- United States

- /

- Commercial Services

- /

- NYSE:CXW

Why CoreCivic (CXW) Is Down 7.0% After Boosting Buybacks and Cutting Profit Guidance

Reviewed by Sasha Jovanovic

- Earlier this month, CoreCivic announced a US$200 million increase to its share buyback program, bringing total authorization to US$700 million, following recent third-quarter financial results and a downward revision of its full-year earnings guidance.

- This combination of an expanded buyback initiative and lowered profit outlook highlights how the company is balancing shareholder returns with evolving business performance.

- We’ll explore how CoreCivic’s decision to significantly boost its share repurchase program could reshape its investment narrative moving forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

CoreCivic Investment Narrative Recap

CoreCivic shareholders are often betting on the continued strength of government detention contracts and a supportive policy environment, with any new contract awards and high facility occupancy as key short-term catalysts. The latest buyback expansion does not materially shift near-term drivers, but it underscores management’s focus on capital returns as earnings guidance is reset, while persistent contract renewal risk remains the company’s biggest vulnerability. Among recent announcements, CoreCivic’s new long-term contract to operate the Diamondback Correctional Facility is especially relevant, as it highlights how contract wins support recurring revenue and help offset policy risk, the main factor influencing both upside and downside for the business. On the other hand, investors should be aware that any sudden policy change or government funding shift could quickly...

Read the full narrative on CoreCivic (it's free!)

CoreCivic's narrative projects $2.8 billion revenue and $252.2 million earnings by 2028. This requires 11.7% yearly revenue growth and a $148.2 million earnings increase from $104.0 million today.

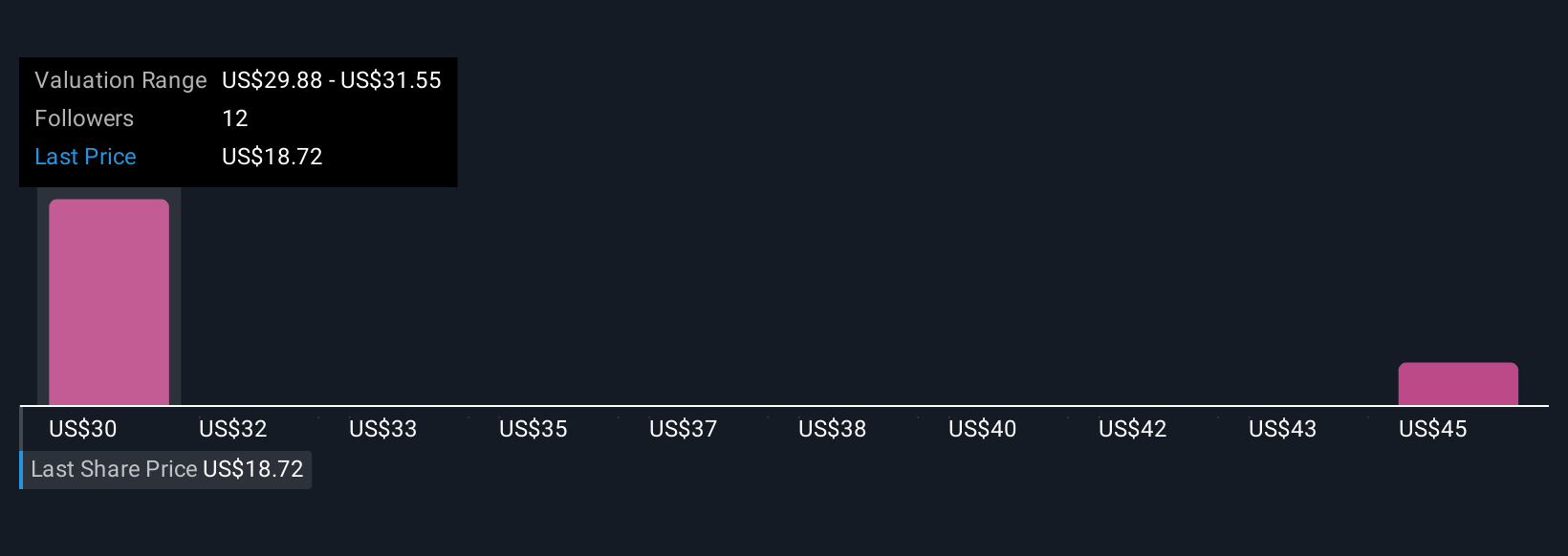

Uncover how CoreCivic's forecasts yield a $29.88 fair value, a 84% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members estimate CoreCivic's fair value from US$23.94 to US$29.88 per share. While government contract wins boost revenue and EPS, contract renewal risk still shapes the outlook for CoreCivic’s long-term performance and is crucial to consider when comparing these opinions.

Explore 3 other fair value estimates on CoreCivic - why the stock might be worth just $23.94!

Build Your Own CoreCivic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CoreCivic research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CoreCivic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CoreCivic's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CXW

CoreCivic

Owns and operates partnership correctional, detention, and residential reentry facilities in the United States.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives