- United States

- /

- Professional Services

- /

- NYSE:FCN

FTI Consulting (FCN): Assessing Valuation After Strategic Hires Bolster Global Tax Advisory Team

Reviewed by Simply Wall St

FTI Consulting (FCN) is making strategic moves, adding two seasoned leaders to its Tax Advisory team in London and Dubai. This expansion broadens the firm’s expertise in areas such as restructuring and VAT advisory across the EMEA region.

See our latest analysis for FTI Consulting.

FTI Consulting’s appointment of seasoned tax experts comes as the firm’s shares have climbed 5.3% over the past month, suggesting renewed optimism after a tougher stretch earlier this year. While its one-year total shareholder return sits at -18.7%, the longer-term five-year total return of 56.5% highlights the company’s resilience and ability to rebound when business momentum builds.

If this leadership shakeup has you curious about other promising opportunities, now is a great chance to broaden your search and discover fast growing stocks with high insider ownership

The question for investors now is whether FTI Consulting’s recent momentum and leadership shakeup signal a bargain in the stock, or if the anticipated growth is already reflected in the price.

Most Popular Narrative: 1.2% Undervalued

FTI Consulting is trading just a touch below the most popular fair value estimate of $166, with the last close at $164.03. The market appears finely balanced between optimism over recent initiatives and caution regarding growth sustainability, leading into a pivotal quote from this widely followed narrative.

Ongoing global regulatory complexity and heightened scrutiny in areas such as anti-money laundering, financial crime, and cybersecurity are driving sustained demand for FTI's Forensic & Litigation Consulting, Corporate Finance & Restructuring, and Strategic Communications practices. This is likely to expand the overall addressable market and support future revenue growth.

Want to know why analysts are so confident in this fair value? Underneath this number lie bold expectations for steady profit gains and a shrinking share count, all powered by a strategy that bets on global regulatory disruption. The full narrative reveals the precise forecasts and controversial assumptions shaping this razor-thin undervaluation.

Result: Fair Value of $166 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing advances in automation and unpredictable shifts in global regulations could challenge FTI Consulting’s growth assumptions and put pressure on future profit margins.

Find out about the key risks to this FTI Consulting narrative.

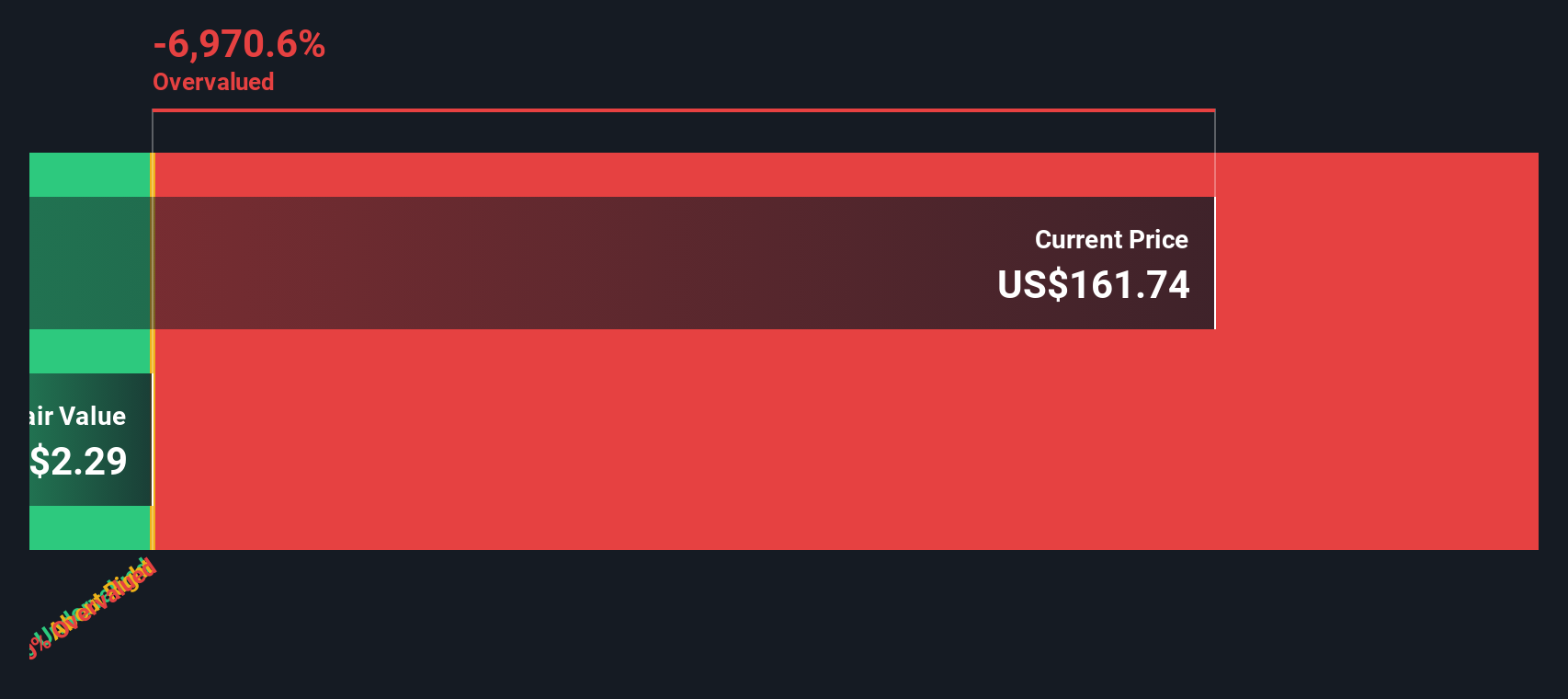

Another View: What Does the SWS DCF Model Say?

For a different angle on FTI Consulting's value, the SWS DCF model estimates fair value by projecting future cash flows and discounting them back to the present. Interestingly, this model suggests the stock may be trading above its fair value, raising questions about whether recent optimism is fully justified. Could this store of value be more brittle than it appears?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out FTI Consulting for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own FTI Consulting Narrative

If you want a different perspective or dig deeper on your own, you can assemble a personalized view of FTI Consulting in just a few minutes, and Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding FTI Consulting.

Looking for More Investment Ideas?

Elevate your strategy by searching beyond just a single stock. The right screen can uncover hidden gems or industries that might align with your investing style. There is opportunity waiting if you know where to look.

- Harvest market-leading yields by investigating companies with steady payouts through these 17 dividend stocks with yields > 3% and enhance your portfolio’s income potential.

- Tap into the companies powering a new healthcare revolution, where human ingenuity meets AI, by checking out these 30 healthcare AI stocks.

- Spot tomorrow’s breakthroughs in technology by assessing the innovators harnessing quantum computing via these 26 quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCN

FTI Consulting

Provides business advisory services to manage change, mitigate risk, and resolve disputes worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives