which could constrain revenue if unresolved.

Among Parsons' recent contract wins, the three-year, $75 million US Army Corps of Engineers award in the Middle East District is especially relevant. Like the BlueFly launch, this contract demonstrates Parsons’ reach across both technology and infrastructure sectors, supporting the catalysts tied to backlog growth and revenue visibility. However, unlike these growing contracts, the risk from government contracting complexity and funding unpredictability continues to weigh on near-term visibility.

In contrast, investors should be aware that changes in federal spending priorities could...

Read the full narrative on Parsons (it's free!)

Parsons' outlook anticipates $7.5 billion in revenue and $389.8 million in earnings by 2028. This is based on a 3.4% annual revenue growth rate and an earnings increase of $128.3 million from current earnings of $261.5 million.

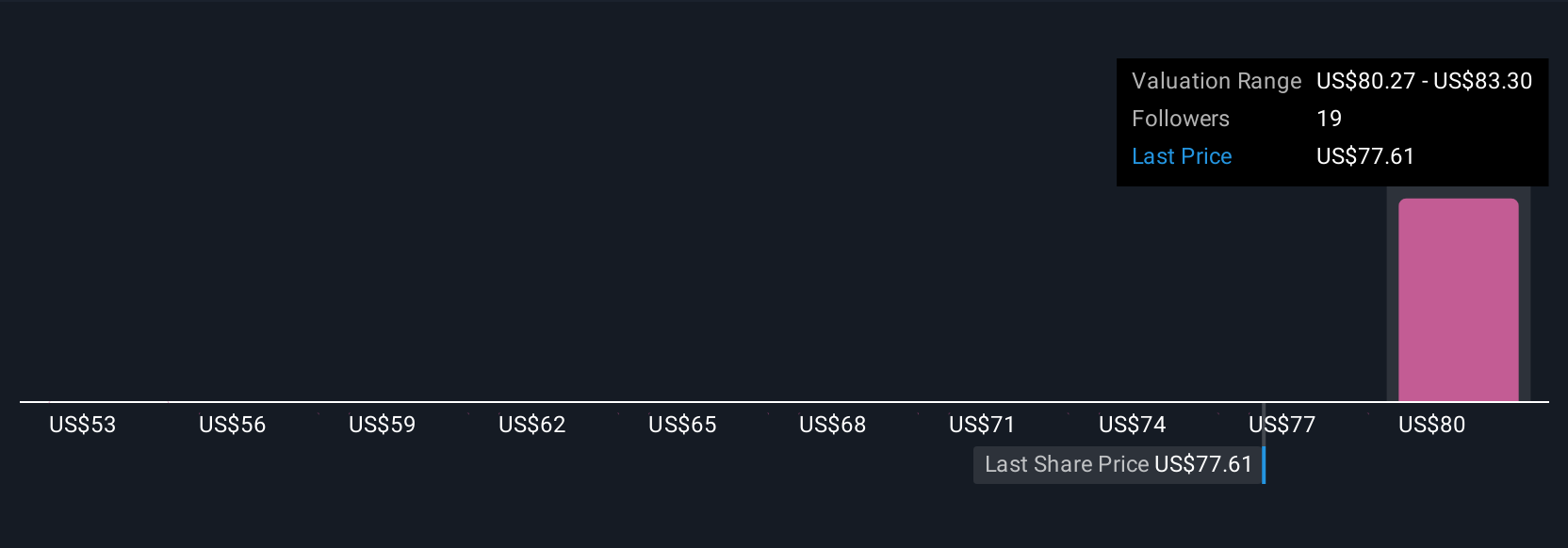

Uncover how Parsons' forecasts yield a $82.86 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community estimate Parsons’ fair value between US$53 and US$116, reflecting significant differences in individual outlooks. At the same time, many are closely watching the company’s reliance on key government contracts and what that could mean for the company’s future performance.

Build Your Own Parsons Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Parsons research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Parsons research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Parsons' overall financial health at a glance.

No Opportunity In Parsons?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSN

Parsons

Provides integrated solutions and services in the defense, intelligence, and critical infrastructure markets in North America, the Middle East, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives