Does Genpact’s AI Push Signal a Missed Opportunity After This Year’s Share Slide?

Reviewed by Bailey Pemberton

If you’re wondering whether to keep holding, buy more, or finally part ways with Genpact, you’re not alone. The stock has been on a bit of a roller coaster, inviting both cautious observers and value hunters to the table. Over the past year, Genpact’s price has ticked up a respectable 4.5%, despite a choppy ride that includes a 6.4% dip over the past month and an overall 8.1% slide year-to-date. While that kind of short-term volatility might spook some investors, it can also mean opportunity, especially if the market is missing something in plain sight.

Recently, news around industry partnerships and Genpact’s efforts to broaden its AI-driven services have sparked conversations about future growth potential and risk. While not creating dramatic price swings, these developments are fueling curiosity about whether the company is currently undervalued or simply in a holding pattern.

The number that grabs my attention is Genpact’s valuation score: a perfect 6 out of 6. That’s right, according to key checks, the stock is undervalued across every major measure we track. Could this be a rare value opportunity that the market is only beginning to recognize?

Let’s dig into how that valuation score is built and what it really says about Genpact’s investment case. And, as we’ll see, that’s just one way to look at the company's worth. There is an even more insightful approach we will explore before we wrap up.

Approach 1: Genpact Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting them back to today’s value. This approach provides a lens into what Genpact could be worth, based not just on current performance, but on expectations for sustained cash generation over the next decade.

Genpact’s latest reported Free Cash Flow stands at $572.9 million, with analyst estimates projecting modest growth ahead. By 2027, annual Free Cash Flow is expected to reach $619 million. Beyond that, further growth is extrapolated, reaching approximately $819.2 million by 2035. All these figures are in US dollars. Notably, only the first five years of projections come directly from analysts, while the years beyond are calculated based on reasonable long-term growth assumptions.

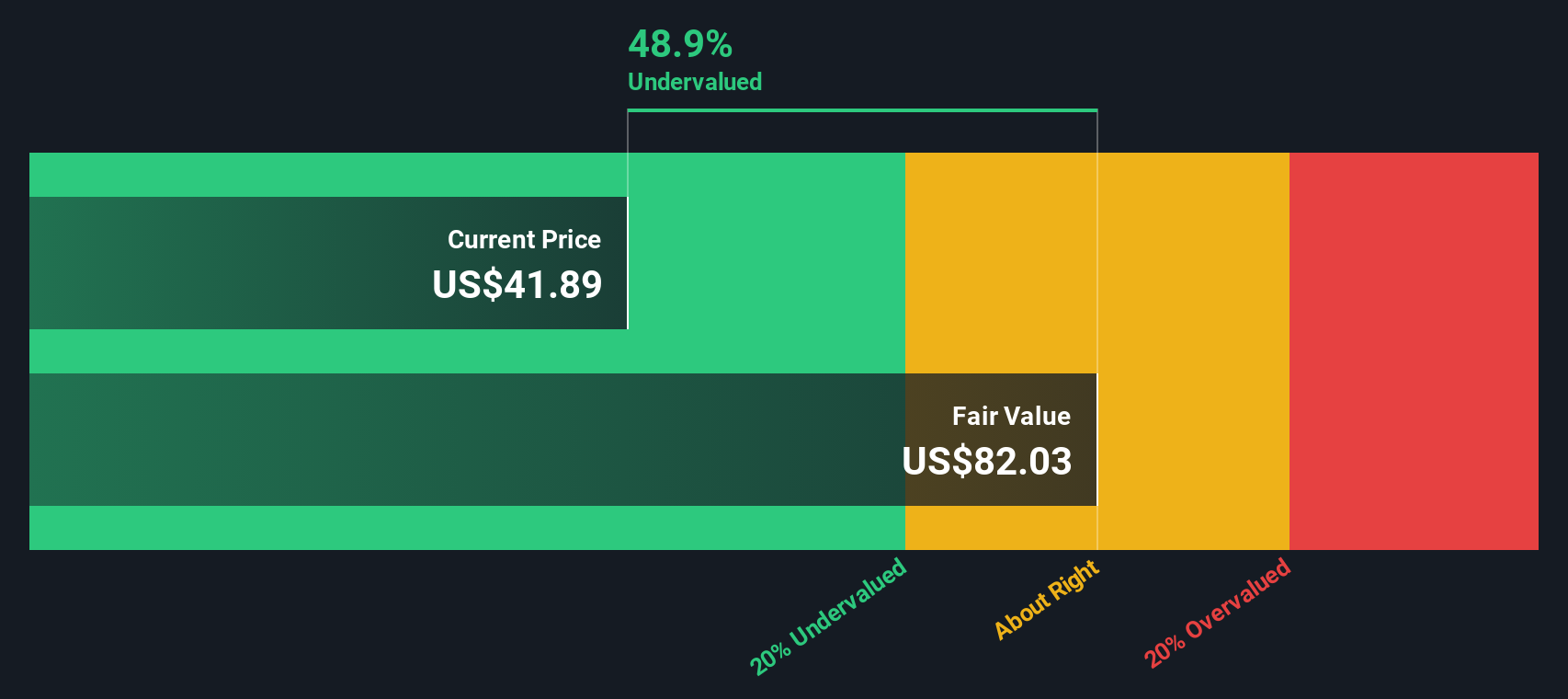

Using these forecasts, the DCF model arrives at an intrinsic value of $82.45 per share. With Genpact’s current market price sitting at a significant discount to this figure, the implied undervaluation is about 52.1%. This suggests the market may be underappreciating Genpact’s long-term cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Genpact is undervalued by 52.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Genpact Price vs Earnings

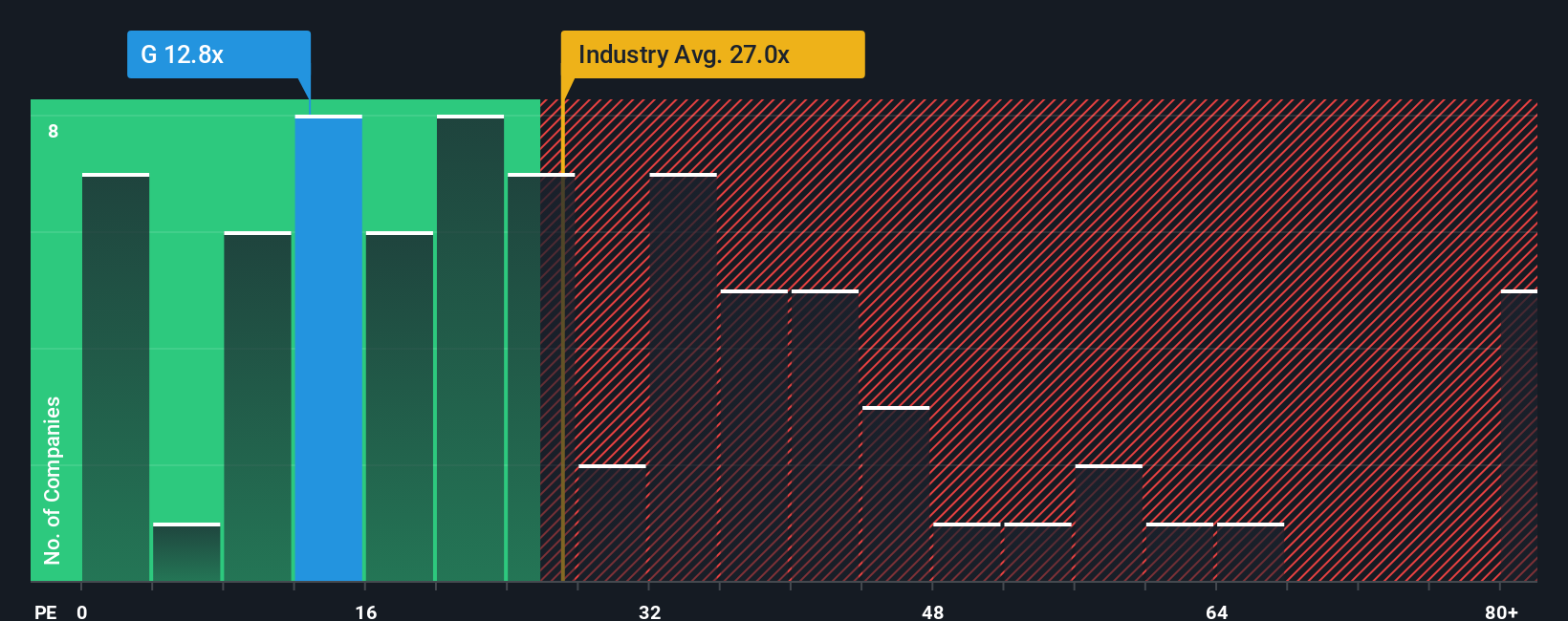

The Price-to-Earnings (PE) ratio stands out as a reliable valuation tool for profitable companies like Genpact, because it directly ties the firm’s market price to its actual earnings performance. Investors often use the PE ratio to quickly assess whether a stock is cheap or expensive relative to its earnings power.

Of course, what counts as a “normal” or “fair” PE ratio is not fixed. Expectations for earnings growth and the perceived riskiness of the business typically push a fair PE higher or lower. Fast-growing and stable companies generally trade at higher PE ratios, while riskier or slower-growing firms usually fetch lower multiples.

At 12.78x, Genpact’s PE ratio is well below both the industry average of 26.46x and the average among its peers at 41.51x. Rather than stopping at those benchmarks, though, it's worth considering Simply Wall St’s proprietary “Fair Ratio.” This dynamic number, set at 24.23x for Genpact, reflects a more nuanced view by factoring in the company’s specific earnings growth outlook, profit margins, market cap, risk profile, and where it sits in its industry.

Compared to the blunt approach of simply benchmarking against industry or peers, the Fair Ratio delivers a tailored yardstick, making it more meaningful for investors looking for genuine value. With Genpact’s actual PE significantly lower than its Fair Ratio, the evidence points to an undervalued stock based on earnings expectations and fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

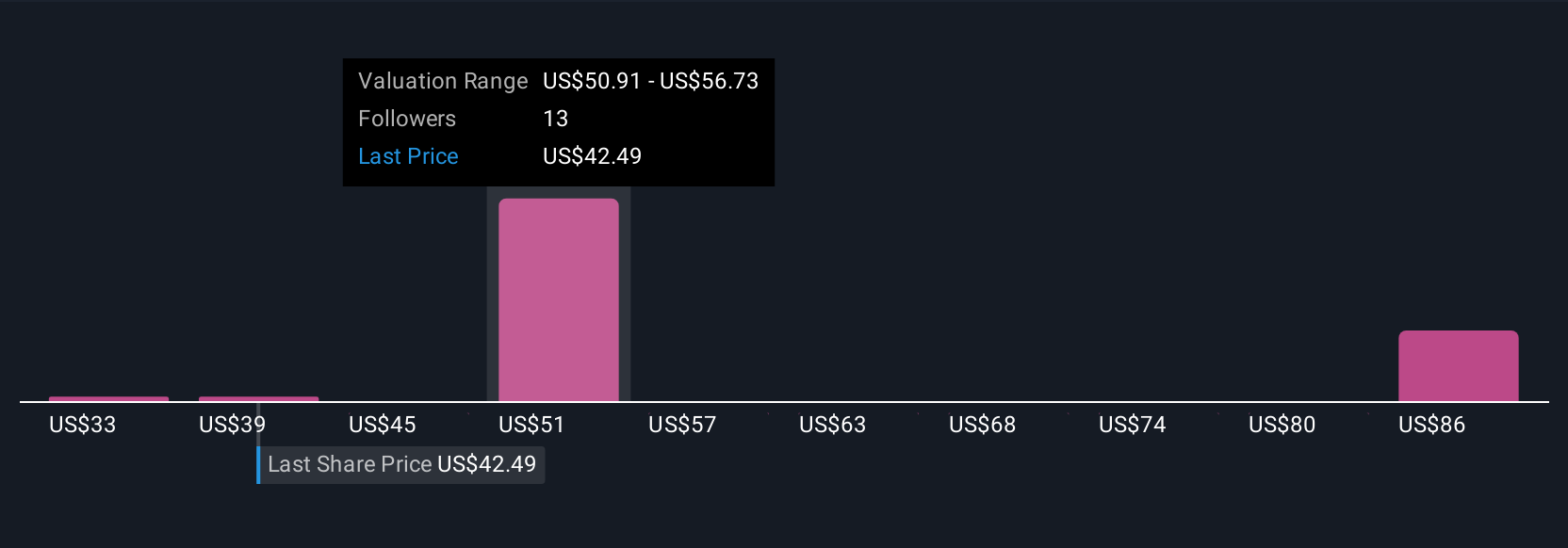

Upgrade Your Decision Making: Choose your Genpact Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives, a powerful tool that connects Genpact’s story with numbers to help you make smarter investment decisions. A Narrative is simply your perspective: you combine your expectations for a company’s future (like its growth, margins, and fair value) with your personal view on why it matters. This approach brings the company’s journey, industry changes, and your own conviction together into a financial forecast. That forecast is then compared to the stock’s current price, allowing you to see not only if it is undervalued, but why.

Available on Simply Wall St’s Community page, Narratives are designed to be both accessible and dynamic, updating whenever fresh news or earnings are released. They make it easy for everyone, whether you are cautious or optimistic, to track their reasons for buying, holding, or selling.

For example, one Genpact investor might base their Narrative on rapid AI adoption and rising margins, leading to a higher fair value and a bullish stance. Another might worry about slowing legacy businesses or intensifying competition, reflecting a lower fair value and a more cautious outlook. Narratives help you visualize these stories side by side so you can confidently decide: Does Genpact’s current price fit your story?

Do you think there's more to the story for Genpact? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:G

Genpact

Provides business process outsourcing and information technology services in India, rest of Asia, North and Latin America, and Europe.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)