- United States

- /

- Professional Services

- /

- NYSE:BAH

Why Booz Allen Hamilton (BAH) Is Down 6.8% After Cutting Guidance Amid Civil Contracting Slowdown

Reviewed by Sasha Jovanovic

- Booz Allen Hamilton Holding Corporation recently reported its fiscal second-quarter earnings, revealing a drop in revenue to US$2.89 billion and net income of US$175 million, both lower than the same period last year, and cut its full-year revenue and earnings guidance due to a significant slowdown in government contract funding for its civil business.

- Despite this, the company is ramping up cost reduction efforts and expanding its share buyback authorization by US$500 million to support financial flexibility amid ongoing operational challenges.

- With management citing a particularly difficult environment for government contracting in the civil sector, we’ll now assess how these headwinds affect Booz Allen Hamilton’s investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Booz Allen Hamilton Holding Investment Narrative Recap

Owning Booz Allen Hamilton Holding means believing in the company’s ability to drive long-term value from federal priorities in AI, cybersecurity and national security, despite sustained funding volatility in its civil sector. The latest earnings miss and cut in guidance directly impacts the short-term outlook, heightening concerns about the timing and stability of government contracts, which is now the biggest risk facing the business; investor optimism likely now hinges on a near-term rebound in government procurement activity.

Of Booz Allen’s recent announcements, the US$500 million expansion of its share repurchase program stands out against the earnings update. While this action provides flexibility and may offer some support to shareholders in challenging conditions, its significance is closely tied to management’s confidence in the company’s ability to generate sufficient cash amid contract uncertainty.

However, behind these strategic moves, investors should also be aware that...

Read the full narrative on Booz Allen Hamilton Holding (it's free!)

Booz Allen Hamilton Holding's outlook anticipates $13.5 billion in revenue and $775.2 million in earnings by 2028. This scenario assumes annual revenue growth of 4.1% and a decrease in earnings of $224.8 million from the current $1.0 billion.

Uncover how Booz Allen Hamilton Holding's forecasts yield a $124.20 fair value, a 36% upside to its current price.

Exploring Other Perspectives

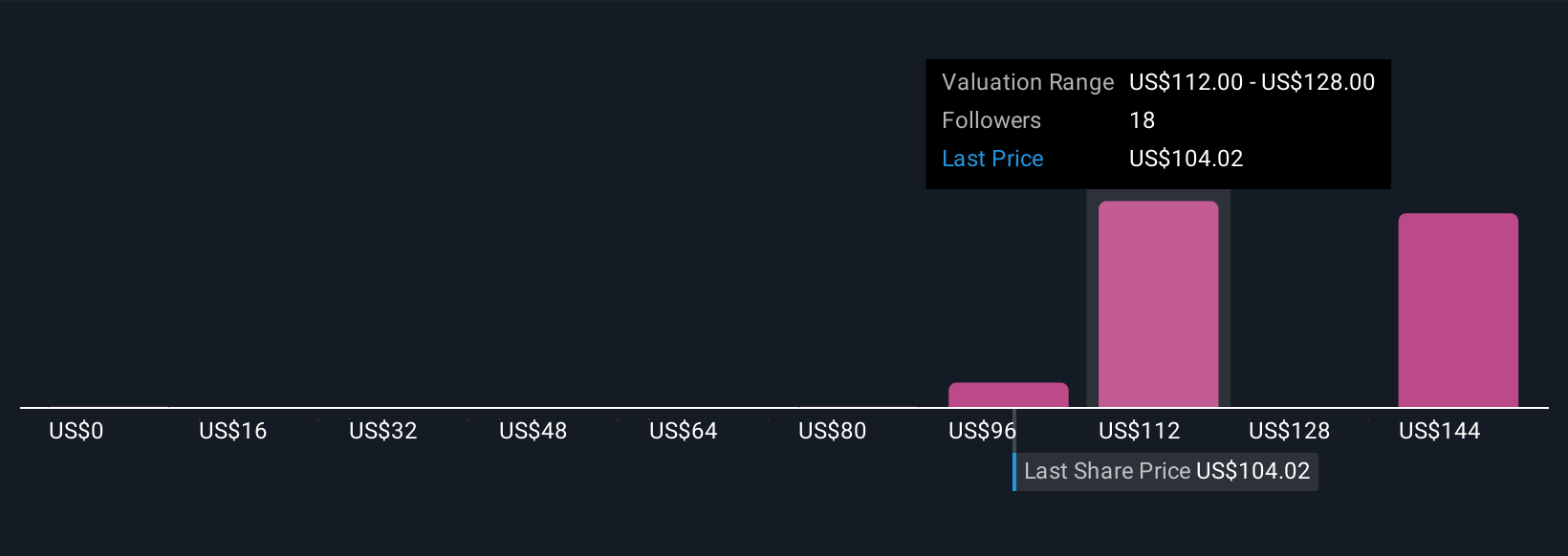

Simply Wall St Community valuations for Booz Allen Hamilton range widely from US$17.75 to US$177.49, with 9 unique perspectives. Persistent government contract funding delays remain a central factor shaping sentiment and potential performance outcomes.

Explore 9 other fair value estimates on Booz Allen Hamilton Holding - why the stock might be worth as much as 94% more than the current price!

Build Your Own Booz Allen Hamilton Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Booz Allen Hamilton Holding research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Booz Allen Hamilton Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Booz Allen Hamilton Holding's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Booz Allen Hamilton Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAH

Booz Allen Hamilton Holding

A technology company, provides technology solutions using artificial intelligence, cyber, and other technologies for government’s cabinet-level departments and commercial customers in the United States and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives