- United States

- /

- Professional Services

- /

- NYSE:CBZ

CBIZ's New AI Platform Launch Might Change The Case For Investing In CBIZ (CBZ)

Reviewed by Simply Wall St

- Earlier this month, CBIZ, Inc. announced the launch of Vertical Vector AI, an artificial intelligence platform designed to help middle-market businesses enhance productivity and decision-making through seamless integration with Microsoft infrastructure and proprietary datasets.

- This move underscores CBIZ's focus on digital innovation and its aim to distinguish itself in the professional services sector with AI-powered solutions tailored for secure, industry-specific applications.

- We'll explore how the Vertical Vector AI launch strengthens CBIZ's digital transformation efforts and could impact its growth narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

CBIZ Investment Narrative Recap

For CBIZ shareholders, the essential premise is that the company can differentiate itself in professional services by driving digital innovation, leveraging acquisitions, and expanding recurring revenue streams. The recent launch of Vertical Vector AI plays into one of the most important short-term catalysts: continued investment in technology and workflow automation to offset pricing pressure and evolving client demands. Its direct impact on near-term financials may not be material yet, but it signals commitment to the long-term margin story, while the risk of slower normalization in rate increases remains front of mind.

Among recent announcements, the July 2025 debut of CBIZ D@taNEXUS is particularly relevant: both D@taNEXUS and Vertical Vector AI address the same imperative of equipping clients with actionable insights and efficiency through technology. These innovations align closely with the company’s stated catalysts, particularly efforts to scale digital transformation and improve client retention against heightened industry competition.

But in contrast to these growth initiatives, investors should be aware that pricing pressure remains a risk that could...

Read the full narrative on CBIZ (it's free!)

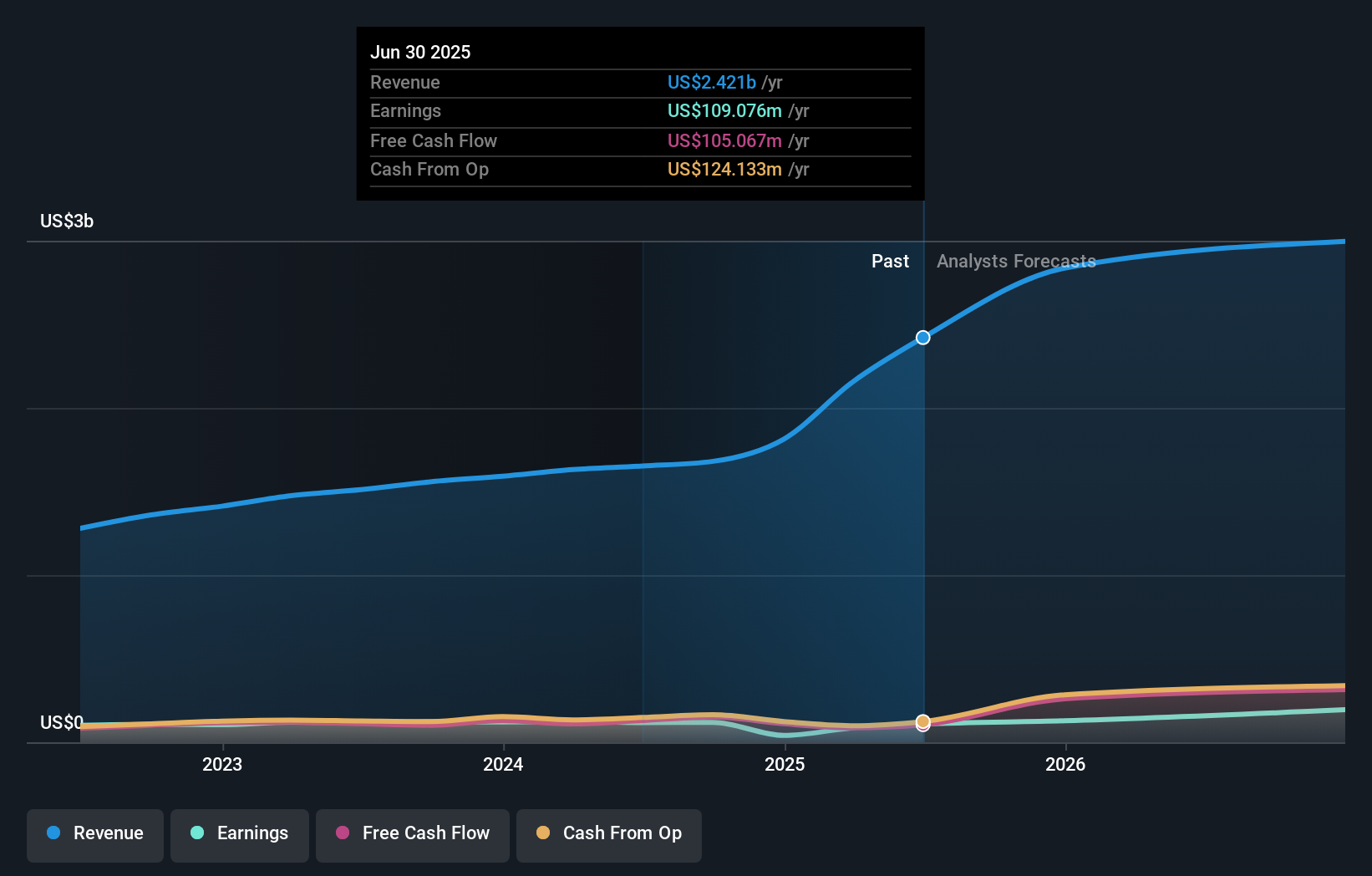

CBIZ's narrative projects $3.3 billion revenue and $257.7 million earnings by 2028. This requires 10.9% yearly revenue growth and a $148.6 million earnings increase from $109.1 million today.

Uncover how CBIZ's forecasts yield a $95.00 fair value, a 77% upside to its current price.

Exploring Other Perspectives

You’ll find two Community-generated fair values for CBIZ, ranging from US$95 to US$223.90. While some expect technology investment to drive sustainable growth, others see ongoing pricing pressure as a significant challenge for long-term earnings.

Explore 2 other fair value estimates on CBIZ - why the stock might be worth just $95.00!

Build Your Own CBIZ Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CBIZ research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free CBIZ research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CBIZ's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 30 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBZ

CBIZ

Provides financial, insurance, and advisory services in the United States and Canada.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives