How Investors Are Reacting To Genpact (G) Raising Guidance Amid AI Momentum and Share Repurchases

Reviewed by Sasha Jovanovic

- Genpact recently reported strong third quarter results, raising its full-year 2025 earnings guidance and highlighting momentum in its Advanced Technology Solutions and Data-Tech-AI segments.

- This follows continued recognition for innovation, including a Salesforce Partner Innovation Award, and multiple capital markets activities such as a $350 million senior notes offering and completion of a major share repurchase program.

- We'll explore how the raised earnings outlook and AI-driven growth are influencing Genpact's investment narrative and long-term potential.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Genpact Investment Narrative Recap

To be a Genpact shareholder, you need to believe that the company’s shift toward Advanced Technology Solutions and innovative AI offerings will drive sustainable revenue and margin growth, even as core BPO services slow. The recent shelf registration filing does not materially affect the key short-term catalyst, accelerating AI-driven contract wins, and does little to shift the primary risk, which remains the challenge of offsetting slower legacy revenue with new tech-led gains.

Among the latest announcements, the upgrade to full-year 2025 guidance is most relevant. Management’s higher expectations for both overall and Data-Tech-AI segment growth directly reinforce the core catalyst of expanding high-value technology contracts, positioning Genpact to better navigate macro uncertainty and potential softness in traditional segments.

However, against this optimism, one ongoing source of risk that investors should be aware of is increasing competition from IT consulting and tech-first entrants as Genpact pivots further from legacy BPO…

Read the full narrative on Genpact (it's free!)

Genpact's narrative projects $5.9 billion revenue and $669.6 million earnings by 2028. This requires 6.2% yearly revenue growth and an increase of about $131 million in earnings from $538.3 million currently.

Uncover how Genpact's forecasts yield a $50.30 fair value, a 12% upside to its current price.

Exploring Other Perspectives

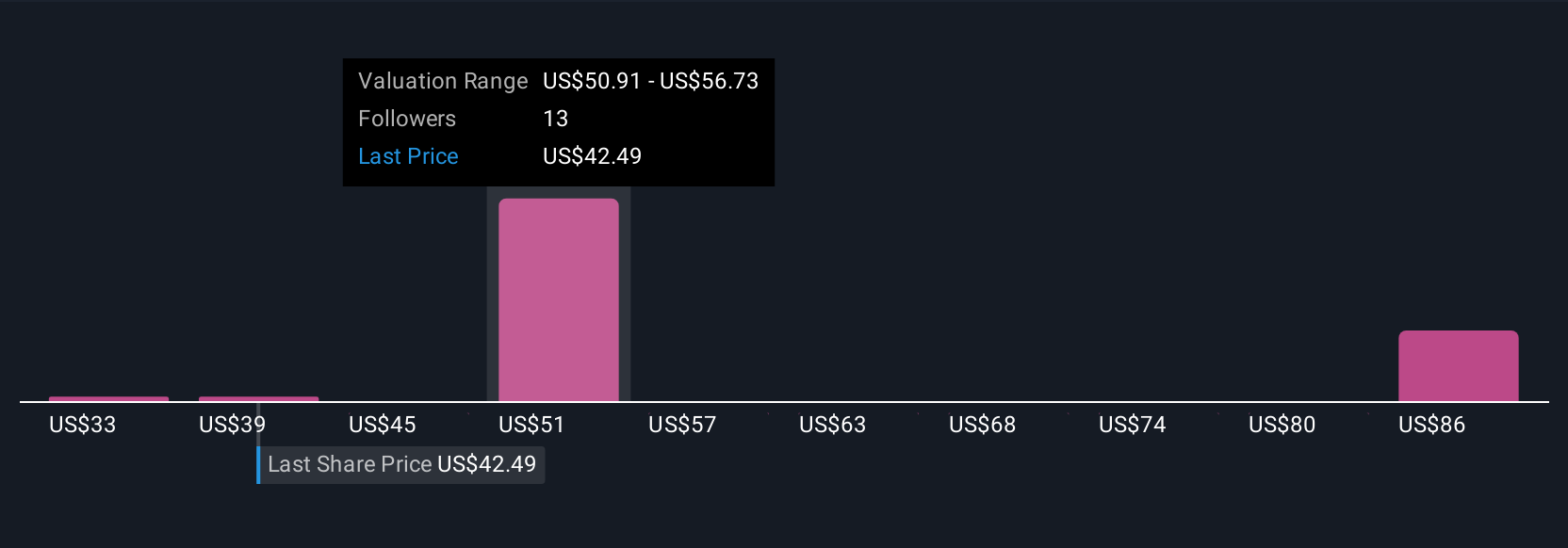

Fair value estimates from the Simply Wall St Community range widely, from as low as US$33.84 to nearly US$78, across three unique perspectives. As you weigh these diverse views, consider how Genpact’s ability to accelerate client adoption of AI-driven solutions could significantly shape its future market share and profitability.

Explore 3 other fair value estimates on Genpact - why the stock might be worth as much as 74% more than the current price!

Build Your Own Genpact Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Genpact research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Genpact research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Genpact's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:G

Genpact

Provides business process outsourcing and information technology services in India, rest of Asia, North and Latin America, and Europe.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives