- United States

- /

- Commercial Services

- /

- NYSE:ABM

Are ABM Industries' (ABM) Share Buybacks and Steady Dividends a Sign of Sustained Earnings Power?

Reviewed by Simply Wall St

- ABM Industries announced in early September 2025 that Carol A. Clements was appointed to its Board’s Stakeholder and Enterprise Risk Committee, declared its 238th consecutive quarterly cash dividend of US$0.265 per share, reported strong third-quarter results with sales reaching US$2.22 billion and net income of US$41.8 million, and completed a major tranche of its share buyback program.

- An interesting insight is that the company has achieved both long-running dividend payments and executed significant share repurchases while delivering robust profit growth over the nine months ended July 2025.

- We'll explore how ABM Industries’ substantial share repurchases and earnings momentum may influence its future growth narrative and market outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

ABM Industries Investment Narrative Recap

To own a company like ABM Industries, investors typically need to believe in the stability of its recurring service contracts and its ability to expand profitably despite competitive pressures in major markets. The latest round of positive earnings and ongoing share buybacks may support near-term confidence, but they do not materially change the biggest short-term risk, the potential for persistent margin pressure driven by contract concessions in softer regions.

Of all the recent announcements, the third-quarter results stand out most for their relevance to ABM’s current story. The solid year-over-year growth in both sales (to US$2,224 million) and net income (to US$41.8 million) offers some reassurance for those watching margin trends but does not fully dispel concerns about ongoing pricing and contract pressures in key segments.

However, it’s important to note that investors should still watch closely for any signs of profitability being squeezed by...

Read the full narrative on ABM Industries (it's free!)

ABM Industries' outlook projects $9.5 billion in revenue and $370.4 million in earnings by 2028. This assumes annual revenue growth of 3.2% and an earnings increase of $254.5 million from current earnings of $115.9 million.

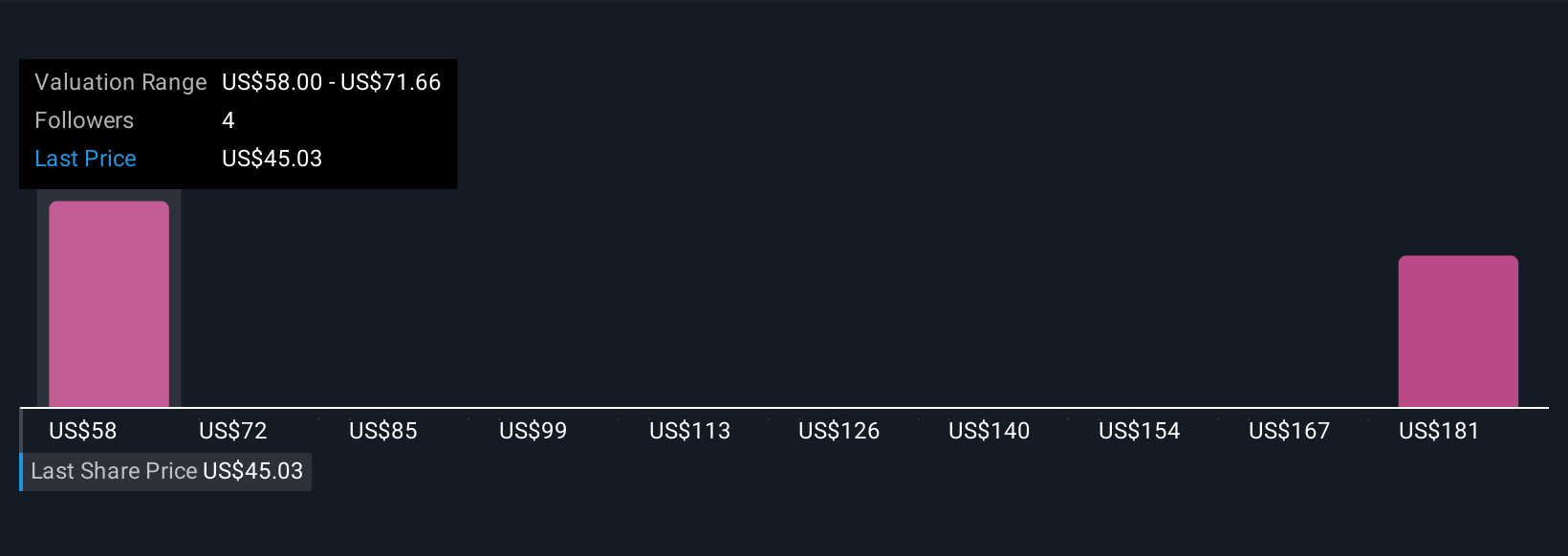

Uncover how ABM Industries' forecasts yield a $58.00 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have published two fair value estimates for ABM Industries, ranging from US$58 to US$195.78 per share. While some see considerable upside, contract renegotiation risks remain a crucial consideration for anyone examining overall performance potential.

Explore 2 other fair value estimates on ABM Industries - why the stock might be worth over 4x more than the current price!

Build Your Own ABM Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ABM Industries research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free ABM Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ABM Industries' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABM

ABM Industries

Through its subsidiaries, engages in the provision of integrated facility, infrastructure, and mobility solutions in the United States and internationally.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives