- United States

- /

- Professional Services

- /

- NYSE:PL

Did Planet Labs' (PL) New NGA Contract Redefine Its AI-Driven Maritime Analytics Trajectory?

Reviewed by Sasha Jovanovic

- Planet Labs PBC announced that its subsidiary Planet Labs Federal has secured a US$12.8 million initial contract from the National Geospatial-Intelligence Agency to deliver AI-enabled Maritime Domain Awareness solutions in the Asia-Pacific region, utilizing daily satellite imagery and analytics with partner SynMax.

- This award highlights the growing demand for intelligence-driven satellite analytics to address global maritime challenges, such as illegal fishing and vessel spoofing, with advanced technology applications.

- We'll look at how this government contract win for AI-powered maritime analytics could impact Planet Labs' growth narrative and future prospects.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Planet Labs PBC Investment Narrative Recap

To be a shareholder in Planet Labs PBC, you have to believe in the company’s ability to transform daily satellite data and AI-driven analytics into scalable, recurring revenue, especially through large government contracts like the recent US$12.8 million NGA award. While this contract win adds credibility to Planet’s AI solutions and their potential for deeper public sector relationships, the most important short-term catalyst remains translating marquee deals into meaningful top-line growth, while the biggest risk is continued heavy spending and delayed profit timelines; this contract meaningfully supports, but does not eliminate, either factor.

Among recent announcements, the renewal of the US$7.5 million contract with the U.S. Navy on October 7 strengthens Planet’s position in government maritime monitoring, which is directly relevant given the NGA contract. Together, these deals reinforce the thesis that government demand for Planet’s advanced maritime and analytics offerings is a primary driver and near-term catalyst for revenue momentum.

By contrast, investors should also keep a close watch on how capital intensity and cash burn could impact...

Read the full narrative on Planet Labs PBC (it's free!)

Planet Labs PBC's narrative projects $409.3 million revenue and $29.2 million earnings by 2028. This requires 17.8% yearly revenue growth and a $135.7 million improvement in earnings from -$106.5 million currently.

Uncover how Planet Labs PBC's forecasts yield a $14.55 fair value, a 7% upside to its current price.

Exploring Other Perspectives

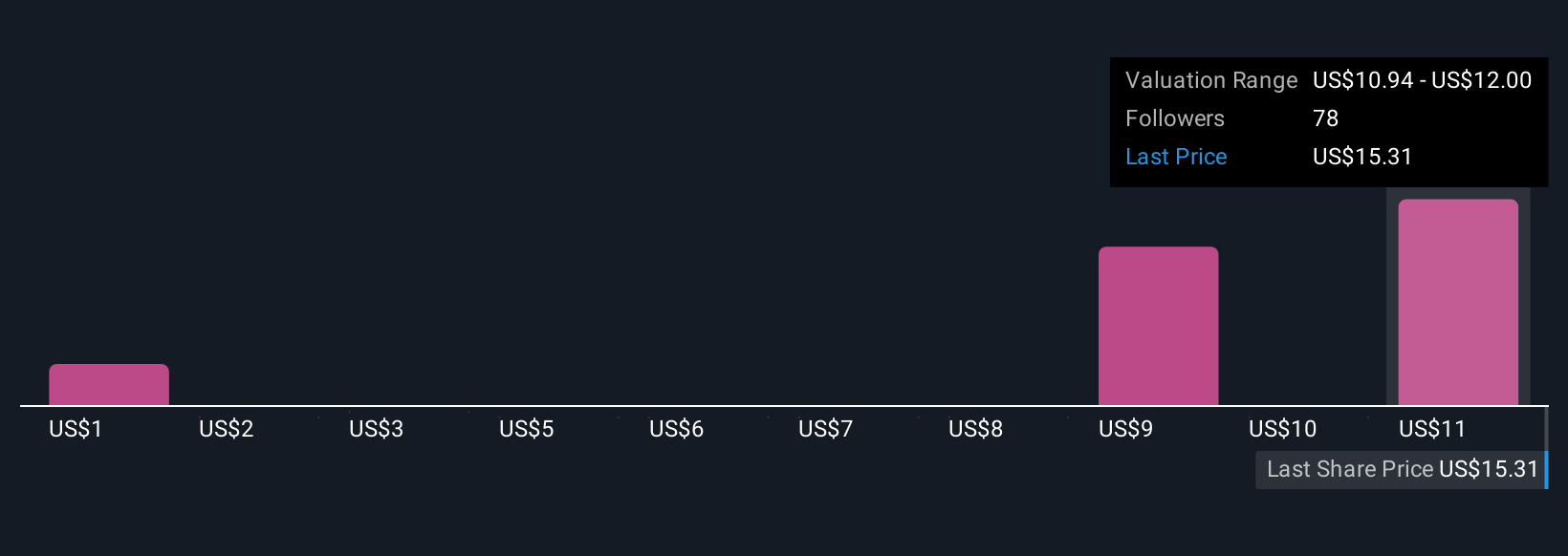

Fair value estimates from 10 Simply Wall St Community members range from US$0.77 to US$14.55, revealing sharply divided opinions. Against this backdrop, the challenge of converting government wins into predictable, profitable cash flows takes on added significance, explore how others see this balancing act.

Explore 10 other fair value estimates on Planet Labs PBC - why the stock might be worth as much as 7% more than the current price!

Build Your Own Planet Labs PBC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Planet Labs PBC research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Planet Labs PBC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Planet Labs PBC's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PL

Planet Labs PBC

Engages in the design, construction, and launch constellations of satellites with the intent of providing high cadence geospatial data delivered to customers through an online platform the United States and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives