- United States

- /

- Commercial Services

- /

- NYSE:KAR

OPENLANE (KAR): Profit Margins Surge to 5.8%—Reinforcing Bullish Growth Narratives

Reviewed by Simply Wall St

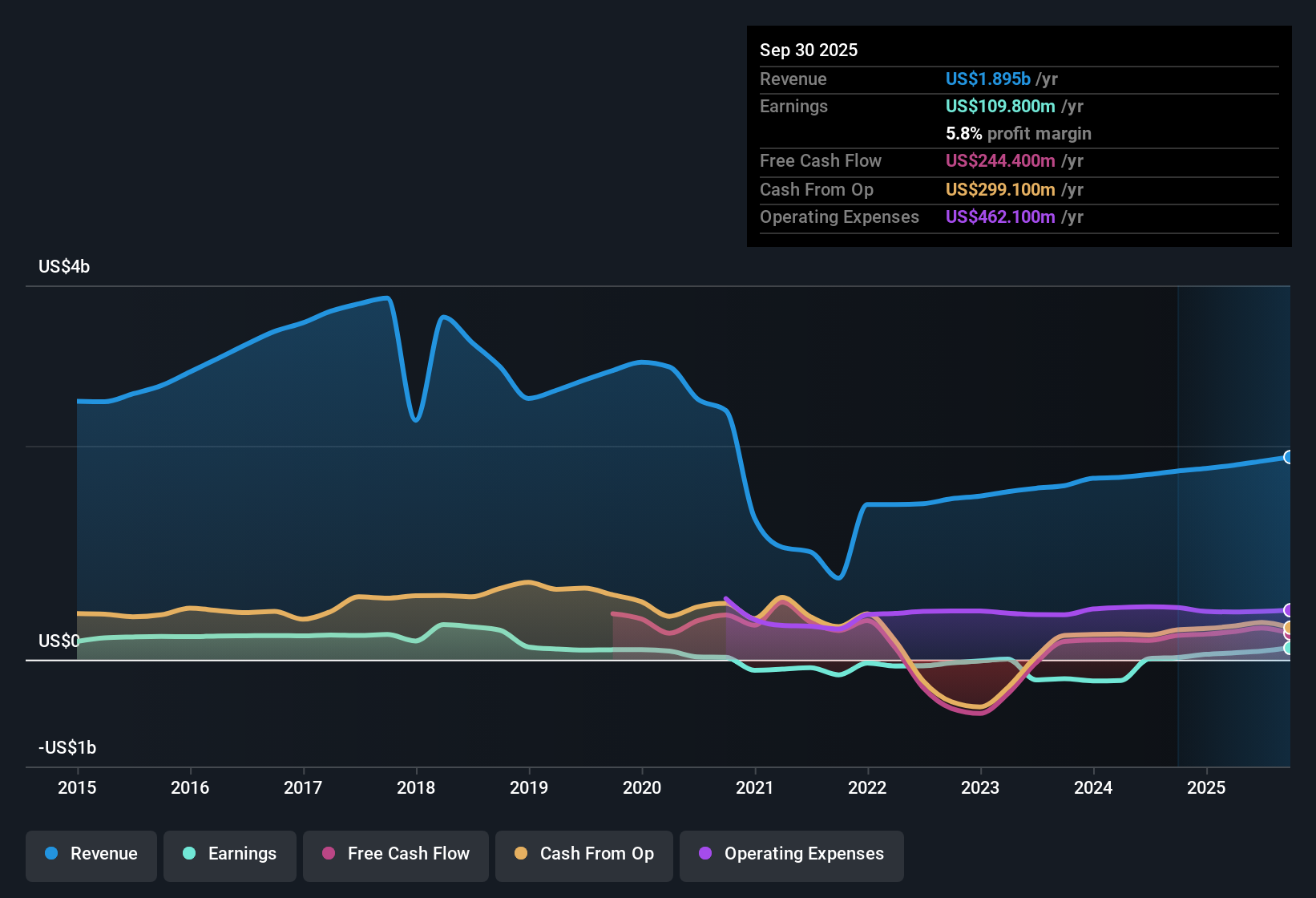

OPENLANE (KAR) posted earnings growth of 427.9% over the past year, a striking leap compared to the five-year average of 27.6% per year. Margins have climbed to 5.8% from 1.2% last year, while the company's annual earnings are forecast to outpace the broader US market with 23.9% growth. With a current share price of $24.94 trading below some estimates of fair value and ongoing questions about financial strength, investors are weighing robust profit expansion against persistent balance sheet concerns.

See our full analysis for OPENLANE.Now, let's see how these figures measure up against the consensus narratives. The numbers reinforce some stories and challenge others.

See what the community is saying about OPENLANE

Margins Expect to Reach Double-Digits

- Analysts predict profit margins will increase from 4.3% today to 10.7% within three years, more than doubling OPENLANE's net margin potential.

- According to the analysts' consensus view, the projected expansion in margins is credited to ongoing investment in AI-driven automation and platform upgrades, which are expected to improve operational efficiency and boost transaction values.

- The consensus narrative notes that, in addition to digital adoption tailwinds, margin growth is further supported by the move toward more sustainable, high-frequency remarketing across the auto industry. This strengthens OPENLANE’s ability to defend its profitability.

- However, persistent integration costs and competition from traditional auction houses expanding their digital capabilities could slow the rate of margin expansion, highlighting the importance of operational discipline.

- Investors wondering whether rising margins make OPENLANE a stand-out in the sector should see how the consensus forecast stacks up against industry trends. 📊 Read the full OPENLANE Consensus Narrative.

Share Dilution and Regulatory Overhang

- Conversion of more than 36 million Series A preferred shares, due in 2026, introduces significant dilution risk for shareholders. This has the potential to depress future earnings per share until fully resolved.

- Analysts' consensus view highlights that regulatory pressures, such as evolving rules on cross-border auto sales and emissions, could lead to higher compliance costs for OPENLANE and slow its expected global scale gains.

- They note that the transition to stricter vehicle emissions requirements and exposure to tariffs could directly squeeze net margins in international markets, making growth less predictable.

- Growing competition from both digital-first rivals and established players moving deeper into online auctions adds challenges for maintaining market share, further complicating the risk picture.

Trading at a Discount to Peers' Valuation

- OPENLANE’s current share price of $24.94 implies a price-to-earnings ratio of 24.1x, which is below the average US peer P/E of 30.7x, but just above the commercial services industry average of 22.7x.

- The consensus narrative points out that this valuation discount may reflect both the strong earnings outlook, as OPENLANE's forecast 23.9% annual earnings growth far outpaces the US market average, as well as uncertainty around its financial strength and competitive headwinds.

- Analysts agree that the consensus price target of 32.07 suggests the market sees further upside, especially if forecasted profit margins and integration benefits are delivered as planned.

- Yet, the relatively modest gap between the current share price and this target also signals that much of the near-term optimism may be priced in, increasing the stakes for execution on growth and margin goals.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for OPENLANE on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique angle on the figures? Share your perspective and shape the conversation by building your own narrative in just a few minutes. Do it your way

A great starting point for your OPENLANE research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite OPENLANE's rapid earnings growth and margin gains, ongoing questions about its balance sheet and dilution risk highlight concerns over financial resilience.

If you're looking for stocks with stronger financial footing, use solid balance sheet and fundamentals stocks screener (1975 results) to zero in on companies built around lasting balance sheet strength and robust fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KAR

OPENLANE

Operates as a digital marketplace for used vehicles, which connects sellers and buyers in the United States, Canada, Continental Europe and the United Kingdom.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives