- United States

- /

- Commercial Services

- /

- NYSE:ACCO

ACCO Brands (NYSE:ACCO) Is Due To Pay A Dividend Of $0.075

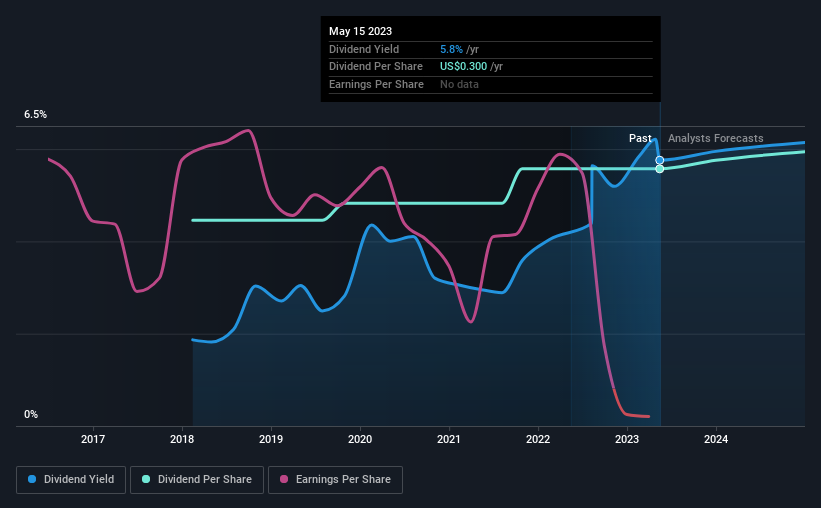

ACCO Brands Corporation (NYSE:ACCO) has announced that it will pay a dividend of $0.075 per share on the 9th of June. The dividend yield will be 5.8% based on this payment which is still above the industry average.

View our latest analysis for ACCO Brands

ACCO Brands Might Find It Hard To Continue The Dividend

A big dividend yield for a few years doesn't mean much if it can't be sustained. ACCO Brands is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. This gives us some comfort about the level of the dividend payments.

Over the next year, EPS is forecast to rise by 88.2%. We like to see the company moving towards profitability, but this probably won't be enough for it to post positive net income this year. The positive free cash flows give us some comfort, however, that the dividend could continue to be sustained.

ACCO Brands Is Still Building Its Track Record

It is great to see that ACCO Brands has been paying a stable dividend for a number of years now, however we want to be a bit cautious about whether this will remain true through a full economic cycle. Since 2018, the dividend has gone from $0.24 total annually to $0.30. This works out to be a compound annual growth rate (CAGR) of approximately 4.6% a year over that time. We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Dividend Growth Potential Is Shaky

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, initial appearances might be deceiving. Earnings per share has been sinking by 22% over the last five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

ACCO Brands' Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 2 warning signs for ACCO Brands you should be aware of, and 1 of them doesn't sit too well with us. Is ACCO Brands not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ACCO

ACCO Brands

Designs, manufactures, and markets consumer, school, technology, and office products in the United States, Canada, Brazil, Mexico, Chile, Europe, the Middle East, Australia, New Zealand, and Asia.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives