- United States

- /

- Professional Services

- /

- NYSE:BR

Broadridge Financial Solutions (BR): Evaluating Valuation Following Major Digital Partnership and Blockchain Milestone

Reviewed by Simply Wall St

Broadridge Financial Solutions (BR) is making headlines after announcing a strategic partnership with Xceptor to create a fully integrated digital tax automation platform for financial firms. In a separate move, Broadridge enabled Societe Generale’s first digital bond issuance using its blockchain solution, putting technology innovation at the forefront.

See our latest analysis for Broadridge Financial Solutions.

Broadridge’s latest innovations seem to be sparking renewed interest, with the company’s 1-month share price return at 3.5% and a steadier 3-year total shareholder return of 65%. While momentum dipped earlier in the quarter, recent partnerships reflect a forward-looking strategy that is catching the eye of long-term investors and helping support the share price near all-time highs.

If transformational fintech trends like these resonate with you, now is the perfect moment to discover fast growing stocks with high insider ownership

With shares trading near all-time highs and new partnerships fueling optimism, the key question remains: is Broadridge still undervalued given its intrinsic growth drivers, or has the stock already accounted for its future potential?

Most Popular Narrative: 15% Undervalued

With Broadridge Financial Solutions' fair value pointed at $269 and the last close at $228, the most widely followed narrative currently signals notable upside. The key drivers behind this view stem from both digital platform momentum and the draw of higher-quality, recurring revenue streams, setting a clear context for future valuation.

The continued shift toward digitization of financial services, evidenced by Broadridge's growing double-digit digital revenue and rapid increases in digitization rates for regulatory communications (now above 90% for equity proxies), positions the company to benefit from rising demand for digital investor communications and lower-cost delivery. This supports long-term recurring revenue growth and future margin expansion.

Curious about the formula powering this optimistic outlook? The narrative’s bold valuation is built on projections that only the most bullish would dare to model, spanning future revenue streams, improving margins, and ambitious earnings growth. Want the specifics that analysts are betting on? Tap into the full narrative and see how all these pieces shape the story.

Result: Fair Value of $269 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, event-driven revenues returning to historical levels and longer sales cycles in key segments may challenge Broadridge's growth narrative in the near term.

Find out about the key risks to this Broadridge Financial Solutions narrative.

Another View: What Do Price Multiples Say?

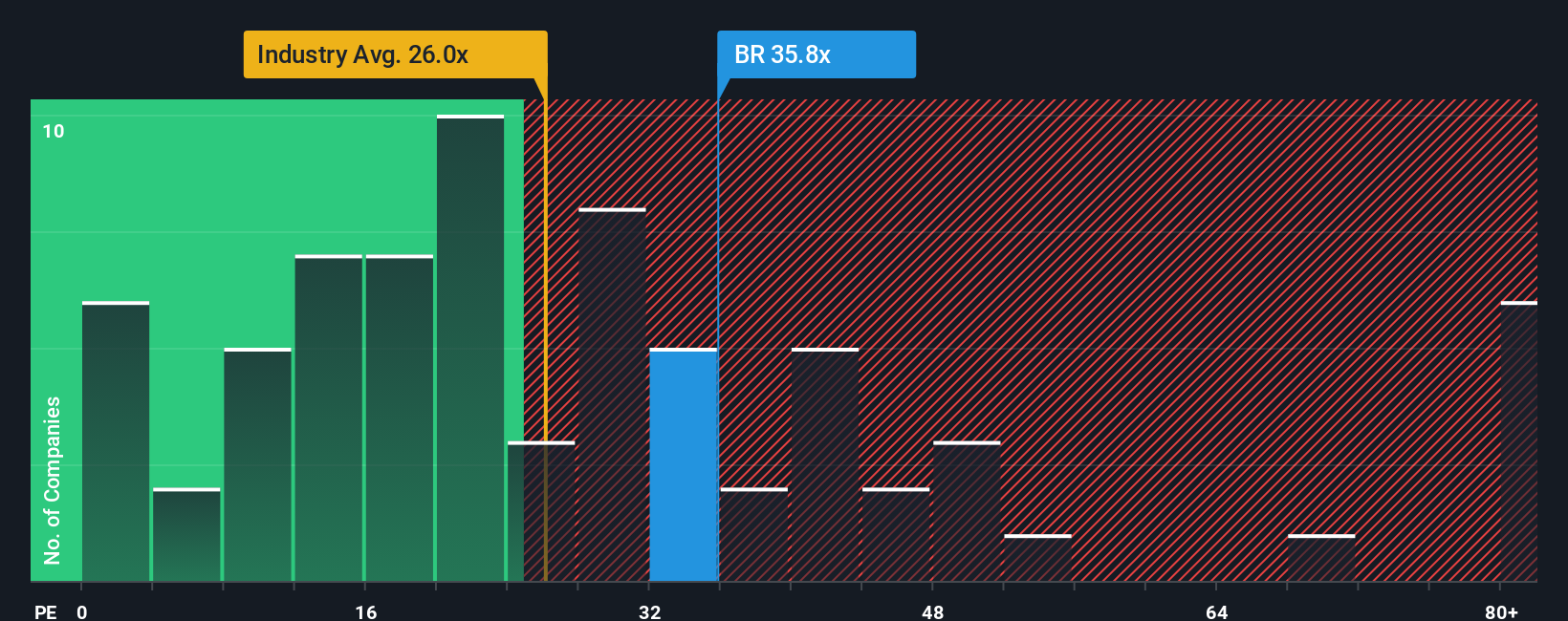

Looking through the lens of the price-to-earnings ratio, Broadridge appears less attractive. Its P/E of 28.8x is notably higher than the US Professional Services average of 24.3x, the peer group at 19.8x, and even the fair ratio of 27.9x. That gap may signal valuation risk if expectations do not keep rising. Could market enthusiasm be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Broadridge Financial Solutions Narrative

If you’re more inclined to dig into the numbers yourself or have a different angle in mind, you can shape your own perspective in just a few minutes. Do it your way

A great starting point for your Broadridge Financial Solutions research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that the biggest opportunities often show up where few are looking. Don’t miss your chance to catch the next wave. Take a look at these powerful stock themes today.

- Tap growth stories early by checking out these 3560 penny stocks with strong financials bringing strong financials and disruptive potential to the market.

- Secure your financial future with steady returns from these 15 dividend stocks with yields > 3% offering yields above 3% for income-focused portfolios.

- Ride the innovation boom by tracking these 25 AI penny stocks redefining entire industries through artificial intelligence breakthroughs and real-world applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadridge Financial Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BR

Broadridge Financial Solutions

Provides investor communications and technology-driven solutions for the financial services industry in the United States and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026