- United States

- /

- Professional Services

- /

- NYSE:LDOS

The Bull Case For Leidos Holdings (LDOS) Could Change Following New AI Cybersecurity Partnership With NVIDIA and VAST Data

Reviewed by Sasha Jovanovic

- Earlier this week, VAST Data Federal announced a partnership with Leidos and NVIDIA to deliver an integrated, AI-driven cyber defense solution for government agencies and enterprises, featuring real-time threat detection and automated policy-based responses.

- This collaboration seeks to address the mounting challenge of security event overload in mission-critical environments by leveraging scalable data analytics and automation capabilities to boost efficiency and analyst effectiveness.

- We'll examine how harnessing AI and automation for cybersecurity could reshape Leidos' investment narrative and growth opportunities.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Leidos Holdings Investment Narrative Recap

To be a shareholder in Leidos Holdings, you need confidence in the company’s ability to capture long-term government and commercial demand for advanced, AI-enabled solutions, while managing the uncertainties tied to federal spending and competitive pressures in technology services. The recent partnership with VAST Data Federal and NVIDIA stands out for its potential to strengthen Leidos’ capabilities in AI-driven cybersecurity. However, the immediate impact on the biggest near-term catalyst, which is contract wins tied to digital modernization initiatives, is likely to be limited. The most significant risk remains Leidos’ exposure to potential changes or cuts in U.S. government budgets, which could disrupt both revenue momentum and confidence in ongoing program funding.

Among recent announcements, the release of Imperium, an AI-powered platform for information operations, closely aligns with the company’s focus on AI-driven innovation seen in the VAST collaboration. Both initiatives signal Leidos' commitment to integrating automation and machine intelligence across mission-critical defense and intelligence contracts. These developments support the view that ongoing customer demand for digital modernization and AI-powered offerings can be a catalyst, especially as clients increasingly prioritize efficiency and actionable insights in security and intelligence environments.

But for investors, it’s also important to consider the contrasting risk if federal contract priorities shift more abruptly than expected…

Read the full narrative on Leidos Holdings (it's free!)

Leidos Holdings' narrative projects $18.6 billion in revenue and $1.5 billion in earnings by 2028. This requires 3.0% yearly revenue growth and a $0.1 billion increase in earnings from $1.4 billion currently.

Uncover how Leidos Holdings' forecasts yield a $198.50 fair value, a 4% upside to its current price.

Exploring Other Perspectives

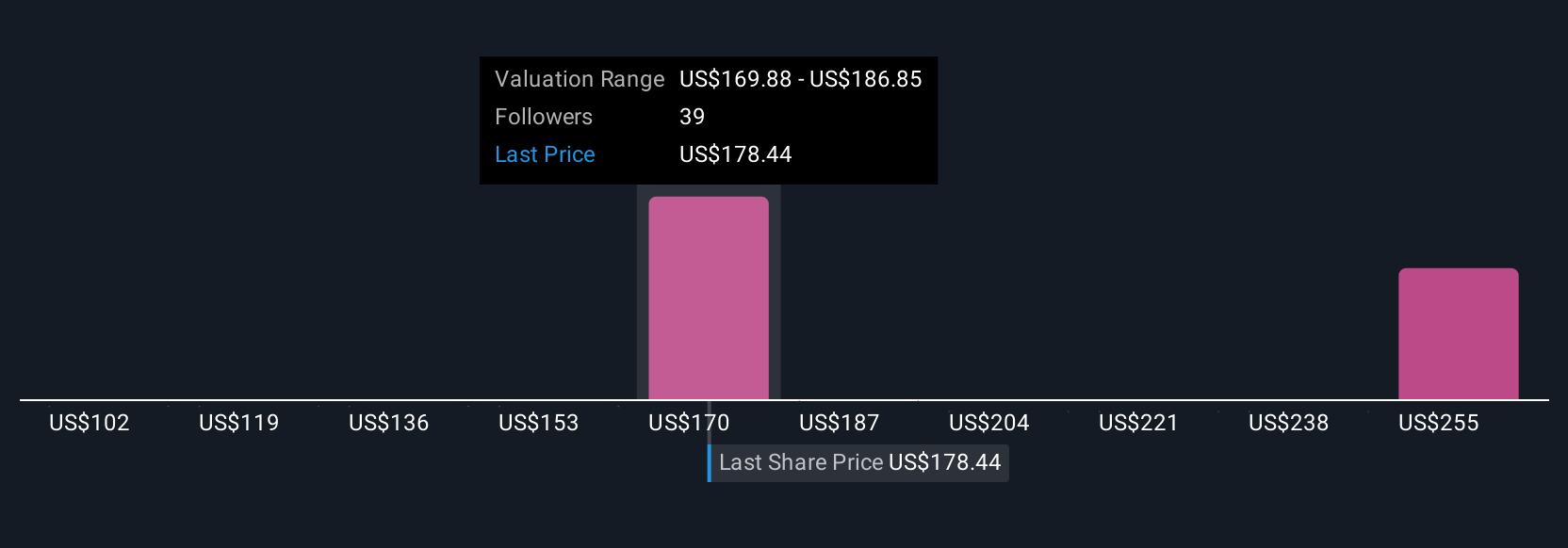

Seven member estimates from the Simply Wall St Community place Leidos’ fair value between US$128.85 and US$309.49 per share. While some anticipate strong gains from digital transformation, many recognize that heavy reliance on federal funding introduces unique unpredictability to the company’s outlook.

Explore 7 other fair value estimates on Leidos Holdings - why the stock might be worth 33% less than the current price!

Build Your Own Leidos Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Leidos Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Leidos Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Leidos Holdings' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LDOS

Leidos Holdings

Provides services and solutions for government and commercial customers in the United States and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives