- United States

- /

- Professional Services

- /

- NYSE:PAYC

A Closer Look at Paycom Software’s Valuation Following Executive Team Shift Toward Tech and Innovation

Reviewed by Simply Wall St

Most Popular Narrative: 12.8% Undervalued

According to rynetmaxwell, the prevailing narrative suggests that Paycom Software's shares are currently trading at a meaningful discount to their fair value. This assessment is supported by perspectives around the company's recurring revenue prospects and certain key strategic transitions.

“Our client value achievement strategy that we're working throughout the year really has to do with meeting clients where they live and making sure that they're achieving the full value of ROI that's available to them through the appropriate usage of our software. And so, we've been focused on that. I've said it many times that it's a lot easier to sell a client an additional product than to get them to actually use it. And we've implemented several strategies to make sure that clients are able to utilize and achieve a full client ROI in value before we sell them another product and in many cases, before we even will bill them, even though we've sold it.”

Curious what’s fueling this bullish price target? The narrative relies on bold assumptions around growth, margins, and a profit multiple that sets this valuation apart from the rest. Wondering what makes Paycom stand out among its peers? Explore the numbers and see which financial projections rynetmaxwell believes truly move the needle for this software giant.

Result: Fair Value of $260.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including the possibility of slower client adoption of new products or intensified competition that could erode Paycom's current advantages.

Find out about the key risks to this Paycom Software narrative.Another View: Market Comparison Tells a Different Story

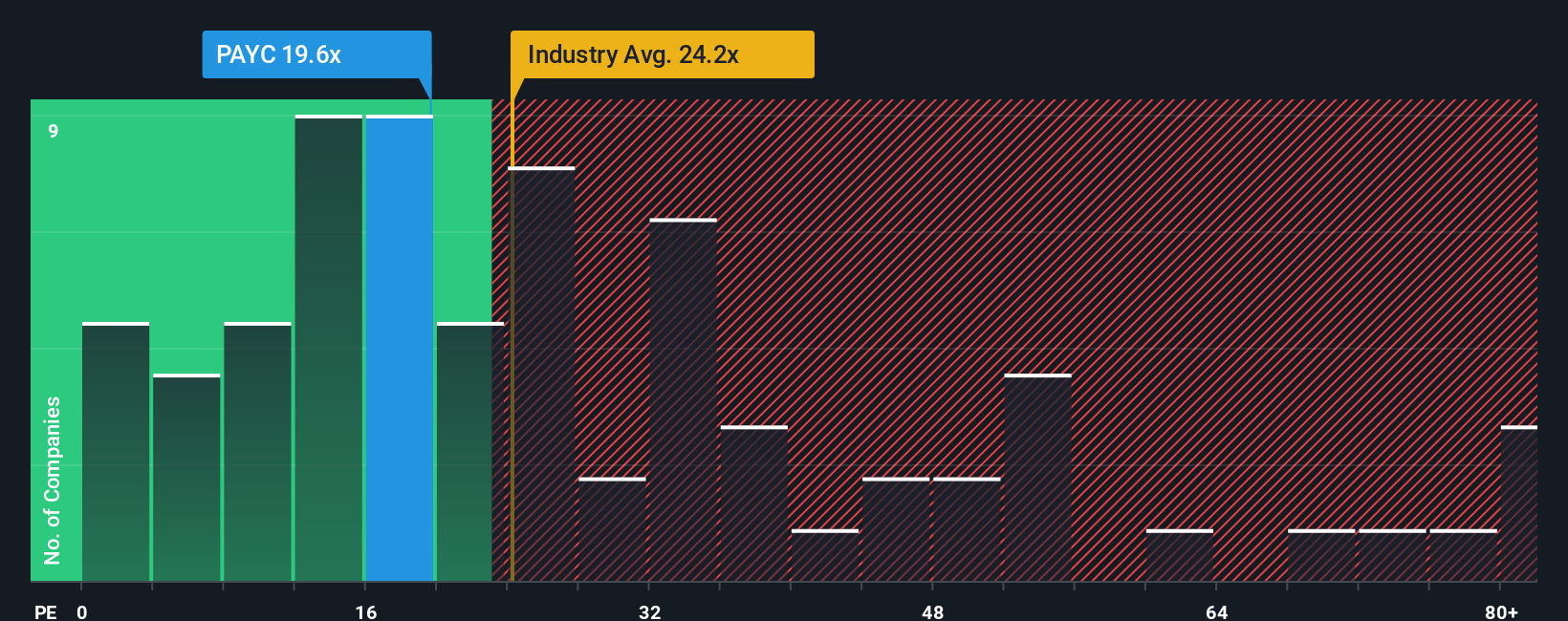

Looking at how Paycom is valued against industry standards paints a more cautious picture. It currently trades at a higher level than similar companies in its sector. This suggests the market may already be pricing in much of its potential. Could this mean the optimistic outlook is actually overstated?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Paycom Software to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Paycom Software Narrative

If you have a different viewpoint or prefer to dive into the details yourself, it's quick and simple to create your own perspective in just minutes. Do it your way

A great starting point for your Paycom Software research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunities like Paycom are just the beginning. Give yourself an edge by exploring handpicked stock ideas that cut through the noise and put real growth within reach.

- Tap into fast-growing industries and see which companies are making waves in artificial intelligence by checking out the latest AI penny stocks.

- Start your search for untapped value and spot hidden gems among stocks trading below their fair value with our updated undervalued stocks based on cash flows.

- Score reliable income streams as you find leading companies offering robust dividend yields in the dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:PAYC

Paycom Software

Provides cloud-based human capital management (HCM) solution delivered as software-as-a-service for small to mid-sized companies in the United States.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026