Jacobs Solutions (J): Evaluating Valuation After New EPCM Partnership for Major Hut 8 AI Infrastructure Project

Reviewed by Simply Wall St

Hut 8 partnership puts Jacobs Solutions in the AI infrastructure spotlight

Jacobs Solutions (J) just landed a high profile role as EPCM partner to Hut 8 Corp. on a major AI infrastructure build, a deal that underlines rising demand for Jacobs advanced facilities expertise.

See our latest analysis for Jacobs Solutions.

The Hut 8 deal lands just as Jacobs navigates a choppy year, with a modest year to date share price return of 2.05 percent, but a stronger 39.44 percent three year total shareholder return, suggesting longer term momentum remains intact.

If this kind of AI infrastructure story interests you, it is worth exploring other potential beneficiaries using high growth tech and AI stocks to see what else is lining up interesting growth and demand.

With revenue and earnings still growing, a roughly 42 percent intrinsic value discount and about 15 percent upside to analyst targets, is Jacobs quietly undervalued or already pricing in its next leg of AI fueled growth?

Most Popular Narrative Narrative: 15% Undervalued

With Jacobs last closing at $135.68 against a most popular narrative fair value near $160, the story leans toward meaningful upside grounded in earnings expansion.

Record high backlog growth in Water, Advanced Facilities, and Critical Infrastructure driven by global infrastructure modernization, water scarcity, and data center expansion provides strong visibility into multi year revenue growth and supports confidence in accelerating top line results into FY '26 and beyond.

Curious how steady top line growth, rising margins, and shrinking share count combine into this upside case? The narrative leans on surprisingly bold earnings math. Want to see exactly how far those assumptions stretch?

Result: Fair Value of $159.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on government infrastructure budgets and capital intensive digital investments could pressure margins and derail those upbeat earnings assumptions.

Find out about the key risks to this Jacobs Solutions narrative.

Another View, Valuation Through Earnings Ratios

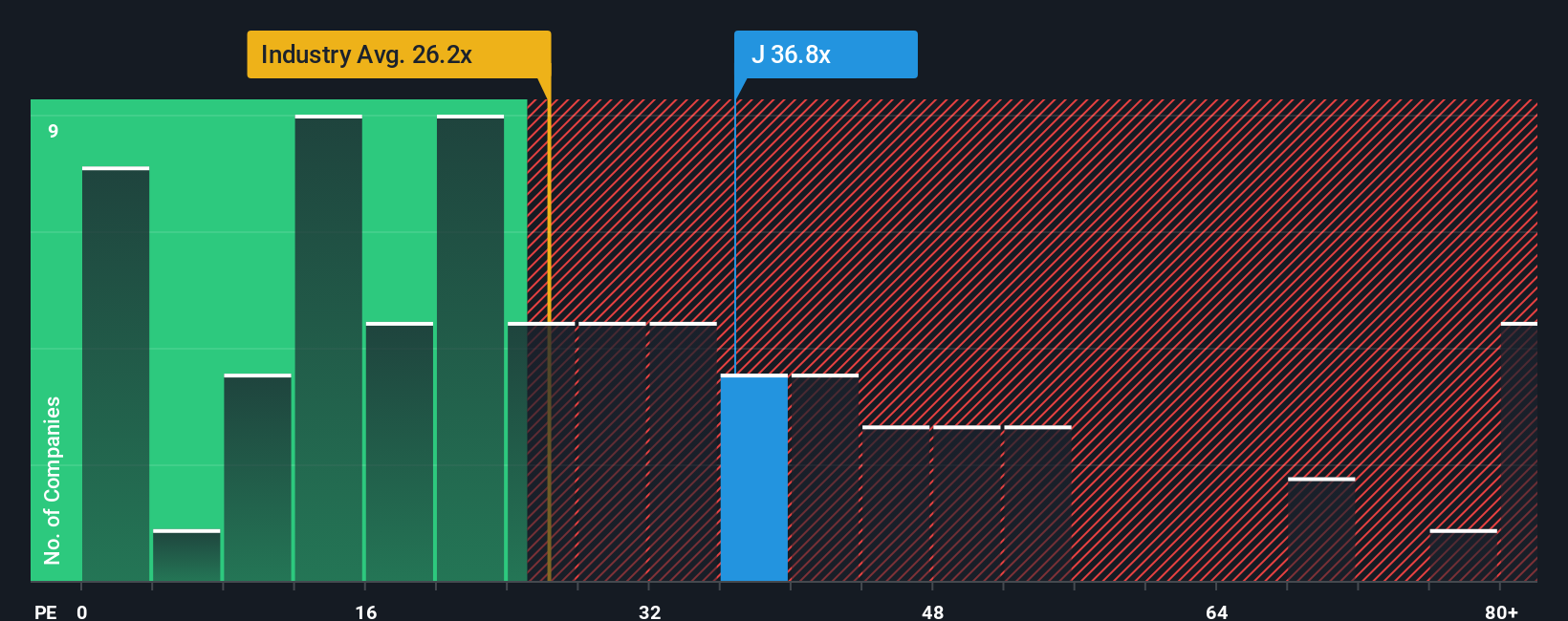

Step away from narratives and fair value models for a moment, and Jacobs suddenly looks pricey. Its P E ratio near 51 times towers over both peers at 32.7 times and a fair ratio of 31.4 times, raising real questions about how much optimism is already in the price.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Jacobs Solutions Narrative

If you want to challenge these assumptions or rely on your own research, you can quickly build a custom view in minutes using Do it your way.

A great starting point for your Jacobs Solutions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high potential opportunities?

Before you move on, set yourself up for the next winning idea by using our screeners to uncover quality opportunities other investors may be overlooking.

- Capture powerful growth trends early by scanning these 24 AI penny stocks that could benefit from accelerating demand in artificial intelligence.

- Seek resilient income streams by targeting these 11 dividend stocks with yields > 3% that balance payouts with sustainable business fundamentals.

- Position yourself ahead of the crowd by filtering for these 79 cryptocurrency and blockchain stocks that may benefit from real world blockchain adoption and digital asset expansion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:J

Jacobs Solutions

Engages in the infrastructure and advanced facilities, and consulting businesses in the United States, Europe, Canada, India, Asia, Australia, New Zealand, the Middle East, and Africa.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion