- United States

- /

- Commercial Services

- /

- NYSE:ACVA

Assessing ACV Auctions (ACVA) Valuation Following Insider Buying and Sector AI Momentum

Reviewed by Simply Wall St

ACV Auctions (ACVA) stock climbed recently, driven by a mix of positive momentum in the tech sector following fresh AI developments and insider share purchases by the company’s management. These events have shifted investor attention back toward its future prospects.

See our latest analysis for ACV Auctions.

ACV Auctions has seen a sharp shift in sentiment, as a 16% uptick in 7-day share price return follows a period of heavy losses earlier this year. Recent insider buying and positive sector momentum have helped revive optimism, even though the stock’s total shareholder return over the past year remains deeply negative. Overall, momentum appears to be building off a low base. Investors are watching closely to see if these signals lead to a sustained turnaround.

If renewed insider confidence has you wondering what else is catching attention lately, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

With ACV Auctions staging a swift rebound yet still trading well below its highs, the central debate now is whether the stock’s recent momentum signals genuine undervaluation or if the market is already factoring in a comeback and leaving little room for upside.

Most Popular Narrative: 29% Undervalued

Compared to the last close of $7.59, the most popular narrative estimates a fair value near $10.69 per share, setting up a significant gap for investors to consider. The narrative builds its valuation on a blend of rapid earnings growth expectations and future profitability turning positive from current losses, raising questions over whether these assumptions can play out in a dynamic sector.

The ongoing integration of advanced AI and machine learning into ACV's vehicle inspection, pricing, and guarantee products positions the platform to further differentiate itself by offering real-time, highly accurate, and transparent transaction solutions. This is expected to continue driving above-industry growth in auction volumes, increase take rates, and support margin expansion.

Curious what ambitious forecast lies behind this valuation leap? Hint: The narrative relies on aggressive future profitability, industry gains, and a long-term shift in market preferences. What are the bold projections at play? The answers might surprise you. Discover what powers this price target.

Result: Fair Value of $10.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent uncertainty in dealer volumes and increased competitive pressures may quickly challenge the bullish case for ACV Auctions’ ongoing rebound.

Find out about the key risks to this ACV Auctions narrative.

Another View: What Do Multiples Say?

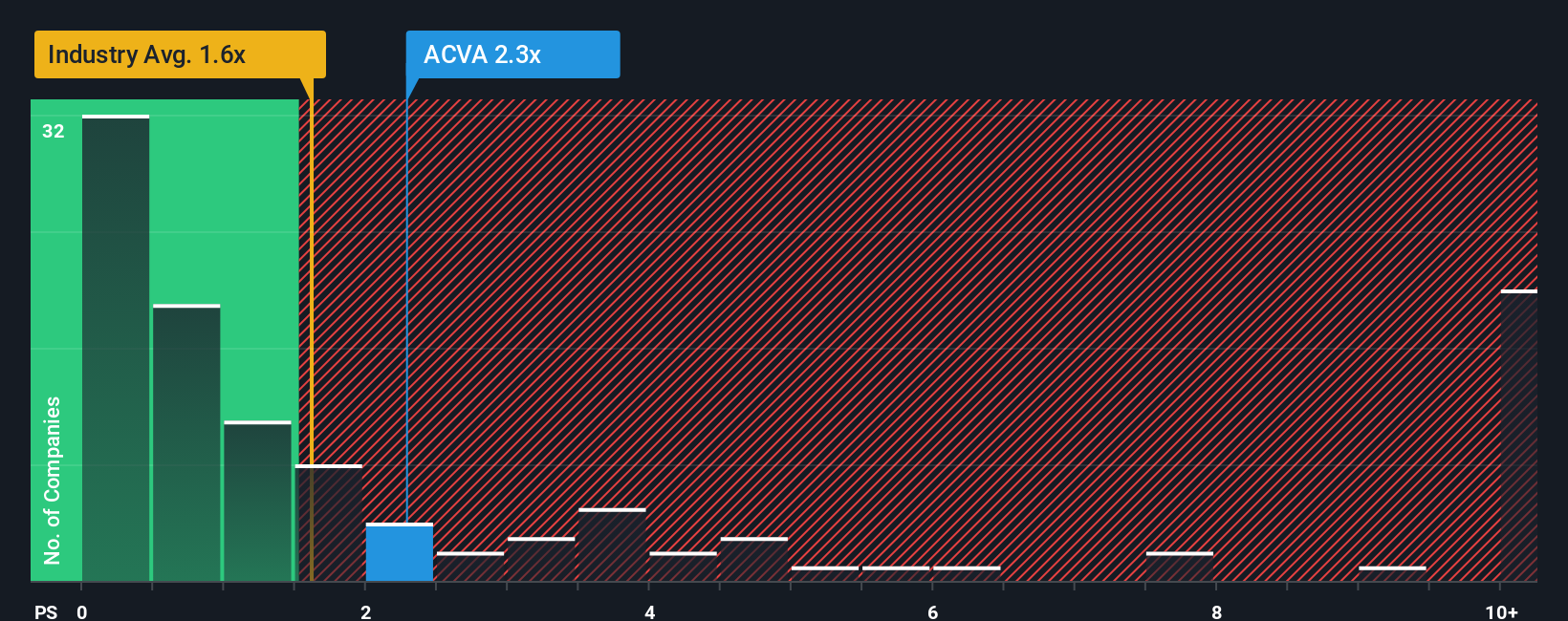

Looking at valuation from another perspective, ACV Auctions is trading at a Price-to-Sales ratio of 1.8x, which is much steeper than its peer average of 1.1x and a fair ratio of just 1.2x. This premium suggests the stock may be overvalued if the market’s expectations do not get met. Is this a warning sign or just the new normal for digital disruptors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ACV Auctions Narrative

If you have a different perspective or want to dive deeper, you can analyze the numbers yourself and build your own view in just a few minutes, then Do it your way

A great starting point for your ACV Auctions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Thousands of investors are finding opportunities by tracking top performers and standout sectors using the Simply Wall Street Screener. Act now to spot your next winning stock before the crowd catches on.

- Uncover rising potential among game-changing small caps by checking out these 3582 penny stocks with strong financials that stand out for their financial strength.

- Target the future of medicine and innovation by exploring these 30 healthcare AI stocks companies that are revolutionizing healthcare with intelligent solutions.

- Fuel your income strategy with these 14 dividend stocks with yields > 3% that offer yields above 3 percent and consistent, reliable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACVA

ACV Auctions

Provides a wholesale auction marketplace to facilitate business-to-business used vehicle sales between a selling and buying dealership.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.