- United States

- /

- Professional Services

- /

- NYSE:PSN

A Fresh Look at Parsons (PSN) Valuation Following Its Latest Annual Growth Results

Reviewed by Simply Wall St

Parsons (PSN) recently posted solid annual growth numbers, with revenue up 4% and net income climbing 10% compared to last year. These steady gains could pique investor interest in the company’s ongoing performance and future potential.

See our latest analysis for Parsons.

Shares of Parsons have rebounded more than 10% over the past three months, recovering some ground after a year where the total shareholder return fell nearly 20%. Despite this recent momentum, the stock still boasts an impressive three-year total shareholder return of over 80%. This hints at its longer-term growth story and renewed investor confidence.

If Parsons’ uptick has you rethinking what’s possible, why not broaden your perspective and check out fast growing stocks with high insider ownership

But with shares ticking up and trading just shy of analysts’ targets, the crucial question now is whether Parsons remains a bargain in disguise or if all the good news is already built into the price.

Most Popular Narrative: 6.5% Undervalued

Parsons shares recently closed at $84.16, but the most popular narrative among analysts values the stock about 6.5% higher, implying more upside exists. The gap highlights some bullish thinking about Parsons’ prospects and draws attention to the drivers fueling that optimism.

Parsons is poised to benefit from ongoing multi-year increases in global and U.S. infrastructure investment, particularly in hard infrastructure like roads, bridges, airports, and transit. This is supported by bipartisan government support and major legislation (IIJA, Surface Transportation Reauthorization). Revenue visibility and growth are supported by an $8.9 billion backlog and a substantial unbooked pipeline. This positions revenue to accelerate through at least 2028 and beyond.

What’s the catalyst behind this bullish price target? It’s a combination of strong infrastructure commitments, diversifying global projects, and a bold push for margin expansion. But the key driver centers on ambitious profit growth projections, all underpinned by a premium multiple that goes well beyond the sector norm. Find out what’s fueling this number.

Result: Fair Value of $90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in U.S. government funding or increased competition for major contracts could threaten Parsons' growth outlook and dampen sentiment around the stock.

Find out about the key risks to this Parsons narrative.

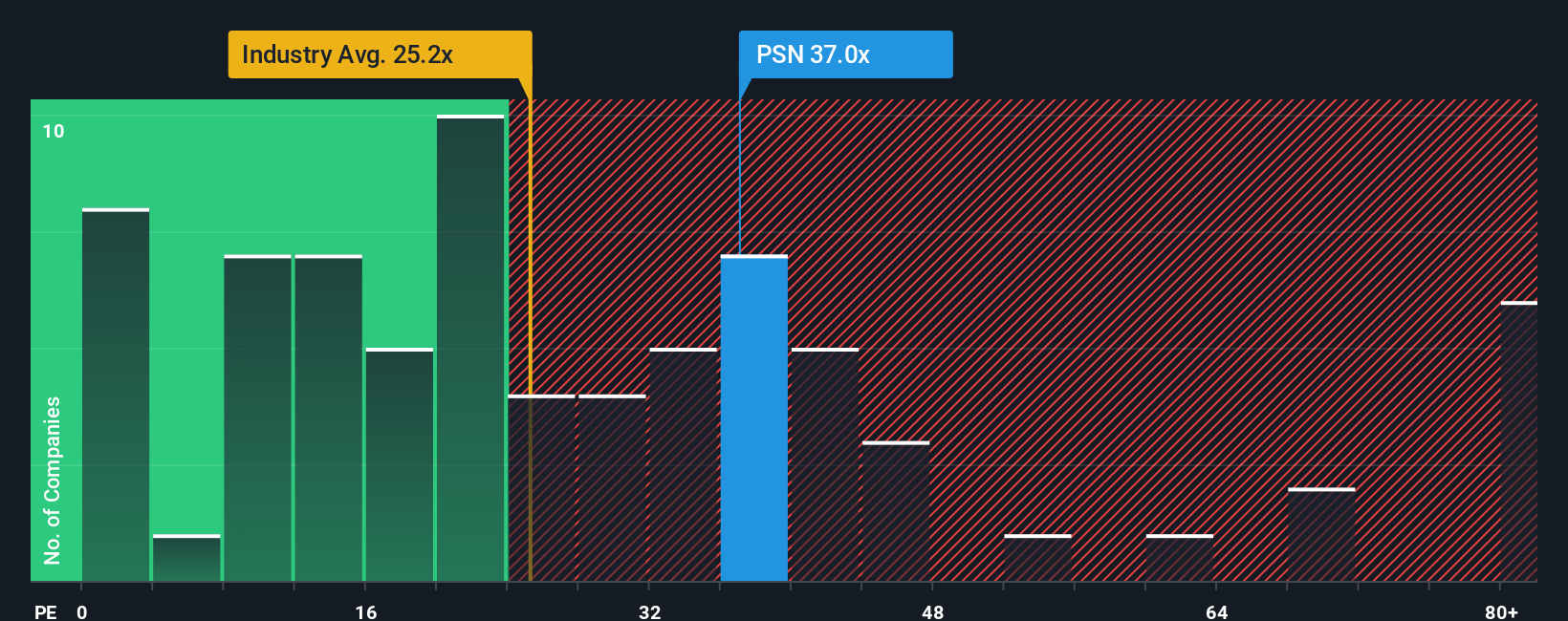

Another View: When Price Ratios Tell a Different Story

Looking through a price-to-earnings lens, Parsons trades at 36.3 times earnings, which is much higher than both the US Professional Services industry’s average of 26.5x and the fair ratio estimate of 26.3x. Despite some earnings momentum, this premium might leave little room for disappointment. Does the market have it right, or could expectations be overdone?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Parsons Narrative

If these perspectives don’t quite align with your own, or you want a deeper dive, you’re free to investigate the numbers and build your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Parsons.

Looking for more investment ideas?

Seize your chance to get ahead. There are exceptional opportunities waiting beyond Parsons. Take action now and give your portfolio an edge before the crowd catches on.

- Uncover untapped growth by targeting these 877 undervalued stocks based on cash flows poised for a turnaround with strong fundamentals and discounted prices.

- Pounce on passive income potential through these 17 dividend stocks with yields > 3% offering high yields and robust payout histories that stand out in any market.

- Ride the wave of innovation by tapping into these 27 AI penny stocks transforming industries with cutting-edge artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSN

Parsons

Provides integrated solutions and services in the defense, intelligence, and critical infrastructure markets in North America, the Middle East, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives