- United States

- /

- Commercial Services

- /

- NYSE:CLH

Clean Harbors (CLH): Examining Valuation as Investors Brace for Q3 Earnings and Lowered Forecasts

Reviewed by Simply Wall St

Clean Harbors (CLH) is facing heightened attention this week as investors gear up for its third quarter earnings release. The mood is more measured because the company fell short of expectations last quarter, and estimates have been trimmed over the past month.

See our latest analysis for Clean Harbors.

Shares of Clean Harbors have edged higher in the lead-up to this week's earnings, with a 6.1% one-month share price return suggesting cautious optimism after last quarter’s disappointment. That said, the one-year total shareholder return stands at -6.5%, reminding investors that momentum, while improving recently, is still lagging the standout multi-year gains the stock has delivered.

If you’re curious where other stocks with steady momentum and insider confidence might be heading, broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares rebounding but estimates lowered, investors face a key question: does Clean Harbors’ subdued outlook mean the stock is attractively undervalued, or is the market already factoring in any future growth potential?

Most Popular Narrative: 7.6% Undervalued

Clean Harbors is trading below the most widely followed narrative’s fair value estimate, with the last close several percentage points under that price. This creates a compelling argument about where future growth and market changes could take the stock.

The growing urgency and evolving regulatory landscape around PFAS and hazardous waste management is expected to create a multibillion-dollar opportunity. Clean Harbors' unique position as the only company with end-to-end PFAS destruction capabilities positions it to capture significant long-term revenue and margin growth as new government and corporate standards take effect.

What’s driving that higher valuation target? The growth story hinges on advanced technology, market expansion, and a strategic bet on sustainability trends. Curious how much profit upside the narrative factors in and why analysts are eager about future margins? The numbers behind this fair value might surprise you.

Result: Fair Value of $266.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if zero-waste initiatives accelerate or green manufacturing makes rapid advances, Clean Harbors’ market could shrink and these bullish expectations could be challenged.

Find out about the key risks to this Clean Harbors narrative.

Another View: Looking Through the Lens of Earnings Ratios

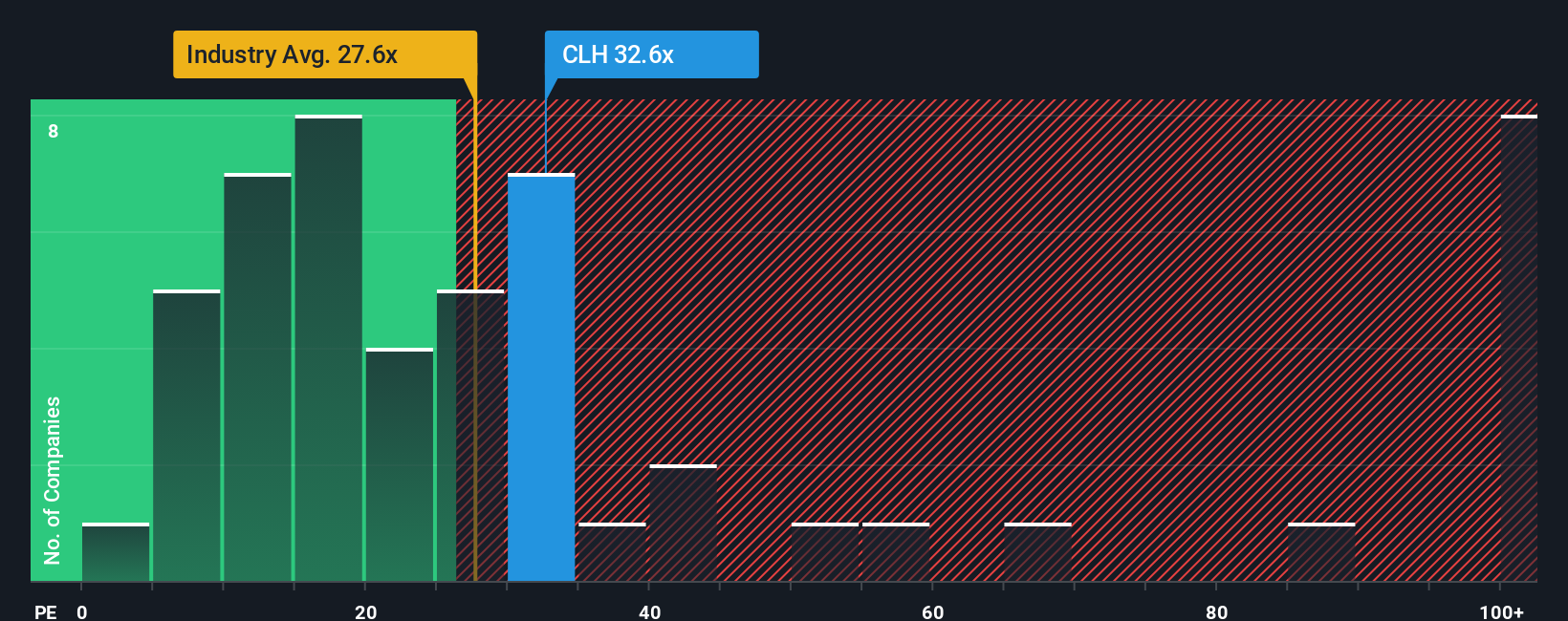

While Clean Harbors appears undervalued at a glance, its price-to-earnings ratio tells a different story. At 34.3x, it is priced higher than both the US Commercial Services industry average of 26.7x and its own fair ratio of 28.2x. This suggests investors are paying a premium and may be accepting more valuation risk if growth falls short. Does this premium indicate untapped upside or point to limited room for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Clean Harbors Narrative

If you want to dig deeper and make sense of the data yourself, you can shape a personalized perspective in just a few minutes. Do it your way.

A great starting point for your Clean Harbors research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expand your strategy and get ahead of the curve by pinpointing companies already grabbing the spotlight in emerging fields and strong dividend sectors. Don’t wait for tomorrow’s winners; find them now.

- Uncover high-potential returns by sifting through these 3575 penny stocks with strong financials with resilient financials and proven growth stories.

- Capture possibilities in the booming world of artificial intelligence by starting your research with these 26 AI penny stocks reshaping tomorrow’s tech landscape.

- Maximize income potential with these 21 dividend stocks with yields > 3% delivering steady yields above 3% for long-term portfolio strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLH

Clean Harbors

Provides environmental and industrial services in the United States and Canada.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives