- United States

- /

- Commercial Services

- /

- NYSE:CLH

Clean Harbors (CLH): Revisiting Valuation After a 10% Monthly Share Price Gain

Reviewed by Simply Wall St

Clean Harbors (CLH) has quietly outperformed many industrial names this month, with the stock up about 10% while remaining nearly flat over the past 3 months, drawing fresh attention to its environmental services franchise.

See our latest analysis for Clean Harbors.

At around $239 per share, Clean Harbors has seen a solid 10.1% 30 day share price return. Its 3 year total shareholder return of about 108% shows momentum has been building rather than fading.

If Clean Harbors solid run has you thinking about what else might be gaining traction, it could be a good time to explore fast growing stocks with high insider ownership.

With shares trading just below analyst targets yet still at a roughly 25% discount to estimated intrinsic value, investors face a key question: is Clean Harbors still undervalued or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 4.4% Undervalued

Clean Harbors last closed at $239, slightly below the most popular narrative fair value of about $250, setting up a modest valuation gap for investors to unpack.

The analysts have a consensus price target of $266.556 for Clean Harbors based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $305.0, and the most bearish reporting a price target of just $240.0.

Want to see what keeps this story bullish despite trimmed growth assumptions and a richer future earnings multiple than the sector? The narrative leans heavily on steadily rising margins, disciplined buybacks, and a step change in long term earnings power. Curious which cash flow and profitability paths have to play out to make that fair value stick?

Result: Fair Value of $250.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, faster adoption of zero waste manufacturing and tougher permitting for new incineration capacity could cap volumes and squeeze Clean Harbors long term margin expansion.

Find out about the key risks to this Clean Harbors narrative.

Another Way to Look at Value

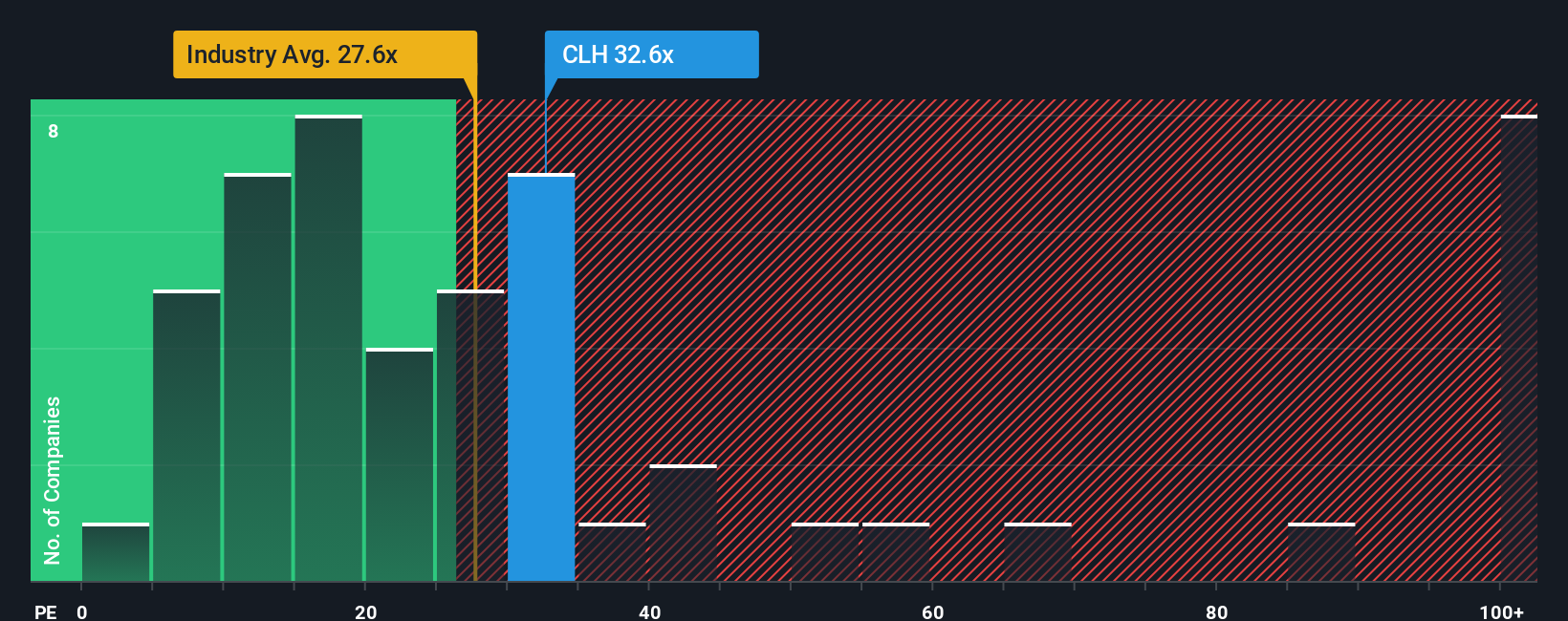

On ratios, the picture is less comfortable. Clean Harbors trades at about 32.9 times earnings versus a fair ratio of 26.1 times and an industry average near 22.9 times. This suggests investors are already paying up for growth. Is that premium a potential reward in waiting or a source of downside risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Clean Harbors Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Clean Harbors research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider using the Simply Wall St screener to uncover focused, data driven stock ideas tailored to your strategy.

- Explore income potential from resilient businesses by scanning these 10 dividend stocks with yields > 3% that offer attractive yields supported by their financials.

- Target the next wave of innovation by reviewing these 24 AI penny stocks that combine growth narratives with observable business traction.

- Strengthen your watchlist with these 901 undervalued stocks based on cash flows that appear to trade below their cash flow potential, ahead of wider market recognition.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLH

Clean Harbors

Provides environmental and industrial services in the United States and Canada.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion