- United States

- /

- Professional Services

- /

- NYSE:PSN

Parsons (PSN): Evaluating Valuation Following Major U.S. Army Contract and New Facility Expansion

Reviewed by Simply Wall St

If you have had your eye on Parsons (NYSE:PSN), this month’s news may give you something new to consider. The company landed an $81 million engineering contract with the U.S. Army to advance radar capabilities through AI integration and modern radio frequency solutions. This is a meaningful addition to its defense-focused portfolio. Just days later, Parsons followed up by opening a large facility just outside Redstone Arsenal, making it easier to deliver on national security projects that require secure, high-capacity operations.

Against this backdrop, Parsons’ stock price action has been mixed over the last year. Shares have slipped 22% over the past 12 months, while longer-term investors have still seen strong returns across three- and five-year periods. Recent contract wins and expansion might indicate a shift in momentum for the business after a tougher year for the share price.

After the year’s underperformance and with these strategic moves in play, is Parsons a bargain that the market is overlooking, or is the stock already factoring in its future growth potential?

Most Popular Narrative: 13.8% Undervalued

The most widely followed narrative currently sees Parsons as undervalued relative to its long-term growth potential and recent operational wins.

Parsons is poised to benefit from ongoing multi-year increases in global and U.S. infrastructure investment, particularly in hard infrastructure like roads, bridges, airports, and transit. These trends are driven by bipartisan government support and major legislation (IIJA, Surface Transportation Reauthorization). Revenue visibility and growth are supported by an $8.9 billion backlog and a substantial unbooked pipeline, positioning revenue to accelerate through at least 2028 and beyond.

Ever wondered what’s fueling Parsons’ bullish fair value? The heart of this narrative is a blend of double-digit organic growth, margin expansion, and ambitious future performance targets that could reset the company’s valuation ceiling. Which aggressive assumptions about profitability and sales are baked into this outlook? Are they within reach? Uncover the engine behind this price target and see whether Parsons’ growth story lives up to the hype.

Result: Fair Value of $87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if political gridlock affects U.S. government funding or if acquisition integration stumbles, Parsons’ growth narrative and valuation outlook could face real pressure.

Find out about the key risks to this Parsons narrative.Another View: Based on Industry Comparisons

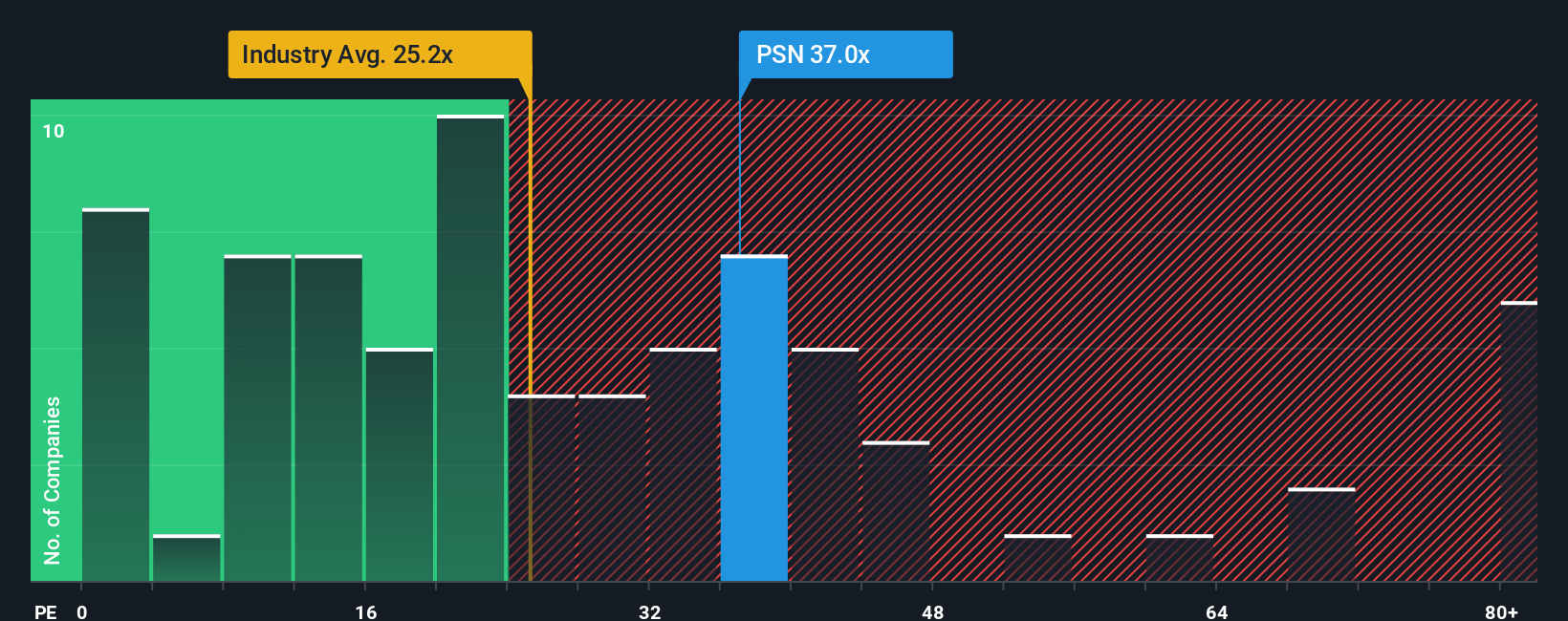

Taking a different approach using the industry’s price-to-earnings comparison, Parsons looks pricier than its sector rivals. This challenges the earlier case for undervaluation and raises the stakes. Could the growth story already be reflected in the price?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Parsons to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Parsons Narrative

If you see things differently or want to challenge the consensus, you can dive into the numbers and craft your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Parsons.

Looking for more investment ideas?

Why stop at Parsons when other standout opportunities are waiting for you? Let Simply Wall Street’s smart screeners guide you to your next move. Don’t let the next big winner pass you by.

- Discover income opportunities by tracking companies that consistently pay reliable returns with dividend stocks with yields > 3%.

- Explore leading innovators in healthcare and artificial intelligence using healthcare AI stocks.

- Identify stocks trading below their potential to give your portfolio a value advantage with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:PSN

Parsons

Provides integrated solutions and services in the defense, intelligence, and critical infrastructure markets in North America, the Middle East, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success