- United States

- /

- Professional Services

- /

- NYSE:ALIT

Alight (ALIT): Assessing Valuation After Steep Losses and $1.4 Billion Goodwill Impairment

Reviewed by Simply Wall St

Alight (ALIT) just posted quarterly results that revealed a sharp jump in net losses and announced a goodwill impairment nearing $1.4 billion. These major developments could reshape investor expectations around the business this year.

See our latest analysis for Alight.

Following these developments, Alight’s share price momentum has sharply reversed, with a 1-month share price return of -26.3% and a year-to-date slide of -66.4%. The 1-year total shareholder return stands at a steep -70.4%, reflecting rapidly fading investor confidence despite new guidance, a buyback milestone, and ongoing dividend payments. Both short-term and long-term returns point to mounting pressure as risk perception grows.

If recent volatility has you rethinking your watchlist, this could be your chance to broaden your search and discover fast growing stocks with high insider ownership

With shares now trading at a steep discount to analyst targets amid headlines of rising losses, investors are left to ask whether today’s valuation reflects a true bargain or if the market is skeptical about future growth prospects for good reason.

Most Popular Narrative: 66.9% Undervalued

Alight’s most widely followed narrative suggests the company’s fair value is substantially above the current share price. This raises the prospect of a dramatic upside if the assumptions play out. At $6.86 fair value versus a $2.27 last close, the gap highlights bold expectations for an earnings turnaround.

Ongoing shift to high-margin, cloud-based, recurring revenue models (over 93% of revenue is now recurring), along with increased wallet share from service expansions in large client renewals, is likely to support revenue stability and further margin expansion over time.

Want to find out what’s driving this rich narrative valuation? There are surprising forecasts for revenue growth, a shift in profit margins, and an aggressive profit multiple behind the scenes. Intrigued by which financial levers could put Alight in rare company? Discover exactly what the narrative is banking on to justify this premium fair value estimate.

Result: Fair Value of $6.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if prolonged delays in new client signings or continued weakness in project revenues persist, this narrative of dramatic upside could quickly come apart.

Find out about the key risks to this Alight narrative.

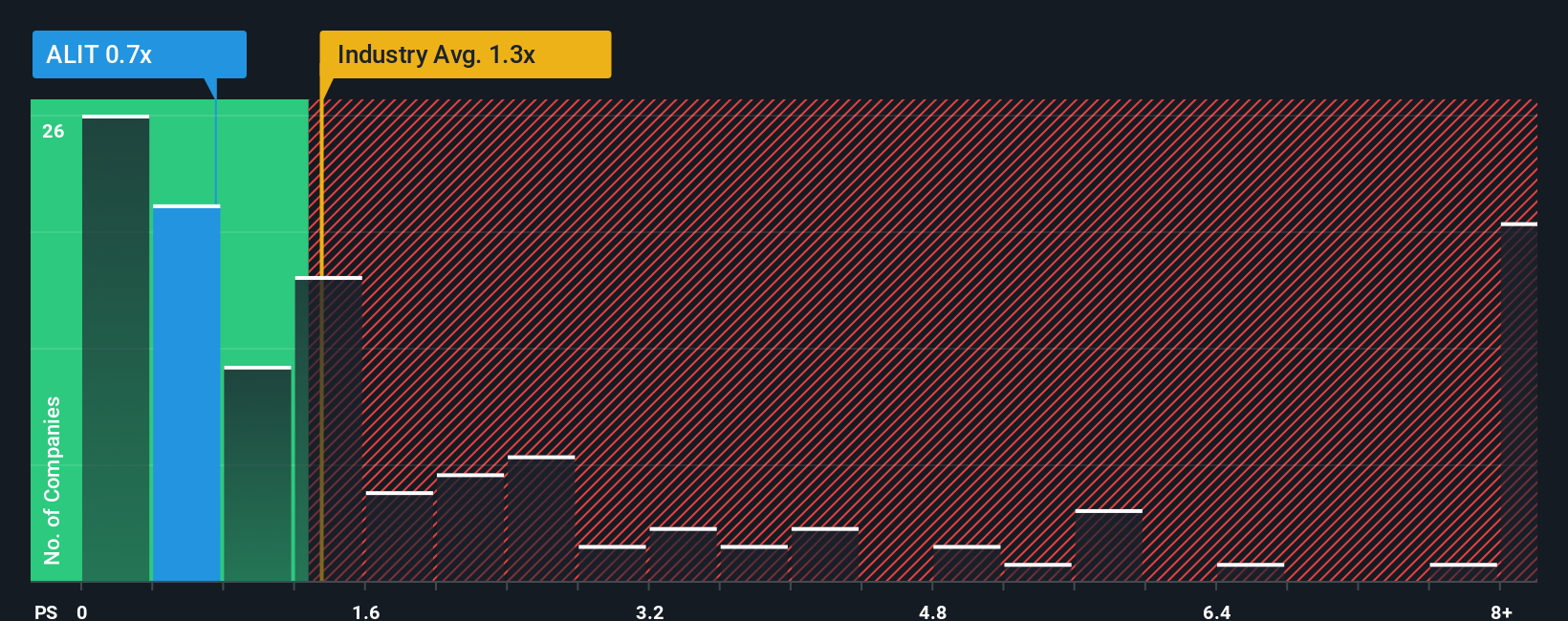

Another View: How Do Multiples Stack Up?

While narrative-driven and analyst valuations suggest Alight is deeply undervalued, a look at its price-to-sales ratio tells a more cautious story. Trading at 0.5x sales, Alight looks cheap compared to the US Professional Services industry average of 1.4x, and comfortably below its fair ratio of 1x.

But does this low valuation reflect true opportunity, or is it the market pricing in lingering worries about growth and profitability? When the market finally re-prices, will Alight close the gap or fall further behind? See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alight Narrative

If you see the story unfolding differently or want to run your own numbers, you can dive in and build a custom view of Alight’s future in just a few minutes with Do it your way.

A great starting point for your Alight research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Open the door to fresh opportunities before the crowd catches on by using powerful screeners tailored to help you spot hidden potential and future winners.

- Uncover high yield possibilities that could boost your returns with these 15 dividend stocks with yields > 3%, offering payouts above market average.

- Seize early-mover advantage in artificial intelligence trends by browsing these 26 AI penny stocks, which focus on automation and machine learning.

- Target solid growth at a fair price with these 875 undervalued stocks based on cash flows, screening for companies trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALIT

Good value with adequate balance sheet.

Market Insights

Community Narratives