- United States

- /

- Professional Services

- /

- NYSE:BR

Broadridge Financial Solutions (BR): Evaluating Valuation After New Growth Strategy, 2026 Guidance, and Dividend Backing

Reviewed by Simply Wall St

Broadridge Financial Solutions (BR) caught investor attention this week as the company shared results from its latest investor presentation, reaffirmed fiscal 2026 guidance, and announced a continued quarterly cash dividend. Ongoing leadership moves also highlight its ambitions abroad.

See our latest analysis for Broadridge Financial Solutions.

Broadridge’s recent executive appointment, strong quarterly results, and ongoing buybacks have kept the spotlight on the company; however, the share price momentum has cooled, drifting down 13% over the past three months while eking out a small gain in total shareholder return over the last year. Over longer horizons, Broadridge’s compounding effect becomes obvious, with three- and five-year total shareholder returns of 64% and 69% still setting the company apart from many peers.

If recent boardroom moves and buybacks have you rethinking your watchlist, now is an excellent time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a noticeable discount to analyst targets and strong growth guidance in place, is Broadridge offering investors an undervalued entry point, or is all of that future potential already reflected in the price?

Most Popular Narrative: 18.1% Undervalued

Broadridge’s most closely followed narrative suggests the stock trades considerably below its fair value, with $276.13 calculated as fair versus the last close at $226.06. This sets the stage for an investment story shaped by growth in recurring, high-margin business streams and product innovation.

The continued shift toward digitization of financial services, evidenced by Broadridge's growing double-digit digital revenue and rapid increases in digitization rates for regulatory communications (now over 90% for equity proxies), positions the company to benefit from rising demand for digital investor communications and lower-cost delivery. This supports long-term recurring revenue growth and future margin expansion.

What’s fueling this bold fair value? The narrative is built around a surprisingly robust outlook for top-line growth, margin expansion, and a future profit multiple that rivals the most sought-after industry leaders. Want to know which forecasted leaps and hidden drivers form the backbone of this valuation? Dive into the full narrative for the full picture.

Result: Fair Value of $276.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting market preferences or a slowdown in event-driven revenues could quickly challenge the optimistic outlook and affect near term growth expectations.

Find out about the key risks to this Broadridge Financial Solutions narrative.

Another View: Is the Market Multiple Telling a Different Story?

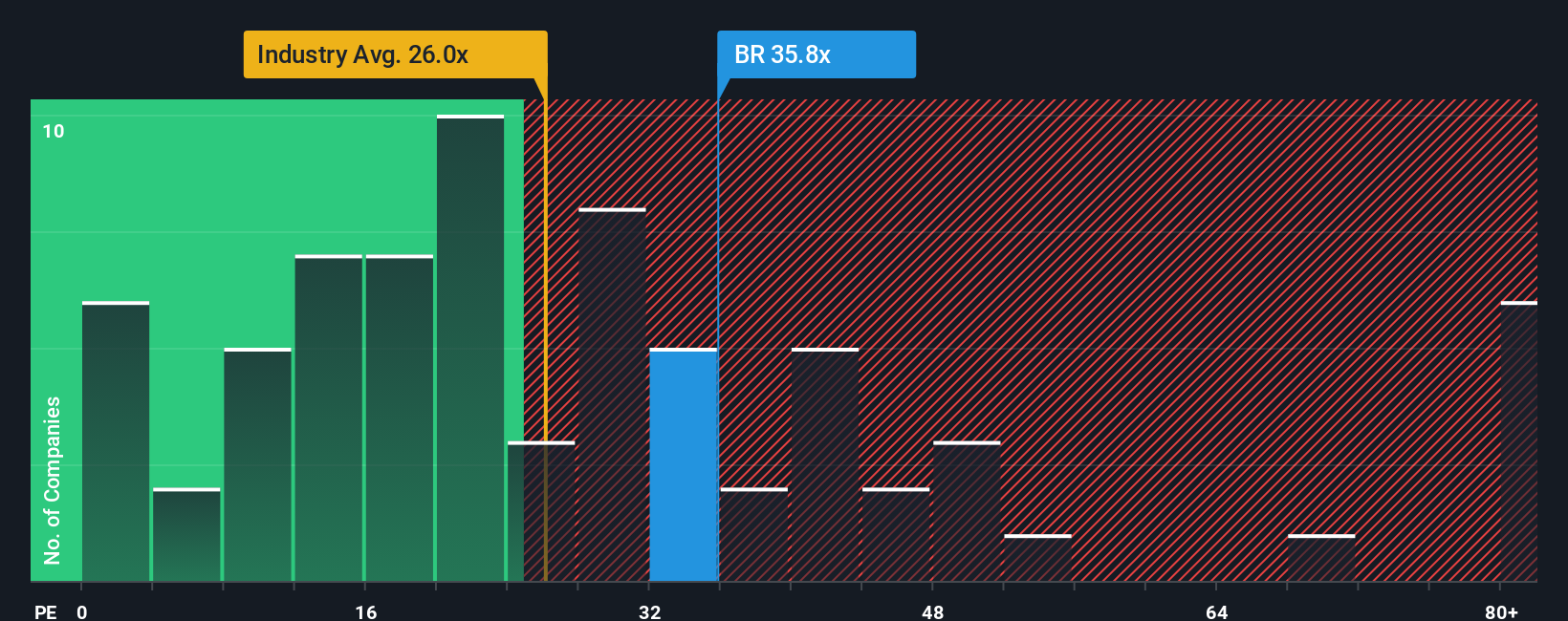

Looking at Broadridge's pricing through the lens of the price-to-earnings ratio, the shares seem less of a bargain. Trading at 28.5x earnings, Broadridge stands above both the industry average of 24x and its peers at 19.6x. It also sits above its fair ratio of 26.4x. This gap means investors may be paying up for growth, with limited margin for error if expectations falter.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Broadridge Financial Solutions Narrative

If you have your own perspective on Broadridge or want to see how the numbers align with your personal investment outlook, you can craft your own full narrative in just a few minutes. Do it your way

A great starting point for your Broadridge Financial Solutions research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means staying a step ahead. Don’t miss the chance to find stocks flying under the radar, delivering reliable dividends, or powering the future with AI.

- Spot fresh opportunities by checking out these 879 undervalued stocks based on cash flows and discovering stocks trading well below their true worth.

- Grow your passive income by tapping into these 16 dividend stocks with yields > 3% for attractive yields over 3% and a robust income stream.

- Get in early with next-generation innovators through these 25 AI penny stocks as they transform industries with artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadridge Financial Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BR

Broadridge Financial Solutions

Provides investor communications and technology-driven solutions for the financial services industry in the United States and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives