- United States

- /

- Professional Services

- /

- NYSE:BKSY

BlackSky Technology (BKSY): Valuation in Focus After $30M Defense Contract Win

Reviewed by Simply Wall St

BlackSky Technology (BKSY) just landed a multi-year contract worth over $30 million to deliver its Gen-3 tactical ISR services to a strategic international defense customer. This move highlights the company’s growing position in the defense intelligence market.

See our latest analysis for BlackSky Technology.

BlackSky’s shares have been volatile, with the recent $30 million contract announcement offering a bright spot amid pressure from slowing revenue growth and widening losses reported last week. After a strong year-to-date share price return of 27.41%, momentum has reversed lately, highlighted by a sharp 54.34% drop in the past month. Long-term total shareholder return sits higher at 55.66% over the last year.

If contract wins and shifting momentum have you rethinking your watchlist, now is a great opportunity to spot fresh defense and aerospace names with See the full list for free.

This recent contract has reignited debate around BlackSky’s potential valuation. Is the stock now set for a turnaround with further upside on offer, or could the market already be factoring in its future growth prospects?

Most Popular Narrative: 50.1% Undervalued

Compared to the last close at $13.62, the most widely followed narrative puts BlackSky Technology's fair value at a much higher $27.29 per share. The spread between market price and narrative estimate turns heads, especially as fresh contract news circulates.

The ramp-up of the Gen-3 satellite constellation, coupled with demonstrated high performance and lower costs, is creating strong demand and contract expansion (especially once general availability launches in Q4). This is likely to drive a step-function increase in recurring imagery and analytics revenues in 2025 and beyond.

Is this pricing justified by BlackSky’s ambitious revenue projections, climbing margins, and bold plans for recurring sales growth? There is more behind this fair value than meets the eye. Find out which head-turning assumptions power such a high price target before everyone else does.

Result: Fair Value of $27.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent revenue volatility and growing dependence on international contracts could quickly undermine the optimistic outlook that is driving current valuations.

Find out about the key risks to this BlackSky Technology narrative.

Another View: Valuation by Revenue Multiples

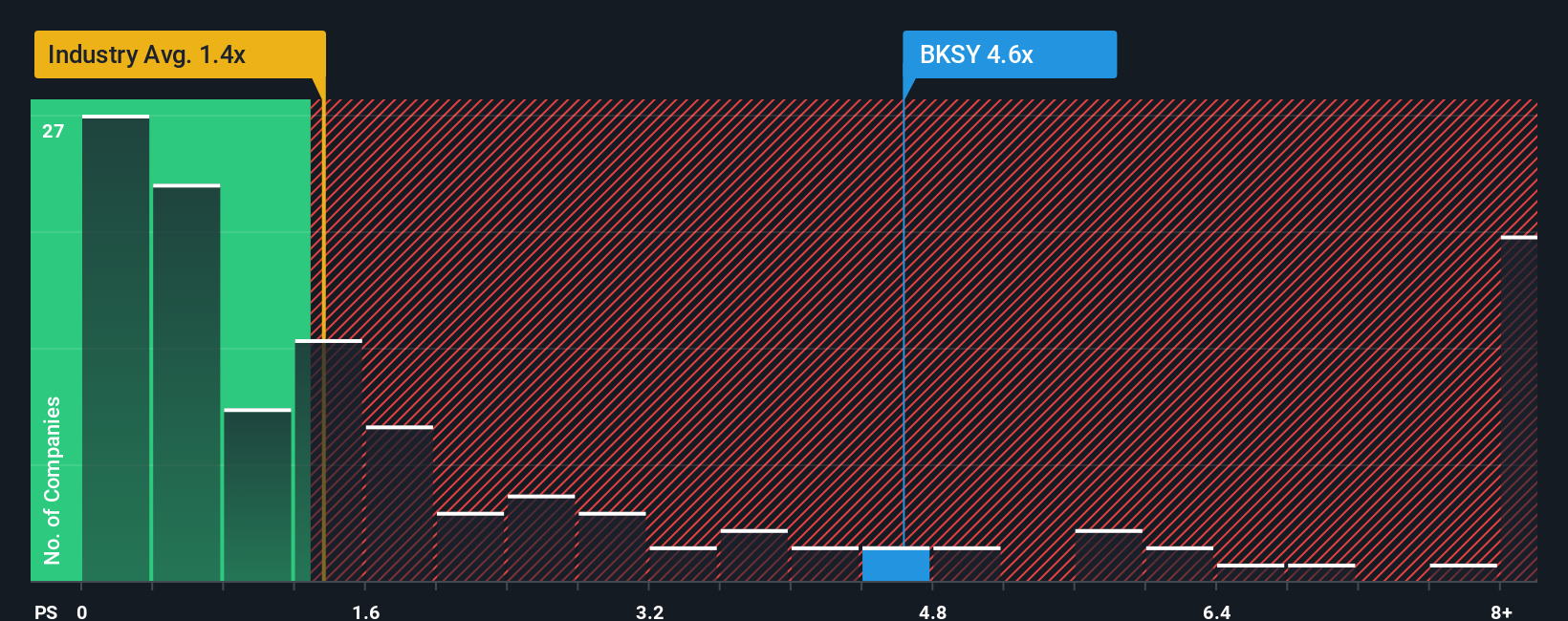

Looking beyond fair value narratives, the market puts a premium on BlackSky Technology's revenue, trading at a Price-to-Sales ratio of 4.8x. This is well above the US Professional Services industry average of 1.4x, the peer average of 1.7x, and the fair ratio of 3.2x. When a company trades far above these benchmarks, it often signals investor excitement about growth potential. However, it also creates valuation risk if expectations are not met. Will BlackSky's fundamentals justify these elevated multiples, or could sentiment shift quickly?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BlackSky Technology Narrative

Not convinced by the consensus or eager to dive into the numbers firsthand? You can piece together your own perspective in minutes: Do it your way

A great starting point for your BlackSky Technology research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. Make your next smart move by checking out standout stocks in booming sectors using Simply Wall Street’s powerful screener.

- Tap into future medical breakthroughs by evaluating leaders in AI-powered healthcare through these 31 healthcare AI stocks.

- Capture strong cash-flow potential when you target these 870 undervalued stocks based on cash flows before the rest of the market catches on.

- Unlock steady income streams by focusing on these 15 dividend stocks with yields > 3%, which delivers yields above 3% for income-driven portfolios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackSky Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKSY

BlackSky Technology

Operates as a space-based intelligence company in North America, the Middle East, the Asia Pacific, and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives