- United States

- /

- Professional Services

- /

- NYSE:ALIT

Does Alight's (ALIT) AI-Powered Benefits Shift Redefine Its Growth Prospects?

Reviewed by Simply Wall St

- Alight, Inc. recently shifted its business strategy by divesting its payroll and professional services divisions to concentrate on employee benefits services, with a strong emphasis on artificial intelligence and high-profile partnerships with Goldman Sachs, Microsoft, and IBM.

- This focus on AI-driven solutions and new alliances is intended to enhance Alight’s offerings and position the company for diversified revenue growth, even as it revises its guidance and accelerates expansion plans.

- To understand how this heightened focus on AI-powered employee benefits might reshape Alight's outlook, let’s examine its impact on the investment narrative.

This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

Alight Investment Narrative Recap

To own shares in Alight, investors need to believe that its pivot to AI-powered employee benefits and premier partnerships will drive client demand and help unlock recurring revenue streams. The divestiture signals sharper focus but does not immediately resolve the biggest catalyst, commercial execution and deal closure rates, while persistent risks like lengthier sales cycles and client concentration remain material concerns in the short term.

Among recent developments, the July release of enhanced AI integrations in Alight Worklife® directly aligns with this renewed focus, aiming to bolster product differentiation and client experience. This move may support the company's growth ambitions and reinforce its sales pipeline, but it arrives amid revenue timing headwinds and a challenging earnings backdrop. The real challenge for Alight, however, is whether these new solutions will be enough, given that...

Read the full narrative on Alight (it's free!)

Alight's narrative projects $2.5 billion revenue and $142.2 million earnings by 2028. This requires 3.0% yearly revenue growth and an increase in earnings of approximately $1.24 billion from the current -$1.1 billion.

Uncover how Alight's forecasts yield a $8.21 fair value, a 123% upside to its current price.

Exploring Other Perspectives

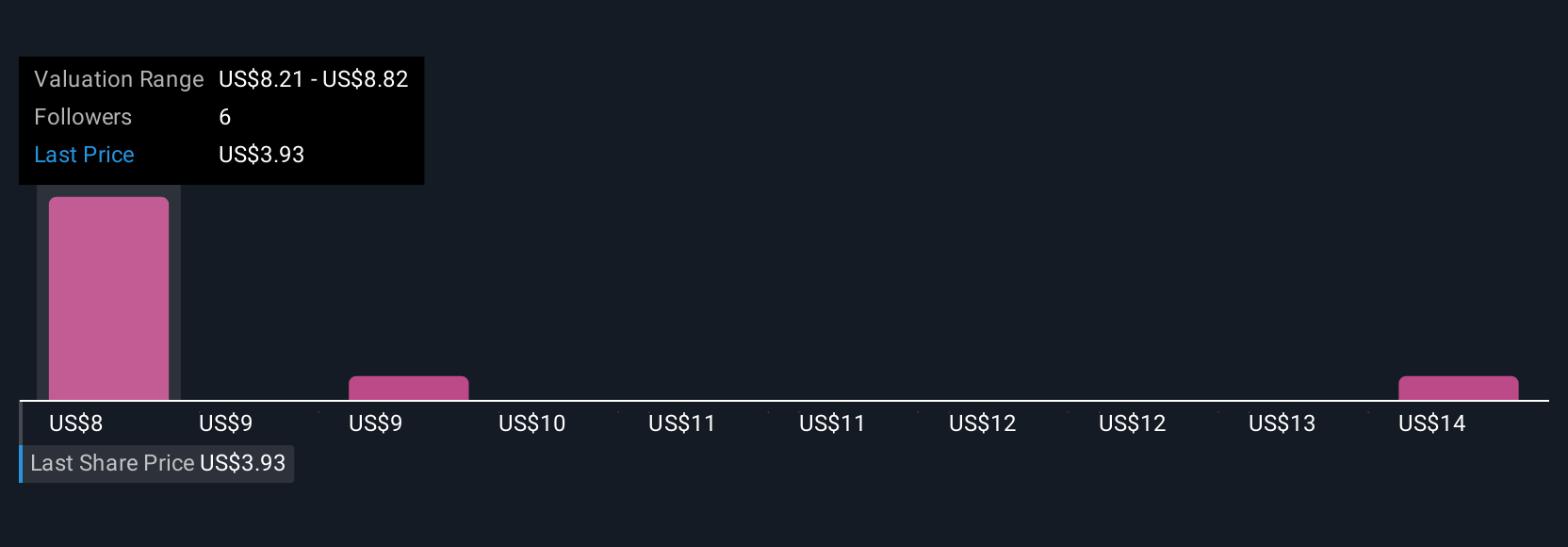

Three community members on Simply Wall St estimate Alight’s fair value between US$8.21 and US$13.94 per share. Many see potential in AI-driven service growth, but ongoing execution risk remains a key factor shaping outlooks across the board.

Explore 3 other fair value estimates on Alight - why the stock might be worth over 3x more than the current price!

Build Your Own Alight Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alight research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alight research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alight's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALIT

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion