- United States

- /

- Professional Services

- /

- NYSE:FVRR

Fiverr (FVRR) Earnings Growth Surges 54.3%, Challenging Concerns Over Premium Valuation

Reviewed by Simply Wall St

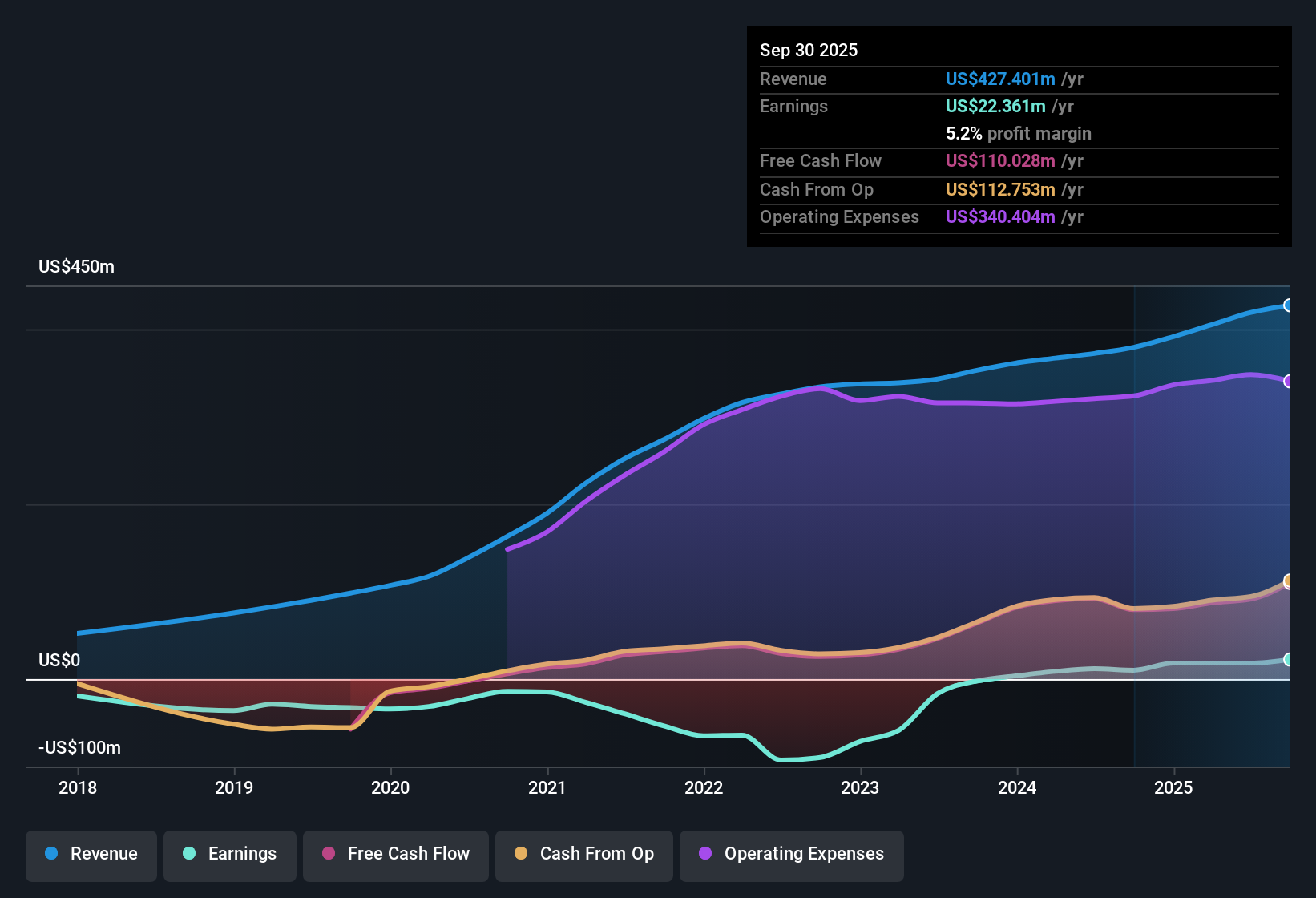

Fiverr International (FVRR) delivered a 54.3% jump in earnings over the past year, outpacing its 5-year annual average growth of 43.4%. Its net profit margin came in at 4.3%, up from 3.2% a year ago, signaling profitability continues to improve. With analyst forecasts predicting earnings growth of nearly 39.8% per year for the next three years, investors are weighing rapid profit expansion and margin gains against a slower 7% revenue growth rate and a recent one-off loss of $3.1 million.

See our full analysis for Fiverr International.The next section explores how these headline numbers compare with the most widely followed narratives around Fiverr, identifying where the storylines converge and where the data pushes back.

See what the community is saying about Fiverr International

Margin Expansion Targets Take Center Stage

- Analysts project Fiverr’s profit margins will rise from 4.3% now to 11.3% within three years, indicating expectations for much higher efficiency and earnings visibility.

- According to the analysts' consensus view, the push into subscription and value-added services is expected to boost these margins, with momentum coming from products like Seller Plus and AutoDS.

- Consensus narrative notes that platform automation (AI-driven tools) is streamlining operations and raising conversion rates, which directly supports the margin growth thesis.

- However, shifting focus upmarket introduces new risk: larger enterprise clients may require greater investment in service and support, which could blunt margin gains if costs outpace forecasts.

Consensus expects robust margin gains to reshape Fiverr’s profit profile, but surprises may arise if bigger clients cost more to win. 📊 Read the full Fiverr International Consensus Narrative.

Upmarket Shift Brings Revenue Mix Changes

- Fiverr’s move toward enterprise clients and international expansion is diversifying its revenue streams and aims to reduce dependence on small business and regional sources that have historically added volatility.

- Analysts' consensus view highlights that while recurring revenues from larger, complex transactions and managed services are rising, signs of a flat-to-slightly-declining Marketplace revenue year-over-year serve as a warning that expanding the active buyer base remains a key challenge.

- What is surprising is that increased spend per buyer has not fully compensated for potential stagnation in new user growth, which suggests a possible ceiling to growth if segment expansion slows.

- Analysts emphasize that international integration and platform cross-selling (between services like AutoDS and the core marketplace) are central to unlocking new channels, but regional risks remain if these efforts lag expectations.

Valuation: Premium Multiples Despite Discounted Price

- Fiverr trades at $20.56 per share, below its DCF fair value of $40.26, creating what appears to be a value gap. However, its 41.8x PE ratio significantly exceeds both peers (35.3x) and the US Professional Services industry (25.1x). This points to a premium valuation that tempers the discount argument.

- Analysts' consensus narrative underscores this tension: even with robust growth forecasts, Fiverr would need to deliver 2028 profits of $60 million and be valued at 29.6x PE by then, which remains above industry averages, to justify even the consensus price target of 31.9.

- Analysts are split, with the most bullish seeing higher upside, but bears argue that margin gains and revenue acceleration must materialize for premium multiples to remain justified as the sector matures.

- This gap between discounted share price and elevated PE draws extra attention to the debate over whether Fiverr is truly a deep-value opportunity or a richly-priced growth stock banking on future execution.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Fiverr International on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on Fiverr’s numbers? Share your perspective and build a custom narrative in just a few minutes with Do it your way.

A great starting point for your Fiverr International research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Fiverr’s premium valuation and flatlining active buyer growth raise concerns that future returns may not justify the higher multiple investors are paying.

If premium pricing and uncertain user growth leave you questioning the upside, target better value opportunities now by checking out these 849 undervalued stocks based on cash flows that align earnings potential with more attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FVRR

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives