- United States

- /

- Professional Services

- /

- NYSE:BKSY

BlackSky Technology (NYSE:BKSY) shareholders are up 10% this past week, but still in the red over the last five years

It is doubtless a positive to see that the BlackSky Technology Inc. (NYSE:BKSY) share price has gained some 116% in the last three months. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Like a ship taking on water, the share price has sunk 84% in that time. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The important question is if the business itself justifies a higher share price in the long term. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

The recent uptick of 10% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for BlackSky Technology

BlackSky Technology isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, BlackSky Technology saw its revenue increase by 39% per year. That's better than most loss-making companies. So on the face of it we're really surprised to see the share price has averaged a fall of 13% each year, in the same time period. It could be that the stock was over-hyped before. We'd recommend carefully checking for indications of future growth - and balance sheet threats - before considering a purchase.

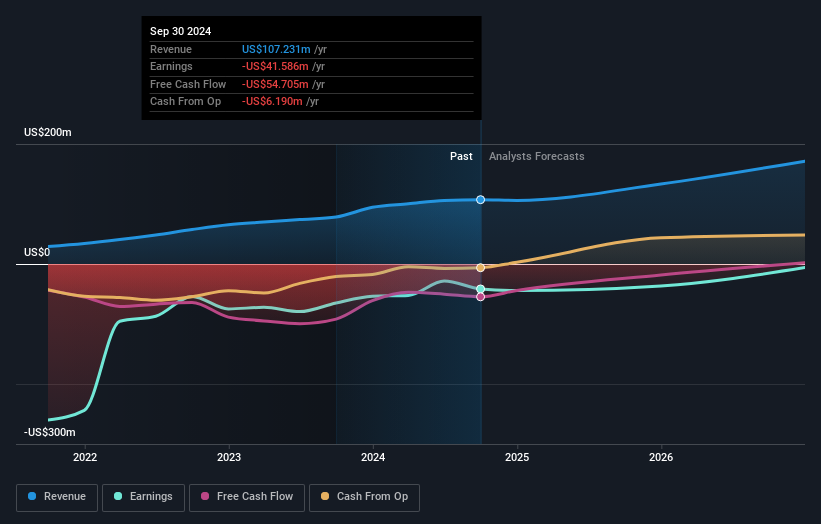

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling BlackSky Technology stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

BlackSky Technology shareholders are up 19% for the year. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 13% per year, over five years. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand BlackSky Technology better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with BlackSky Technology (including 1 which is potentially serious) .

But note: BlackSky Technology may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if BlackSky Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BKSY

BlackSky Technology

Operates as a space-based intelligence company in North America, the Middle East, the Asia Pacific, and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success