- United States

- /

- Professional Services

- /

- NYSE:BAH

Are Booz Allen Hamilton Shares a Bargain After Shifting Client Spending News?

Reviewed by Bailey Pemberton

- Curious whether Booz Allen Hamilton Holding shares are now a bargain or still priced for perfection? Let’s break down what’s really happening beneath the surface.

- Despite climbing 3.3% over the past week, the stock remains deeply in negative territory for the year. It is down 34.9% year-to-date and 42.4% over the last 12 months.

- These recent price swings have sparked renewed debate, especially after industry news highlighted shifting client spending patterns and the company’s latest contract wins. Such headlines have generated both optimism and caution among investors watching for a potential turnaround.

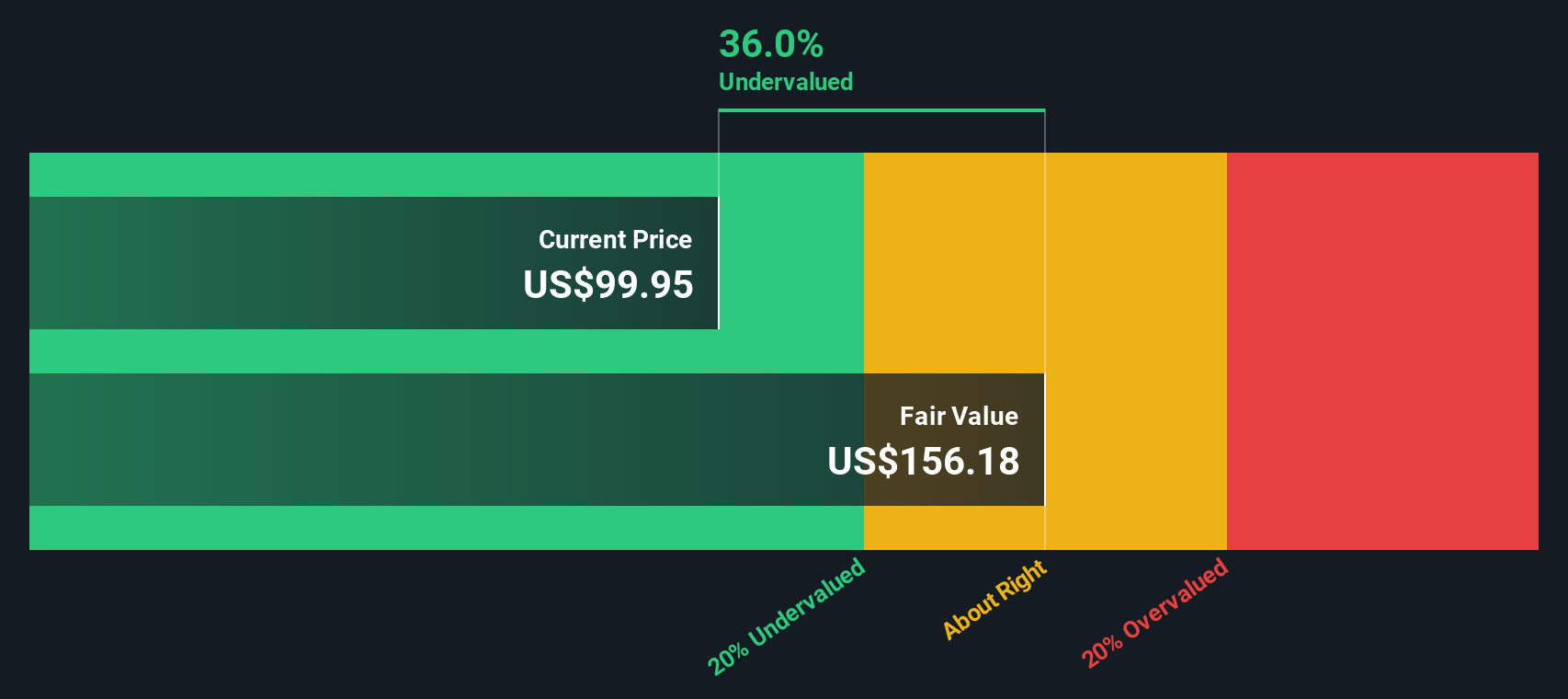

- Looking at the numbers, Booz Allen Hamilton Holding scores a 5 out of 6 on our undervaluation checklist. This suggests there may be value hiding in plain sight. Next, we’ll compare various valuation methods and explain why a more holistic approach can provide even deeper insights by the end of this article.

Approach 1: Booz Allen Hamilton Holding Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to today’s value, using a required rate of return. This approach aims to reflect what Booz Allen Hamilton Holding’s business is truly worth based on actual cash generation, rather than just current market sentiment.

Looking at Booz Allen Hamilton Holding, the company reported Free Cash Flow (FCF) of $818 million over the last twelve months. Based on analyst and extrapolated estimates, FCF is expected to climb gradually, reaching approximately $1.27 billion by 2035. Projections suggest steady cash flow growth, with each year’s FCF discounted to reflect its value in present dollars. This is considered a robust method for long-term value assessment.

According to the DCF analysis, Booz Allen Hamilton Holding’s intrinsic value is estimated at $166.91 per share. Compared to the company’s recent share price, this suggests the stock is trading at a 50.0% discount to its calculated fair value. In practical terms, the model indicates the shares are significantly undervalued relative to their long-term cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Booz Allen Hamilton Holding is undervalued by 50.0%. Track this in your watchlist or portfolio, or discover 914 more undervalued stocks based on cash flows.

Approach 2: Booz Allen Hamilton Holding Price vs Earnings

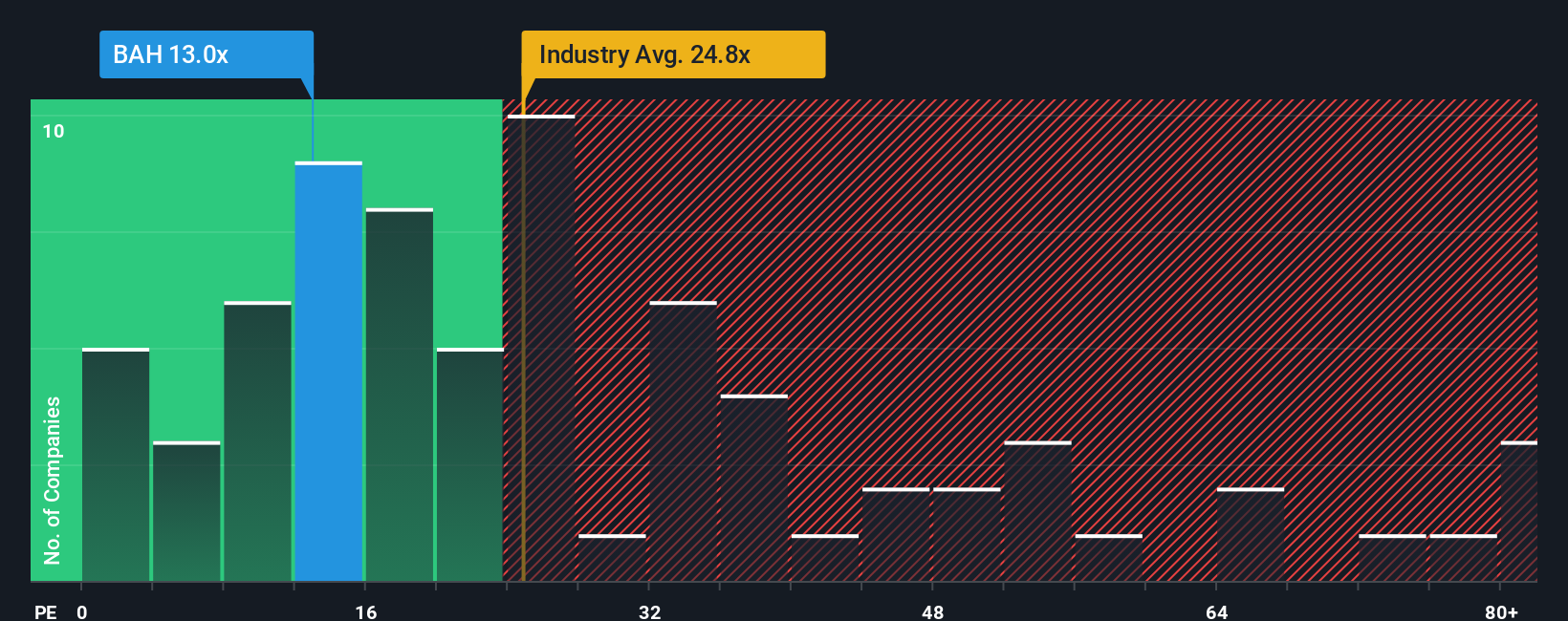

For profitable companies like Booz Allen Hamilton Holding, the Price-to-Earnings (PE) ratio is a widely used and effective valuation tool. The PE ratio helps investors understand how much they are paying today for each dollar of a company’s earnings. When evaluating whether a stock is cheap or expensive, it is important to consider both growth prospects and risk. Higher expected growth typically justifies a higher PE, while greater risk should result in a lower one.

Booz Allen Hamilton Holding currently trades at a PE ratio of 12.33x. This figure stands out against the broader professional services industry average of 24.28x and its peer group’s average of 52.40x. On the surface, this substantial discount suggests potential value. However, these benchmarks do not account for Booz Allen’s unique characteristics or risk profile.

This is where Simply Wall St’s “Fair Ratio” comes into play. The Fair Ratio, calculated at 20.27x for Booz Allen Hamilton, estimates what a reasonable PE would be by factoring in aspects like the company’s earnings growth, profit margins, industry conditions, risks, and market capitalization. This holistic approach provides a more grounded view than simply comparing to peers or industry averages, which can overlook critical differences unique to the business.

Comparing the Fair Ratio of 20.27x to Booz Allen’s current PE of 12.33x, the stock appears undervalued by this measure. This indicates investors are paying much less than what would typically be expected for a company with Booz Allen’s profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1437 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Booz Allen Hamilton Holding Narrative

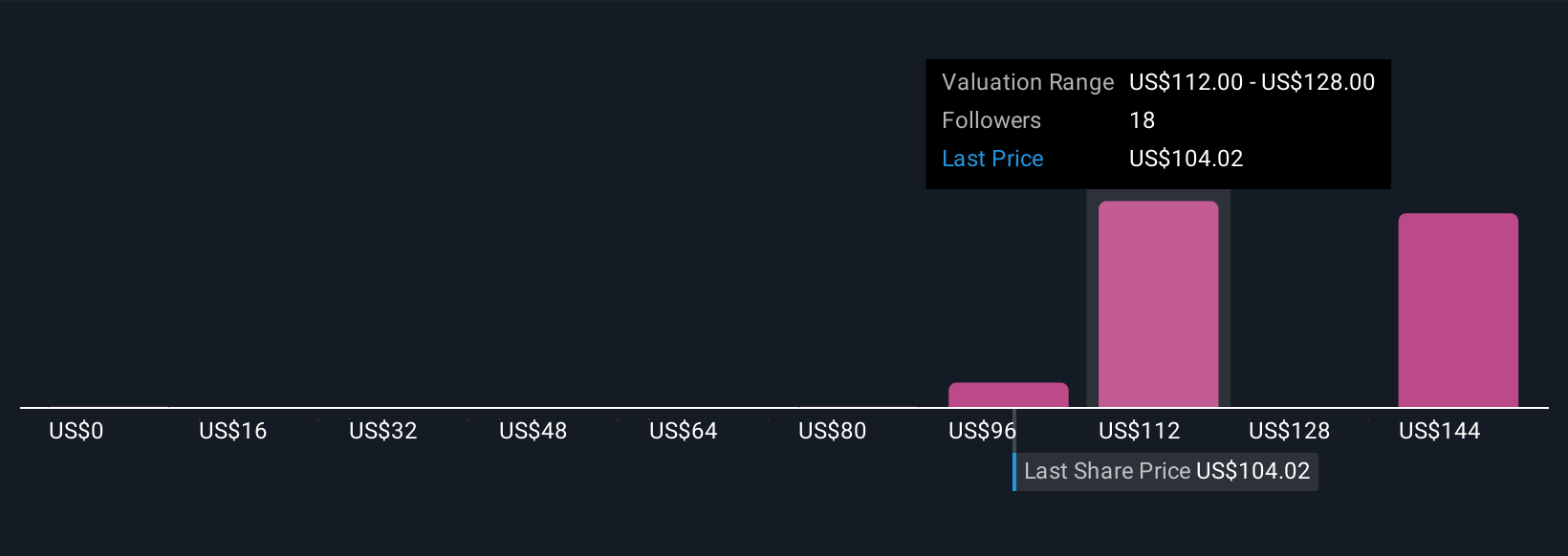

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Rather than relying on just numbers and ratios, a Narrative is your personal story or perspective on a company, backed by your assumptions about its fair value and forecasts for future revenue, earnings, and margins. Narratives connect the “why” behind a company’s prospects and risks directly to a financial forecast, so your investment decisions are based on both story and substance.

Narratives are easy to use and accessible within the Community page on Simply Wall St, where millions of investors explore and share perspectives. They help you decide more confidently when to buy or sell Booz Allen Hamilton Holding by comparing your Fair Value estimate to the current Price. Whenever news breaks or earnings are released, Narratives update dynamically, ensuring your view stays current as real-world events unfold.

For example, one investor focusing on defense contracts and technical innovation might build a bullish Narrative with a $160 price target, while another, concerned about civil sector weakness and margin pressure, could see fair value closer to $89. Narratives let users compare these views and choose their own smart investment story.

Do you think there's more to the story for Booz Allen Hamilton Holding? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Booz Allen Hamilton Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAH

Booz Allen Hamilton Holding

A technology company, provides technology solutions using artificial intelligence, cyber, and other technologies for government’s cabinet-level departments and commercial customers in the United States and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026