- United States

- /

- Professional Services

- /

- NYSE:PL

How Recent Contract News Impacts Planet Labs Stock Valuation After 289% Price Surge

Reviewed by Bailey Pemberton

- If you have ever wondered whether Planet Labs PBC stock is undervalued, overhyped, or somewhere in between, you are in the right place. Let’s cut through the noise and figure out what the numbers really say.

- The past year has been dramatic, with shares skyrocketing over 289.1%. However, a recent pullback of -11.0% in the last week shows how quickly sentiment can shift in this space.

- Behind these swings are headlines about Planet Labs’ new commercial contracts and expanding partnerships in global earth observation, which have stoked market excitement. At the same time, ongoing discussions about satellite market competition and long-term profitability are prompting investors to reassess risks and rewards.

- Despite all the buzz, Planet Labs currently scores 0 out of 6 on our undervaluation checks. This signals that classic metrics see little value upside at today’s prices. So, how does Planet Labs stack up when we look at a range of valuation approaches, and could there be a smarter way to spot true opportunity? Stay tuned as we dive in.

Planet Labs PBC scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Planet Labs PBC Discounted Cash Flow (DCF) Analysis

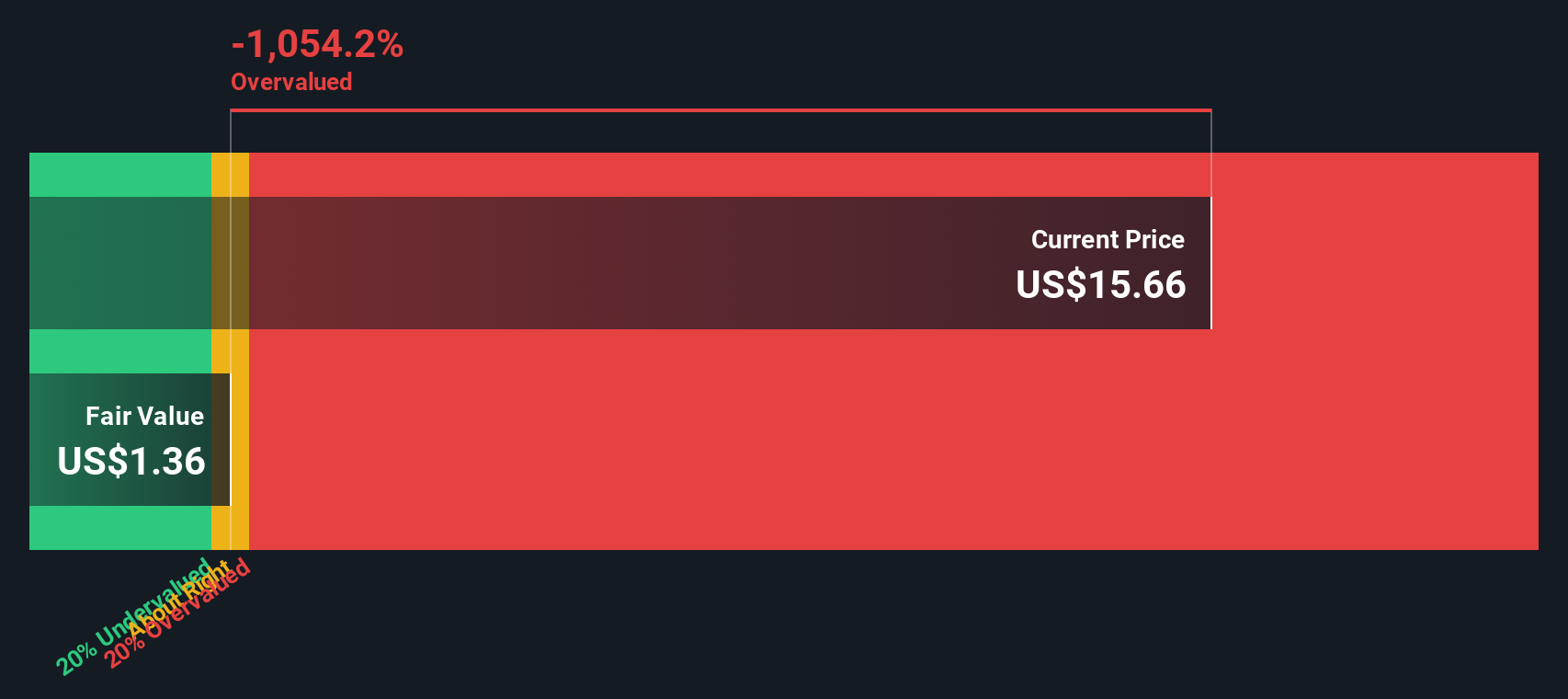

A Discounted Cash Flow (DCF) model estimates a stock’s intrinsic value by projecting future cash flows and discounting them back to today’s dollars. For Planet Labs PBC, the DCF approach focuses on forecasting annual free cash flow based on both analyst estimates and extended projections.

Currently, Planet Labs generates $33.36 million in Free Cash Flow. According to analyst projections and further extrapolation, cash flow will fluctuate in the coming years and reach approximately $10.11 million by 2028. Longer-term projections by Simply Wall St suggest modest growth and stabilization through 2035. These forward-looking estimates become increasingly uncertain over extended timelines.

Based on these inputs, the DCF analysis calculates Planet Labs’ fair value at just $0.27 per share. This figure is significantly lower than the current market price, implying the stock is 4089.9% overvalued relative to its projected cash generation. The size of this gap suggests that the market may be pricing in expectations far beyond what current cash flows indicate.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Planet Labs PBC may be overvalued by 4089.9%. Discover 886 undervalued stocks or create your own screener to find better value opportunities.

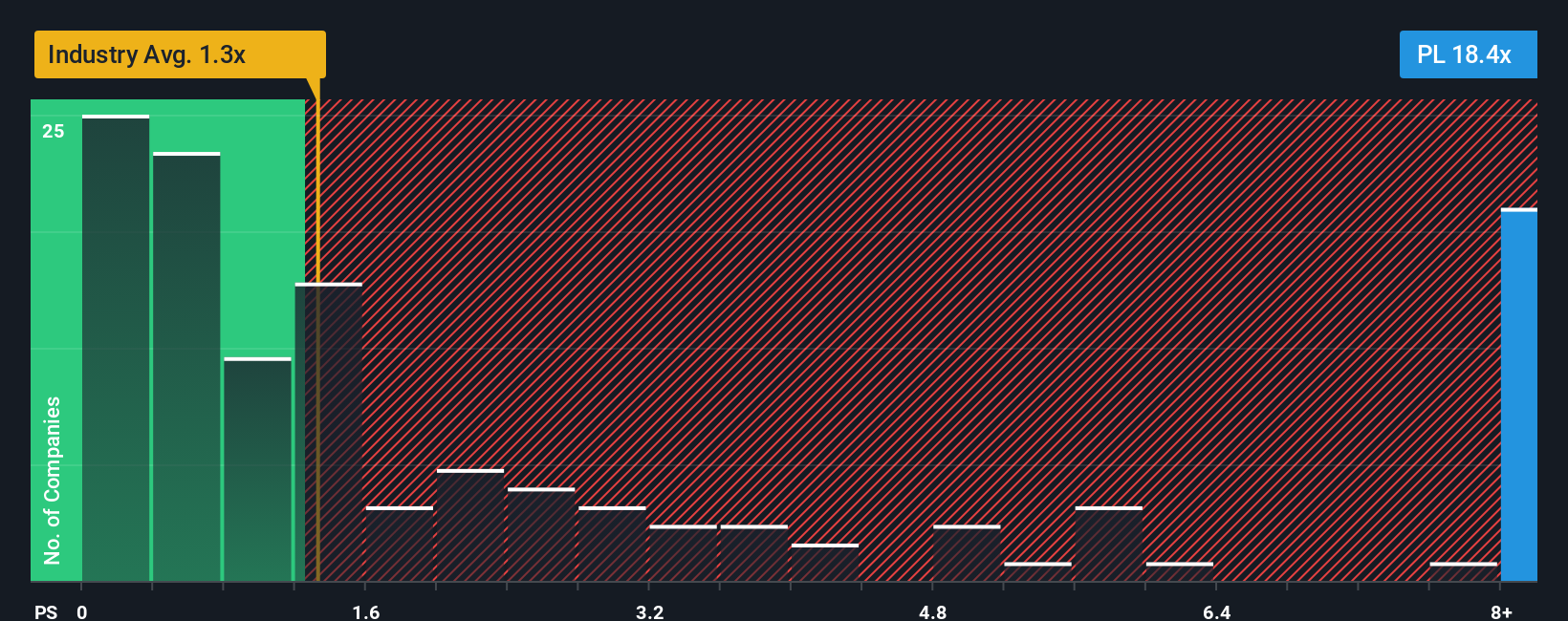

Approach 2: Planet Labs PBC Price vs Sales

For a company like Planet Labs PBC, which is not currently generating positive earnings but has meaningful sales, the Price-to-Sales (P/S) ratio is a reasonable way to assess valuation. The P/S ratio is often used for high-growth or unprofitable companies, since it helps investors gauge how the market values each dollar of the company’s revenue, regardless of short-term profitability.

Growth prospects and risks have a major influence on what a "normal" P/S ratio should be. Companies with higher expected sales growth and lower risks tend to justify higher P/S multiples, as investors are willing to pay more today for future potential. In contrast, slower growth, thinner margins, or higher uncertainty typically warrant lower ratios.

Planet Labs currently trades at a Price-to-Sales multiple of 13.37x. This stands in sharp contrast to the Professional Services industry average of 1.35x and the peer average of 2.64x. This suggests the stock is trading at a significant premium to its immediate comparison groups.

Simply Wall St’s proprietary Fair Ratio for Planet Labs is calculated at 4.05x. The Fair Ratio takes into account more than just industry or peer comparisons; it evaluates the company’s prospects, risks, profit margins, market cap, and specific industry context. This tailored approach gives a more accurate picture of the valuation Planet Labs deserves, especially relevant for dynamic businesses where sector averages may overlook unique factors.

Comparing Planet Labs’ actual P/S multiple of 13.37x to its Fair Ratio of 4.05x, the current valuation is much higher than what would appear justified by its individual growth and risk profile.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

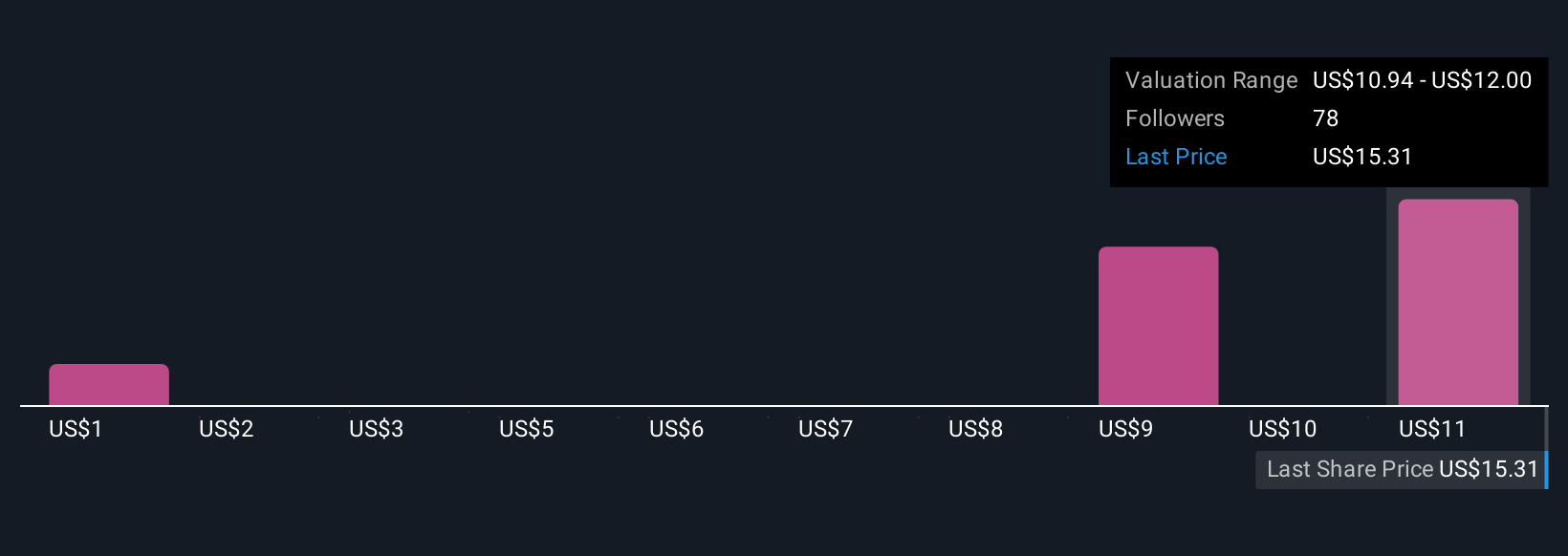

Upgrade Your Decision Making: Choose your Planet Labs PBC Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your unique story or perspective about a company, linking your expectations for Planet Labs’ revenue, profit margins, and risks directly to a financial forecast and then to a personal estimate of fair value.

Narratives take the financial numbers you believe in, connect them to what is happening in the business, and show how your story stacks up against the current market price. It is a dynamic, accessible tool available to all investors within the Simply Wall St Community page, empowering you to easily compare your outlook with thousands of others.

Because Narratives instantly update as new news, contracts, or earnings reports come in, you can see your fair value refreshed and know exactly when your investment thesis still holds or needs revisiting. This helps clarify whether it is time to buy, hold, or sell.

For example, while some investors might have a bullish Narrative valuing Planet Labs at $14.55 by factoring in rapid contract growth and industry leadership, others may land at just $4.50 if they see execution risks and slower adoption, highlighting how one set of facts can support very different investment decisions.

For Planet Labs PBC, we will make it really easy for you with previews of two leading Planet Labs PBC Narratives:

Fair Value: $14.55

Currently 21.6% undervalued (based on last close and this fair value)

Revenue Growth Forecast: 21.93%

- Strategic partnerships and a focus on solutions are expected to expand revenue streams and drive improved margins and cash flow positivity, especially with contracts such as the $230 million JSAT deal.

- Nearly 100 new satellites are set to double Planet Labs' capacity and potentially accelerate revenue growth. Collaborations with AI companies could further broaden future opportunities.

- The consensus analyst price target of $7.16 remains slightly above current levels, but this outlook assumes significant margin improvement and sustained high sales growth, with key risks around execution and geopolitical factors.

Fair Value: $11.31

Currently 0.8% overvalued (based on last close and this fair value)

Revenue Growth Forecast: 30.0%

- Planet Labs leads the Earth Observation market with the largest satellite constellation and is positioned to benefit from rising global EO data demand.

- Falling launch and GPU costs, along with technological advances, are enhancing the value and adoption of geospatial data products. Planet Labs’ equity stakes in EO startups provide additional growth exposure.

- The company’s growth and financial prospects hinge on the pace of commercial adoption and the successful conversion of a strong pipeline of high-value government and commercial contracts.

Do you think there's more to the story for Planet Labs PBC? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PL

Planet Labs PBC

Engages in the design, construction, and launch constellations of satellites with the intent of providing high cadence geospatial data delivered to customers through an online platform the United States and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives