- United States

- /

- Professional Services

- /

- NYSE:BAH

Booz Allen Hamilton (BAH): Margin Expansion Challenges Cautious Growth Narratives After 71% Earnings Surge

Reviewed by Simply Wall St

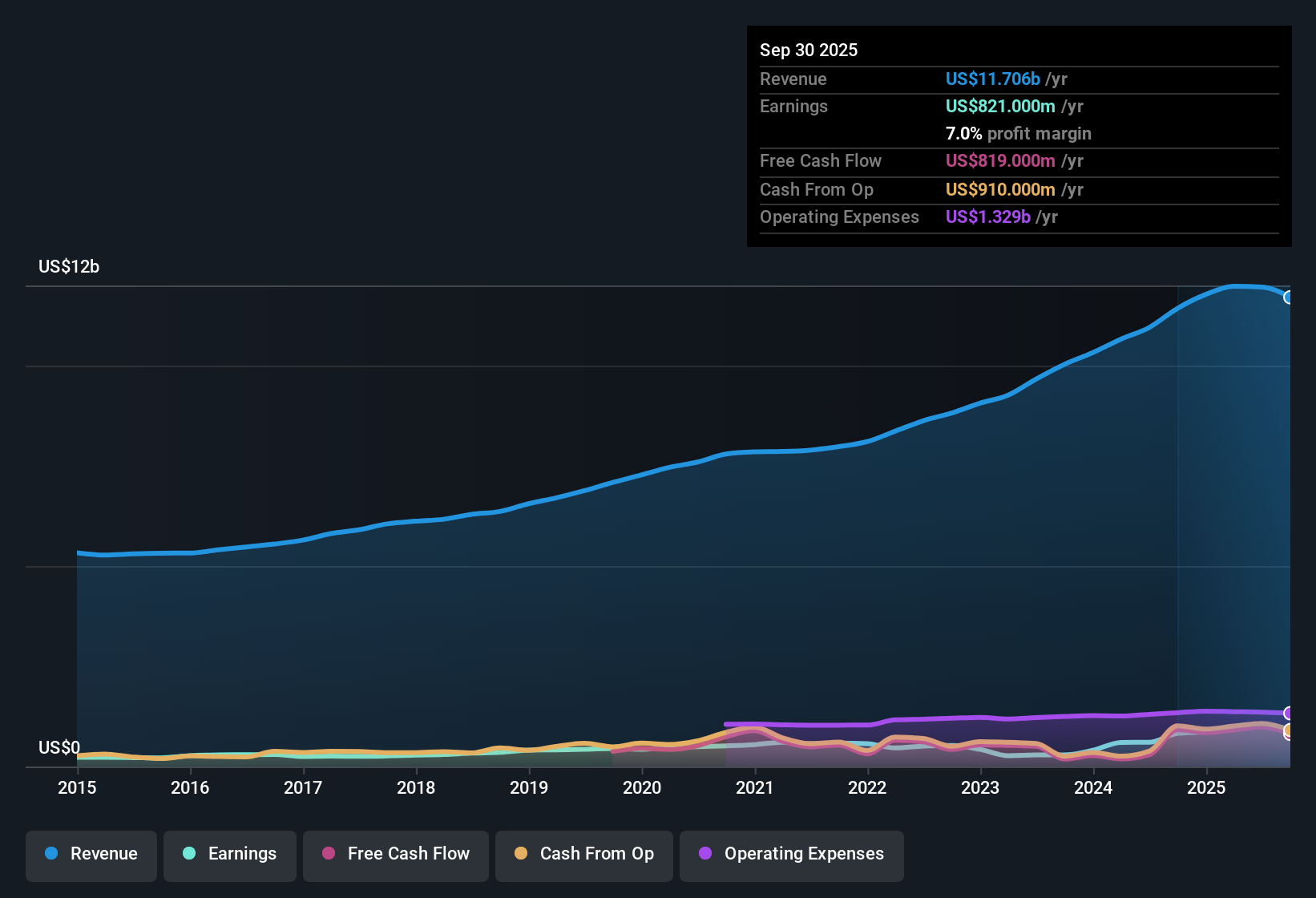

Booz Allen Hamilton (BAH) posted net profit margins of 8.7%, a jump from last year’s 5.5%, while earnings showed a striking 71.1% year-over-year increase, much higher than the company’s 5-year average annual growth of 11.4%. With a current Price-To-Earnings Ratio of 10.9x, shares trade at a deep discount to peers and well below the US Professional Services industry average, underscoring their value credentials. Investors have reason to appreciate strong profit momentum and margin expansion, but with earnings growth forecasts set to moderate, the market may be weighing these results against more cautious long-term growth expectations.

See our full analysis for Booz Allen Hamilton Holding.Now it’s time to see how Booz Allen’s latest results stack up against the prevailing stories. You’ll find some market narratives reinforced and others put to the test in the following sections.

See what the community is saying about Booz Allen Hamilton Holding

Analysts Expect Shrinking Margins by 2028

- Consensus forecasts Booz Allen’s profit margin will fall from the current 8.7% to 5.7% over the next three years, even as revenues are projected to rise by 4.1% annually.

- According to the analysts' consensus narrative, margin pressure introduces a key tension for bullish investors:

- Long-term government and technology contracts are expected to drive stable revenue growth. However, expanding outcome-based and fixed-price deals could challenge profitability if execution proves difficult.

- While new tech-enabled offerings are seen as potential margin boosters, the anticipated drop in profit margins underscores the risk that productivity or pricing gains may not fully offset higher delivery costs or competitive pressure.

- Strong margin improvement might reassure the optimists, but consensus sees future compression as a nuanced take that keeps both sides on their toes.

- Consensus narrative raises a critical question: will digital and AI investments be enough to sustain higher profitability, or will government contract mix and market competition erode margins as forecast? 📊 Read the full Booz Allen Hamilton Holding Consensus Narrative.

Shares Still Trade Far Below DCF Fair Value

- The latest share price of $91.40 sits 45% below the DCF fair value of $166.52, and is also well under the peer average price-to-earnings ratio (10.9x for Booz Allen versus 37.6x for peers).

- Analysts' consensus narrative points out:

- This valuation gap may appeal to value-focused investors, who see established profitability and revenue growth at a substantial discount relative to both sector averages and Booz Allen’s own fair value estimate.

- On the flip side, the fact that consensus analyst targets top out at $115.20 reflects tempered optimism, as near-term margin contraction and modest growth outlooks curb upside expectations despite strong historical earnings performance.

Analyst Price Target Implies 26% Upside

- Booz Allen’s analyst price target of $115.20 is 26% higher than the current share price, though it is notably lower than the DCF fair value estimate.

- The consensus narrative reinforces that:

- While analysts remain positive on long-term contract trends and tech expansion, their price target assumes that projected revenue of $13.5 billion and earnings of $775.2 million will justify a rebound in valuation by 2028.

- The ultimate upside depends on whether Booz Allen can deliver steady returns as government procurement normalizes and digital investments begin to pay off, balancing persistent risks around contract concentration and industry competition.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Booz Allen Hamilton Holding on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a different take on the figures? Turn fresh insight into your personal narrative in just a few minutes by sharing your unique view. Do it your way

A great starting point for your Booz Allen Hamilton Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Booz Allen’s projected margin compression and tempered growth expectations raise questions about its ability to deliver consistent long-term performance.

If steady gains and reliable upside are what you want, check out stable growth stocks screener (2098 results) to discover companies with proven, dependable expansion even when others slow down.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Booz Allen Hamilton Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAH

Booz Allen Hamilton Holding

A technology company, provides technology solutions using artificial intelligence, cyber, and other technologies for government’s cabinet-level departments and commercial customers in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives