- United States

- /

- Professional Services

- /

- NYSE:LDOS

Is It Too Late to Consider Leidos Holdings After 30% Rally and Federal Contract Wins?

Reviewed by Bailey Pemberton

- Wondering if Leidos Holdings is a value play or if you might be jumping in late? Let’s dig into what the numbers and recent trends say about the current price.

- While the stock is up a strong 30.1% year to date and has delivered nearly 95% total returns over five years, there's been a pullback lately. Shares have slid 2.6% over the last week.

- Investors are keeping a close eye on the company after several major federal contract wins made headlines. This highlights Leidos’ role as a key player in the defense and technology sector. Recent government cybersecurity initiatives and expanded project awards continue to give the market plenty to talk about.

- On our valuation scorecard, Leidos Holdings earns a 5 out of 6 for being undervalued across different methods, which puts it in rare company. We will break down those approaches in a moment. Stick around as we share how smart investors dig even deeper to truly understand value.

Approach 1: Leidos Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a fundamental tool for valuing a company by projecting its expected future cash flows and discounting them back to their present value. This method provides an estimate of what the business is worth today, based on how much cash it is expected to generate in the future.

For Leidos Holdings, the current Free Cash Flow (FCF) stands at $1.33 billion. Analyst forecasts see this figure steadily rising, with projections reaching $1.74 billion by 2028. Looking further ahead, extrapolations by Simply Wall St estimate the company’s annual cash flows could approach $2.19 billion in 2035. These long-term forecasts extend beyond the five years of specific analyst estimates, using established growth assumptions.

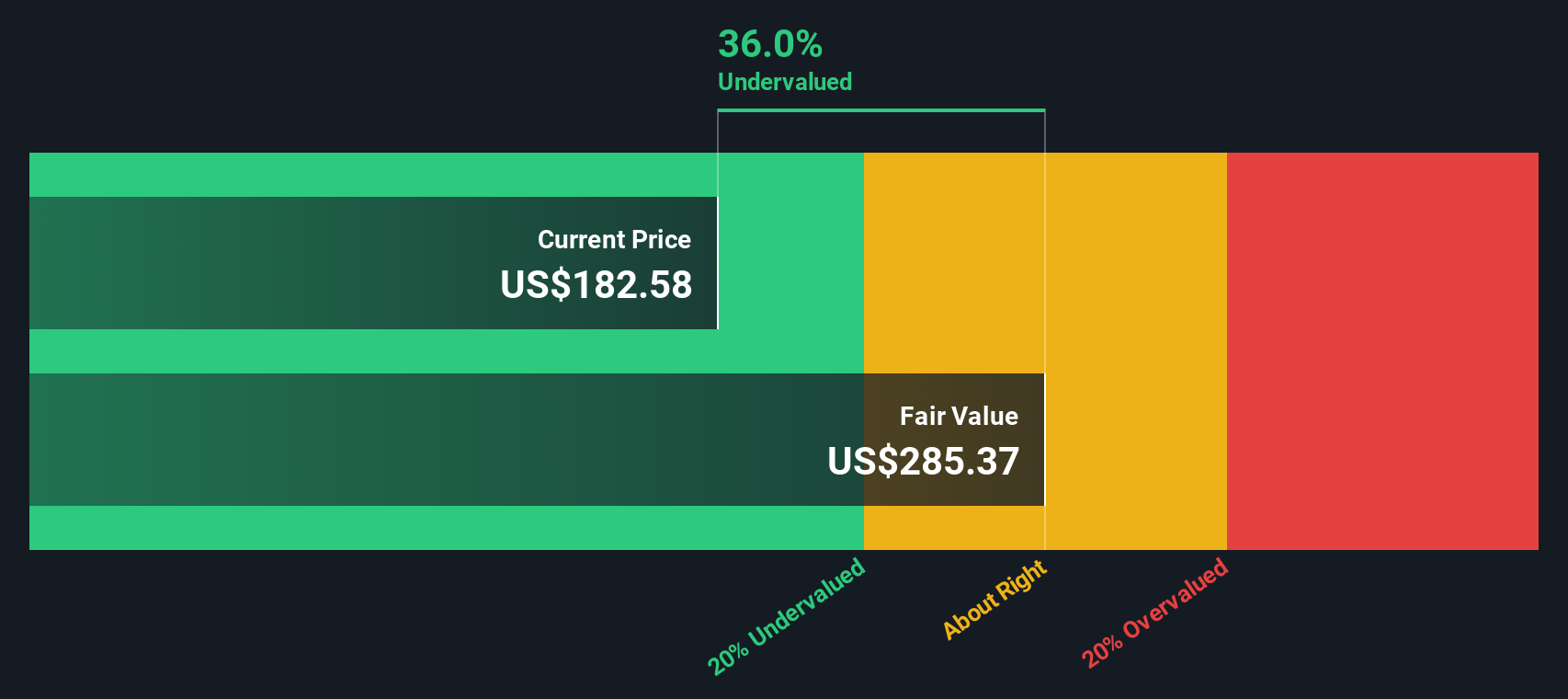

Using a two-stage approach, the DCF model estimates Leidos Holdings’ intrinsic value at $298.11 per share. This valuation suggests the stock is trading at a substantial 37.4% discount to its fair value according to underlying cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Leidos Holdings is undervalued by 37.4%. Track this in your watchlist or portfolio, or discover 926 more undervalued stocks based on cash flows.

Approach 2: Leidos Holdings Price vs Earnings

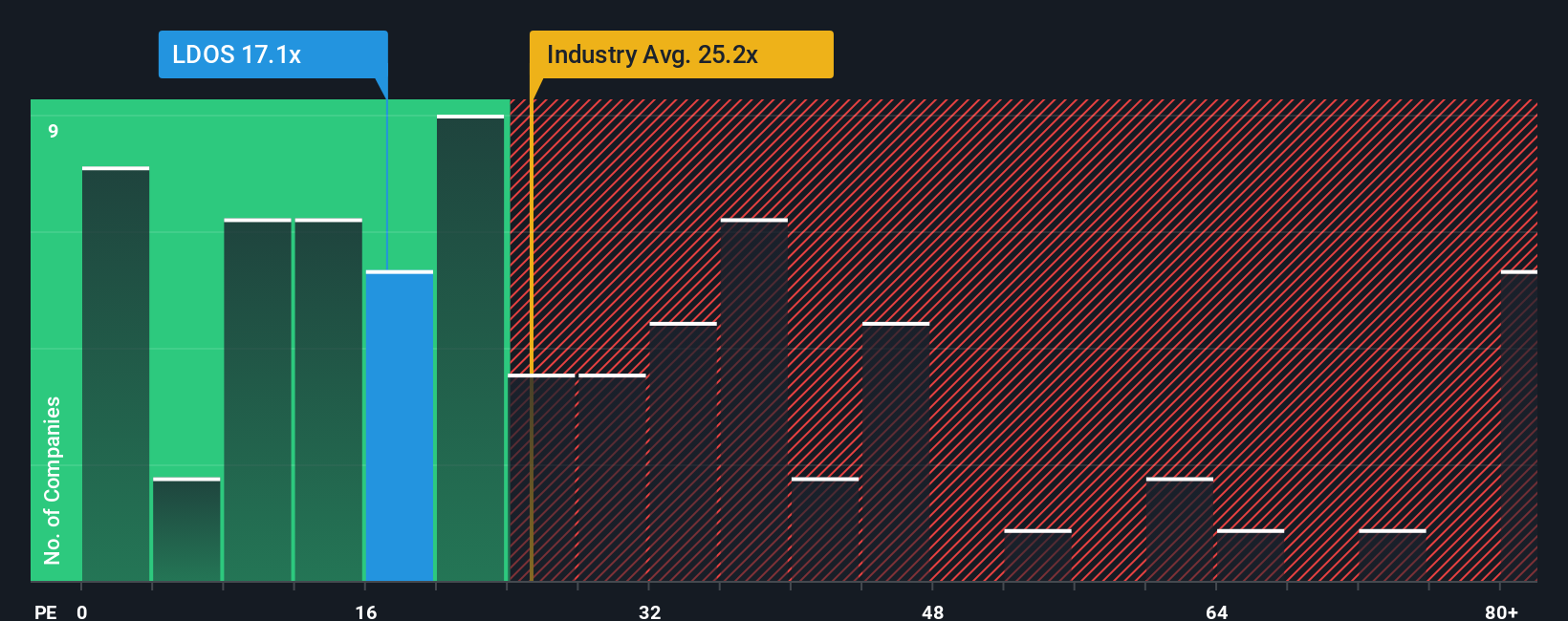

The Price-to-Earnings (PE) ratio remains a classic valuation metric for profitable companies such as Leidos Holdings. This measure shows how much investors are willing to pay for each dollar of current earnings, making it especially relevant when the company has stable earnings and consistent growth prospects.

Growth expectations and perceived risks play a key role in defining what counts as a “normal” or fair PE ratio for any stock. Faster-growing or lower-risk firms generally command a higher multiple, while slower-growing or riskier peers tend to see a lower figure.

Leidos Holdings currently trades at a PE of 17.0x. For context, this is well below the Professional Services industry average of 24.0x and even further below its peer group, which averages 40.8x. On the surface, this could suggest that Leidos is comparatively inexpensive, but traditional benchmarks do not paint the full picture for each unique company.

This is where the Simply Wall St Fair Ratio comes in. Calculated from a mix of factors including Leidos’ earnings growth outlook, profitability, industry dynamics, market cap and risk profile, its Fair Ratio is 24.7x. Because this approach incorporates growth rates, margins, and company-specific risks, it gives a more tailored and reliable valuation signal than simply looking at peer or industry averages.

Comparing the Fair Ratio to Leidos Holdings’ actual PE (17.0x vs. 24.7x), the stock appears to be trading at a substantial discount to what would be considered fair value based on its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1430 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Leidos Holdings Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a clear, user-friendly framework that lets you put your perspective behind the numbers by connecting the company’s story, your forecasts for revenue, earnings, and margins, and what you believe is a fair value for the stock. Instead of just relying on traditional ratios or outside opinions, a Narrative empowers you to map out how specific events such as contract wins, technological shifts, or changes in margin trends impact Leidos Holdings’ future prospects in a transparent, data-backed storyline.

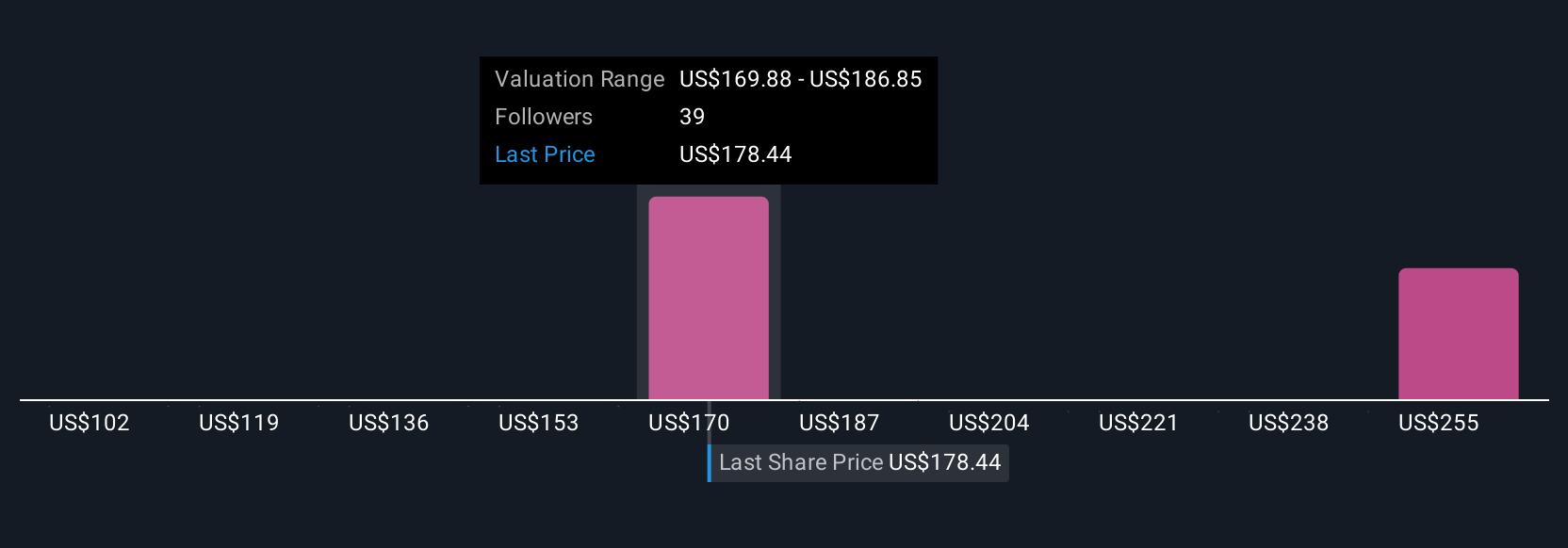

On Simply Wall St's Community page, millions of investors use Narratives to capture their reasoning, update assumptions as new news or earnings arrive, and directly compare their calculated Fair Value to the current Price to guide buy or sell decisions. Because Narratives are dynamic and update automatically with new information, they help you adapt quickly, whether that means holding as positive margin growth continues or re-evaluating if contract risks surface. For Leidos Holdings, some investors may frame a bullish Narrative with a higher price target of $210, focusing on government project growth and expanding margins, while others anchor a more cautious view around $164, emphasizing acquisition and funding risks. This demonstrates how Narratives effortlessly reflect different investor perspectives.

Do you think there's more to the story for Leidos Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LDOS

Leidos Holdings

Provides services and solutions for government and commercial customers in the United States and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives