- United States

- /

- Commercial Services

- /

- NYSE:KAR

OPENLANE (KAR): Evaluating Valuation Following Canadian Receivables Program Expansion

Reviewed by Simply Wall St

OPENLANE (KAR) just updated its Canadian Receivables Purchase Agreement, increasing the cap from C$375 million to C$500 million. This signals a deeper footprint in the Canadian market and added momentum for their financial operations.

See our latest analysis for OPENLANE.

After a rapid start to the year, OPENLANE’s share price return year-to-date stands at an impressive 22.05%, even as short-term momentum has cooled in recent weeks. Investors seem to be digesting the expanded Canadian program along with recent conference presentations in the US. The company’s three-year total shareholder return of 88.88% reflects sustained progress for longer-term holders.

If this kind of strategic expansion sparks your interest, now is a great time to broaden your investing radar and explore fast growing stocks with high insider ownership

With financial performance strong and expansion plans accelerating, the question now becomes clear: does OPENLANE’s current share price reflect this future growth, or could there still be an attractive entry point for investors?

Most Popular Narrative: 22.6% Undervalued

OPENLANE’s most widely followed narrative puts its fair value at $31.81, which is significantly above the last close at $24.63. The gap suggests that consensus expectations for future growth, margins, and innovation have not yet been fully priced in. Let’s take a look at a key catalyst fueling this valuation outlook.

Ongoing investment in AI-driven products, process automation, and user experience enhancements (for example, Absolute Sale and advanced inspection technology) is driving higher transaction values and operational efficiencies, which are already resulting in significant margin expansion and are likely to further improve net margins over time.

Want to know why analysts think OPENLANE is poised for a lasting re-rating? The narrative hints at margin growth and a digital transformation, but there is a bold profit leap built into the numbers. Uncover exactly what is driving this valuation. Dive in to get the full picture behind the fair value target.

Result: Fair Value of $31.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition from digital-first entrants and ongoing integration challenges could quickly pressure OPENLANE’s margins and disrupt its expected profit trajectory.

Find out about the key risks to this OPENLANE narrative.

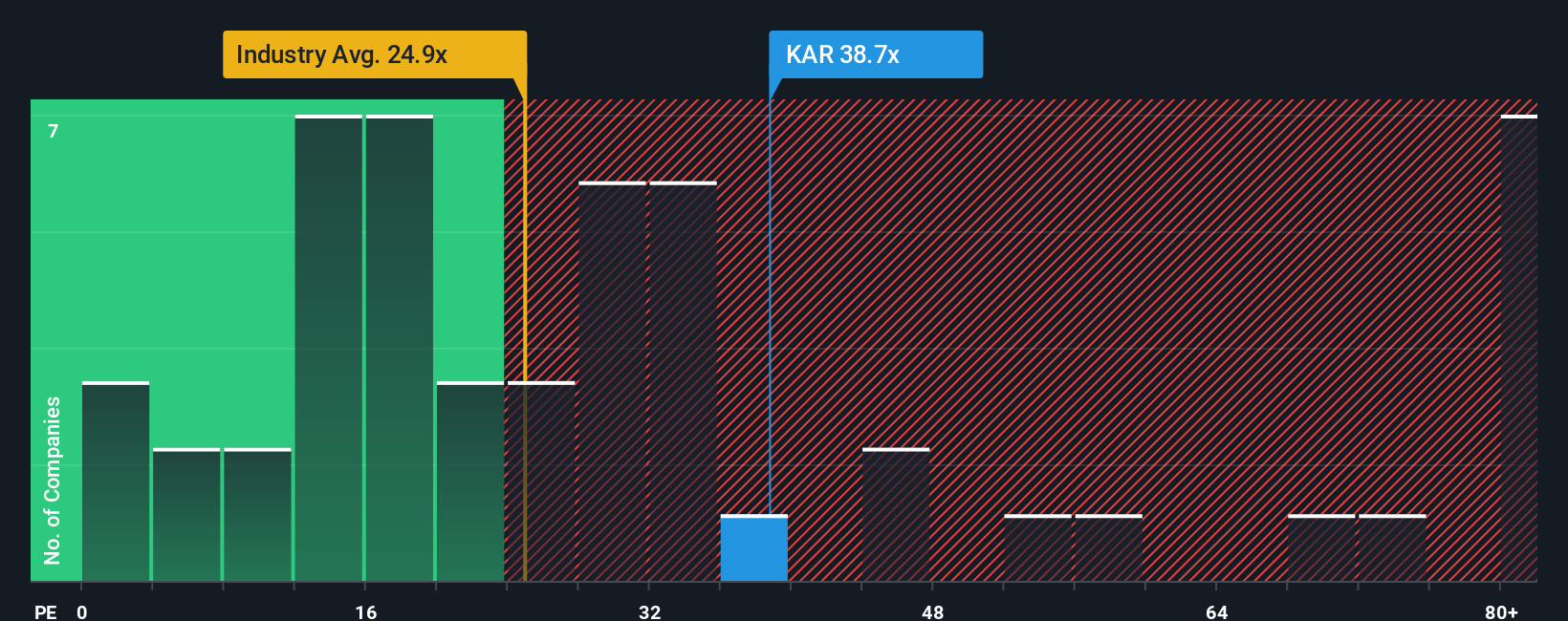

Another View: Comparing Ratios to Peers

Looking at OPENLANE's price-to-earnings ratio for a second opinion, the stock currently trades at 27.7x, which is lower than the peer average of 32.1x but higher than the US Commercial Services industry at 22.3x. The fair ratio, based on market trends, stands at 28.5x. This means OPENLANE appears to be better value than most competitors, yet not the cheapest among its sector. How much should investors trust this measure? Could the market’s “fair ratio” signal more upside, or does the current premium to industry peers pose a risk?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OPENLANE for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OPENLANE Narrative

If you have a different perspective or want to dig into the analysis firsthand, creating your own OPENLANE narrative takes just a few minutes. Do it your way

A great starting point for your OPENLANE research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't miss your chance to get ahead of the market. Leverage powerful data and sharpen your strategy by using these hand-picked stock idea screens on Simply Wall Street:

- Target growing companies at compelling prices by scanning these 924 undervalued stocks based on cash flows, a selection of stocks trading below their true value according to future cash flows.

- Put your capital to work in artificial intelligence by starting with these 26 AI penny stocks, offering a front-row seat to tech disruption and innovation leaders.

- Maximize your yields and generate steady income as you browse these 15 dividend stocks with yields > 3%, which features stocks with robust and sustainable dividend payouts above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KAR

OPENLANE

Operates as a digital marketplace for used vehicles, which connects sellers and buyers in the United States, Canada, Continental Europe and the United Kingdom.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives