- United States

- /

- Commercial Services

- /

- NYSE:CLH

Does New Analyst Coverage and Strong Q3 Results Shift the Narrative for Clean Harbors (CLH)?

Reviewed by Sasha Jovanovic

- In the past week, Clean Harbors received new analyst coverage and ratings updates from Wells Fargo, Barclays, and TD Cowen, alongside reporting higher quarterly revenue and net profit for the period ended September 30.

- This convergence of fresh analyst attention and improved financial results has drawn considerable investor interest to the company's current momentum and outlook.

- We'll explore how the recent analyst coverage initiation highlights Clean Harbors' business performance and shapes its investment narrative moving forward.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Clean Harbors Investment Narrative Recap

To be a shareholder in Clean Harbors, you need to believe that regulatory complexity and industrial expansion will keep hazardous waste management in demand, with the company's end-to-end PFAS destruction capabilities offering long-term potential. The latest analyst coverage and improved Q3 financials haven’t meaningfully shifted near-term catalysts or changed the largest risk, which remains the possibility that accelerating zero-waste initiatives and new technologies could reduce volumes processed through traditional channels.

Among recent developments, the October PFAS destruction study announcement is especially relevant. It validates Clean Harbors’ high-temperature incineration technology with EPA standards, reinforcing its position as a unique provider capable of addressing tightening federal and corporate hazardous waste rules, a key catalyst alongside expanding industrial and regulatory needs.

By contrast, investors should remain conscious of how rapid advancements in alternative waste processes could threaten the core business if...

Read the full narrative on Clean Harbors (it's free!)

Clean Harbors' narrative projects $7.0 billion revenue and $605.1 million earnings by 2028. This requires 5.7% yearly revenue growth and a $220.3 million increase in earnings from $384.8 million today.

Uncover how Clean Harbors' forecasts yield a $255.60 fair value, a 24% upside to its current price.

Exploring Other Perspectives

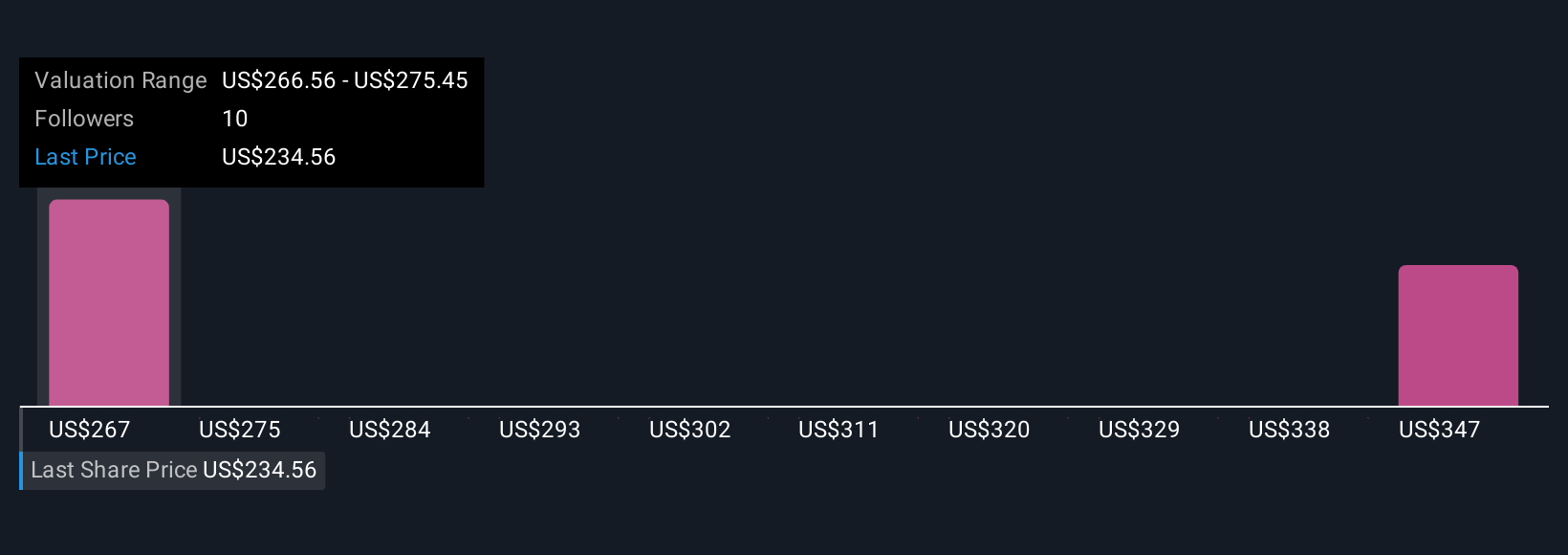

Simply Wall St Community members submitted two fair value estimates for Clean Harbors, ranging from US$255.60 to US$310.99. While opinions vary, the risk that evolving waste management technology could disrupt demand for core disposal services is a central issue and worth closer study. Explore the range of community viewpoints here.

Explore 2 other fair value estimates on Clean Harbors - why the stock might be worth as much as 51% more than the current price!

Build Your Own Clean Harbors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clean Harbors research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Clean Harbors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clean Harbors' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLH

Clean Harbors

Provides environmental and industrial services in the United States and Canada.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives