- United States

- /

- Professional Services

- /

- NYSE:KFY

Can Korn Ferry's (KFY) Lower Returns Hint at Shifting Profitability Strategy?

Reviewed by Sasha Jovanovic

- In recent days, Korn Ferry reported that its revenue has declined by 1.3% annually over the last two years, with analysts forecasting only modest 2.7% growth over the next 12 months, falling short of sector norms.

- An important insight is that the company’s return on invested capital has also decreased significantly, highlighting concerns about fewer profitable growth opportunities moving forward.

- We’ll explore how rising investor concerns over profitability and modest near-term revenue growth might affect Korn Ferry’s investment outlook.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Korn Ferry Investment Narrative Recap

To be a Korn Ferry shareholder today, you have to believe in the company's ability to convert new business wins and strategic engagements into sustainable revenue growth, even as recent news shows annual revenue declines and a dip in return on invested capital. This softer top-line outlook may weigh on the pace of recovery, but it doesn't fundamentally alter the biggest short-term catalyst, demand for workforce transformation services, or the top risk of persistent macroeconomic and competitive pressures on revenue and margins.

Among recent announcements, Korn Ferry’s September 2025 earnings report stands out: revenue ticked up to US$715.54 million, and earnings increased year-on-year, despite sector-wide challenges. These results suggest the company is still capturing new opportunities, yet the reported decline in return on invested capital raises questions about the profitability of future growth and how quickly upcoming engagements might benefit the bottom line.

Conversely, investors should keep an eye on how delayed revenue conversion from large transformation projects could...

Read the full narrative on Korn Ferry (it's free!)

Korn Ferry's narrative projects $3.1 billion revenue and $331.4 million earnings by 2028. This requires 4.3% yearly revenue growth and a $88.6 million earnings increase from $242.8 million.

Uncover how Korn Ferry's forecasts yield a $83.75 fair value, a 26% upside to its current price.

Exploring Other Perspectives

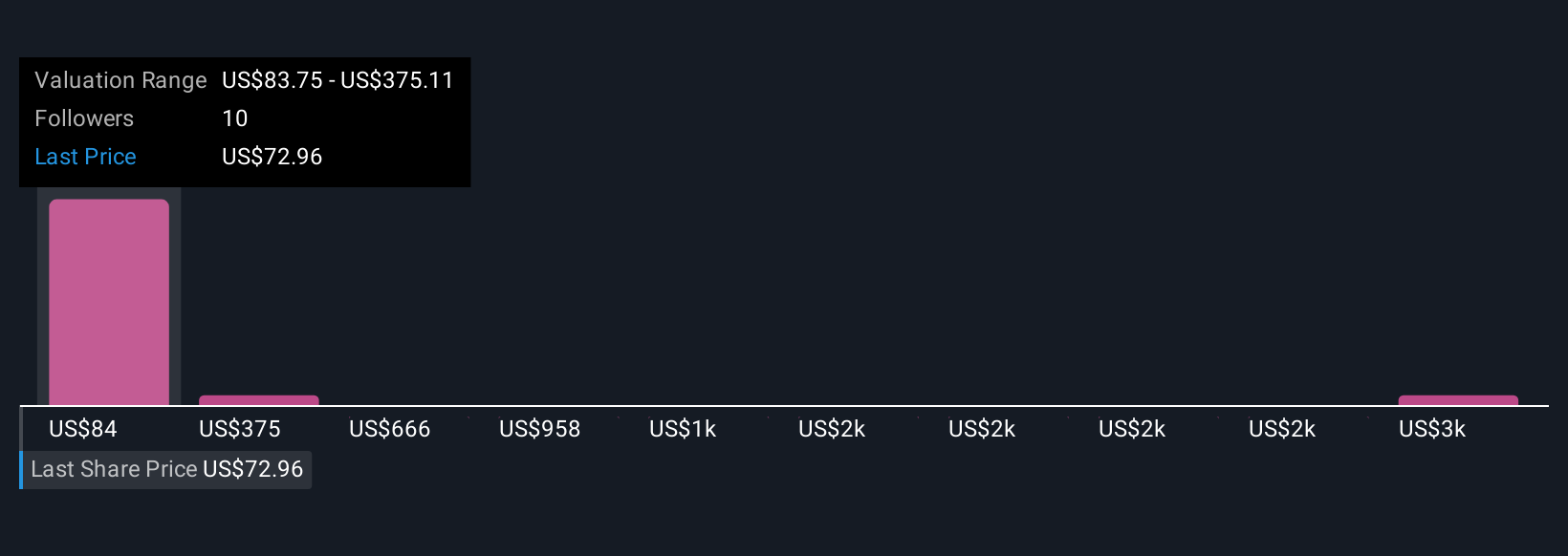

Fair value estimates from four members of the Simply Wall St Community range from US$83.75 to US$2,997.37 per share. While projected revenue growth remains modest, these divergent views highlight how differently market participants interpret Korn Ferry’s long-term potential and current risks.

Explore 4 other fair value estimates on Korn Ferry - why the stock might be worth just $83.75!

Build Your Own Korn Ferry Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Korn Ferry research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Korn Ferry research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Korn Ferry's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Korn Ferry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KFY

Korn Ferry

Engages in the provision of organizational consulting services worldwide.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives