- United States

- /

- Professional Services

- /

- NYSE:AMTM

Why Amentum Holdings (AMTM) Is Up 14.9% After Beating Earnings and Securing Major Government Contracts

Reviewed by Sasha Jovanovic

- Amentum Holdings recently announced full-year earnings results, reporting sales of US$14.39 billion and net income of US$66 million, alongside quarterly earnings and revenues that surpassed analyst expectations.

- The company also secured several major government contracts in space, nuclear, and mission operations, highlighting expanding market reach and operational momentum since becoming publicly traded.

- We'll examine how Amentum's strong contractual wins and year-over-year financial growth shape its current investment narrative and outlook.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

What Is Amentum Holdings' Investment Narrative?

Amentum Holdings’ recent full-year earnings report, revealing US$14.39 billion in sales and a move to profitability, strengthens its investment story at a time when the stock has already enjoyed strong price gains. The company’s delivery on major government contracts in defense, space, and nuclear sectors has reinforced expectations that short-term growth will be anchored by reliable project backlogs. With consistent quarterly outperformance and a leadership team building momentum since the IPO, market attention now turns to whether these operational wins can be sustained against several lingering risks. While the updated annual revenue guidance only slightly narrows expectations, it also points to muted top-line growth ahead, potentially tempering further upside as analysts have already priced in much of the current contract momentum. Another focal point remains Amentum’s valuation, with a high price-to-earnings ratio and relatively inexperienced leadership team now in sharper focus following the strong news. These elements may influence both short-term confidence and long-term conviction for shareholders weighing fresh catalysts against emerging risks.

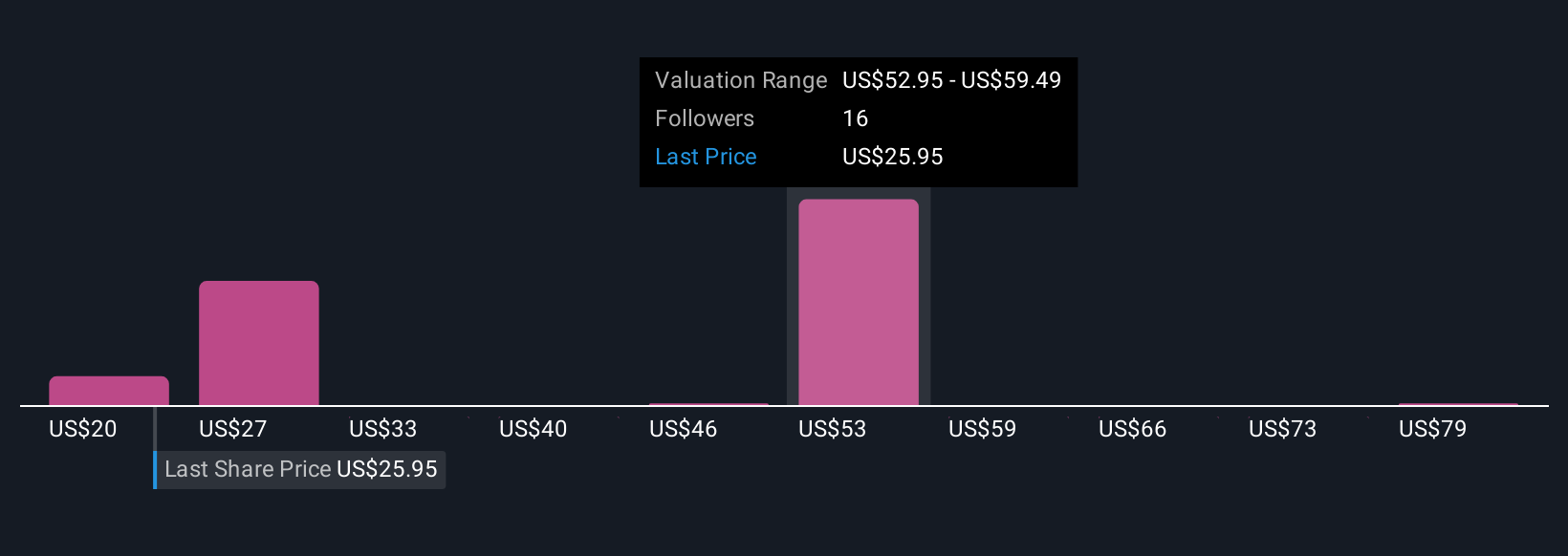

But with leadership changes and a board early in its tenure, management execution is critical going forward. Amentum Holdings' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 7 other fair value estimates on Amentum Holdings - why the stock might be worth 31% less than the current price!

Build Your Own Amentum Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amentum Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Amentum Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amentum Holdings' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMTM

Amentum Holdings

Engages in the provision of engineering and technology solutions in the United States and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success