- United States

- /

- Commercial Services

- /

- NYSE:GEO

Investors more bullish on GEO Group (NYSE:GEO) this week as stock ascends 4.4%, despite earnings trending downwards over past three years

It hasn't been the best quarter for The GEO Group, Inc. (NYSE:GEO) shareholders, since the share price has fallen 10% in that time. But don't let that distract from the very nice return generated over three years. To wit, the share price did better than an index fund, climbing 57% during that period.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for GEO Group

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the three years of share price growth, GEO Group actually saw its earnings per share (EPS) drop 41% per year.

This means it's unlikely the market is judging the company based on earnings growth. Given this situation, it makes sense to look at other metrics too.

We severely doubt anyone is particularly impressed with the modest 2.9% three-year revenue growth rate. While we don't have an obvious theory to explain the share price rise, a closer look at the data might be enlightening.

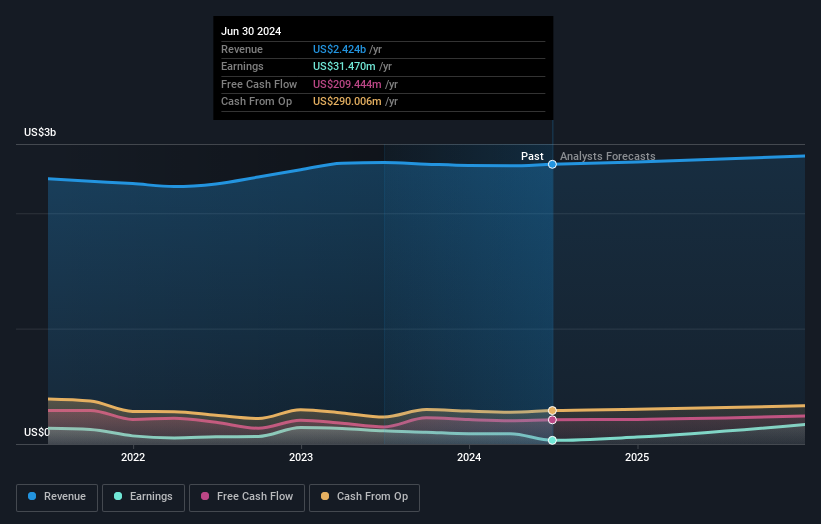

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. You can see what analysts are predicting for GEO Group in this interactive graph of future profit estimates.

A Different Perspective

We're pleased to report that GEO Group shareholders have received a total shareholder return of 52% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 0.7% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand GEO Group better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for GEO Group (of which 1 is potentially serious!) you should know about.

GEO Group is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:GEO

GEO Group

The GEO Group, Inc. (NYSE: GEO) engages in ownership, leasing, and management of secure facilities, processing centers, and community-based reentry facilities in the United States, Australia, the United Kingdom, and South Africa.

Good value slight.