- United States

- /

- Commercial Services

- /

- NYSE:MSA

A Look at MSA Safety’s Valuation Following Strong Revenue and Earnings Beat

Reviewed by Simply Wall St

MSA Safety (MSA) reported a 2.5% increase in revenue year over year and surpassed consensus estimates on both revenue and EPS. This stronger financial performance is catching investors' attention this week.

See our latest analysis for MSA Safety.

Despite a muted 1-day share price return of -1.93%, MSA Safety’s strong results come as momentum has paused following a stellar multi-year run. A 3-year total shareholder return of 46.41% points to substantial wealth creation for long-term investors even as the stock consolidates around $165.33 this year.

If you're exploring other ways to capitalize on strong fundamentals and growth potential, now could be a smart time to discover fast growing stocks with high insider ownership.

With shares hovering near $165 and trading at a modest discount to analyst targets, investors are left to ponder whether MSA Safety offers untapped value or if the market has already considered all of its future growth potential.

Most Popular Narrative: 13.8% Undervalued

MSA Safety's most widely followed narrative sets a fair value of $191.80, which sits well above the last close price of $165.33. This gap puts a spotlight on the financial levers driving analysts' future assumptions and keeps investors wondering which business drivers matter most right now.

Robust growth in connected safety solutions (such as MSA+ and ALTAIR io 4) reflects increasing customer adoption of advanced, cloud-connected worker technologies. This trend is driven by heightened workplace safety requirements and industrial digitization. It positions MSA for above-average revenue and margin expansion, as these premium products command higher prices.

Want a behind-the-scenes look at what’s fueling that valuation? A few bold assumptions around future growth, profits, and market expansion are hiding in plain sight. If you want to see exactly what numbers fuel analyst conviction, don’t miss the full story behind this fair value call.

Result: Fair Value of $191.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential setbacks from weakness in core product demand or increased exposure to foreign exchange headwinds could alter analysts' upbeat outlook for MSA Safety.

Find out about the key risks to this MSA Safety narrative.

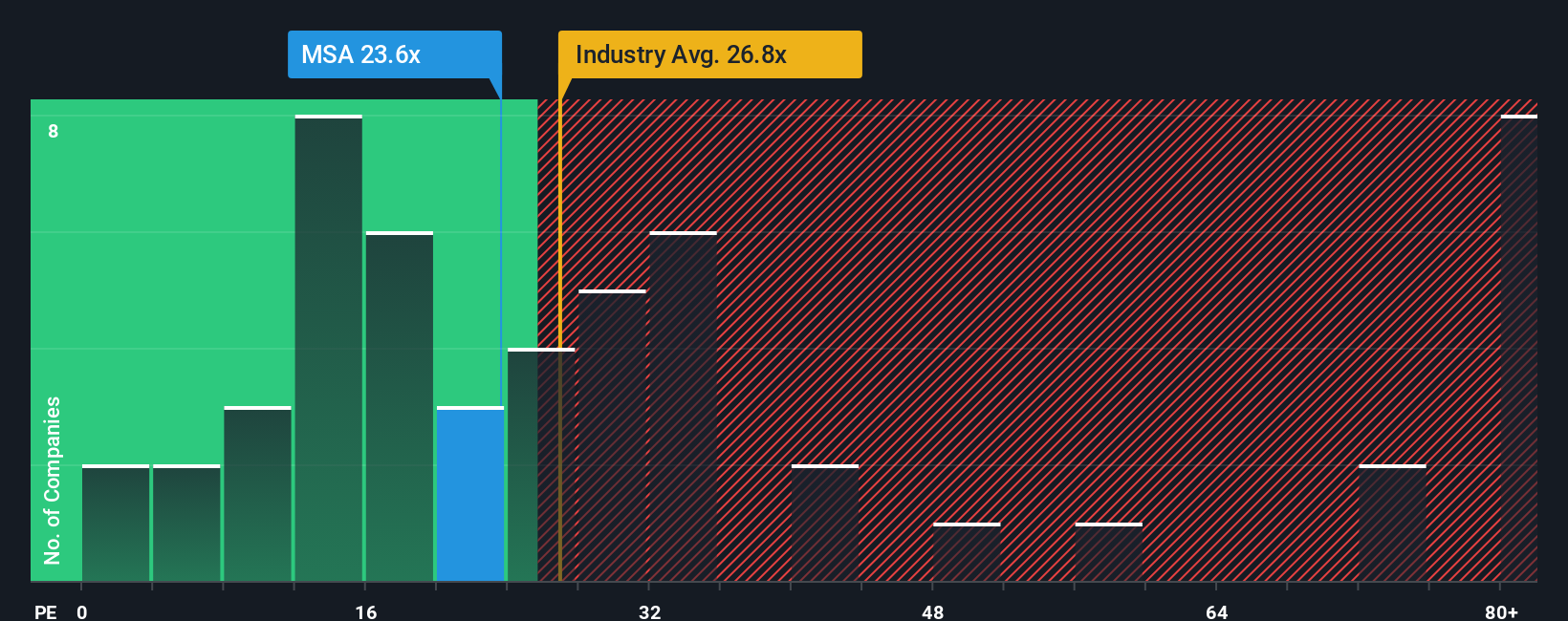

Another View: What Do Earnings Ratios Reveal?

Looking at how shares are priced based on earnings, MSA trades at 23.4 times its profits. That is more expensive than similar peers, who average just 16.2 times earnings. Compared to the industry average of 27.4, though, it sits in the middle. The fair ratio is 25.1, suggesting shares could drift higher or lower as market optimism changes. Does this higher price signal confidence or added risk for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MSA Safety Narrative

If you see these findings differently or want to dig deeper into the numbers yourself, you can craft your own personalized narrative with just a few clicks, starting now with Do it your way.

A great starting point for your MSA Safety research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that opportunity knocks in unexpected places. Open new doors to growth by checking out these unique investment themes that others might overlook.

- Grab the potential for steady income and attractive yields with these 17 dividend stocks with yields > 3%, which offers reliable returns even in turbulent markets.

- Uncover tomorrow’s breakthrough technologies and innovation leaders through these 26 AI penny stocks, where top AI-focused companies are transforming industries.

- Strengthen your portfolio with these 875 undervalued stocks based on cash flows, helping you spot stocks trading below their fair value before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSA

MSA Safety

Develops, manufactures, and supplies safety products and technology solutions that protect people and facility infrastructures worldwide.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives