- United States

- /

- Commercial Services

- /

- NYSE:CXW

How Investors May Respond To CoreCivic (CXW) Q3 Earnings With Anticipated Double-Digit Revenue Growth

Reviewed by Sasha Jovanovic

- CoreCivic is set to report its Q3 earnings after the market close on Wednesday, with analysts forecasting 10.1% year-on-year revenue growth for the quarter.

- The company’s consistent record of surpassing revenue expectations since going public draws particular focus to this upcoming announcement.

- With investor attention heightened by CoreCivic’s history of outperforming revenue forecasts, we will examine how this impacts the company’s investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

CoreCivic Investment Narrative Recap

To be a shareholder in CoreCivic, you need confidence in continued strong federal funding for detention services and a belief that government policy will sustain or grow the demand for private correctional capacity. While the company’s upcoming earnings call will remain a key short-term catalyst, particularly given its record of beating estimates, the result itself is not expected to materially shift the underlying risks, especially exposure to government contract renewals and policy changes, which remain the biggest uncertainties. The most relevant recent announcement is CoreCivic’s new five-year contract with ICE to reactivate the 2,160-bed Diamondback Correctional Facility, estimated at around US$100 million annually from Q2 2026. This speaks directly to the company’s core revenue growth catalysts: securing large, long-term federal contracts that increase facility utilization and recurring income, reinforcing near-term visibility but still subject to evolving policy priorities and potential legal or regulatory headwinds. In contrast, the biggest risk for investors to watch remains the concentration of revenues from a handful of federal agencies...

Read the full narrative on CoreCivic (it's free!)

CoreCivic's narrative projects $2.8 billion in revenue and $252.2 million in earnings by 2028. This requires 11.7% yearly revenue growth and a $148.2 million increase in earnings from the current $104.0 million.

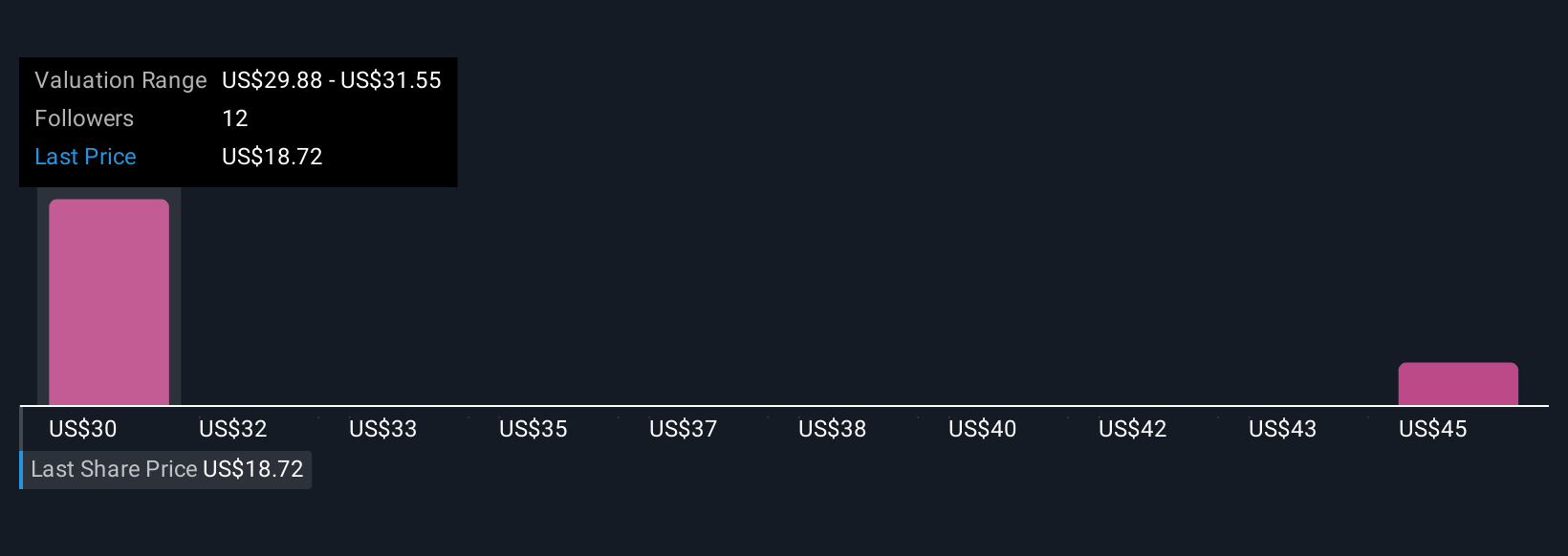

Uncover how CoreCivic's forecasts yield a $29.88 fair value, a 58% upside to its current price.

Exploring Other Perspectives

Fair value estimates from three Simply Wall St Community members range from US$29.88 to US$47.11 per share. Many contributors highlight the company’s reliance on federal contracts, reminding you to consider broader policy changes when forming your own view.

Explore 3 other fair value estimates on CoreCivic - why the stock might be worth over 2x more than the current price!

Build Your Own CoreCivic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CoreCivic research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CoreCivic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CoreCivic's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CXW

CoreCivic

Owns and operates partnership correctional, detention, and residential reentry facilities in the United States.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives