- United States

- /

- Professional Services

- /

- NasdaqGM:WLDN

Willdan Group (WLDN) Is Up 5.4% After Winning US$97 Million Alameda County Energy Upgrade Contract Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Alameda County, California has selected Willdan Group for a US$97 million contract to design and implement comprehensive energy and infrastructure upgrades across 24 sites, including electrification, solar PV, EV charging, and decarbonization measures.

- The partnership not only addresses sustainability targets but also positions Willdan as a key advisor in helping public sector clients access external funding to reduce overall project costs.

- We will explore how the newly secured US$97 million energy contract with Alameda County influences Willdan Group's long-term investment outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Willdan Group Investment Narrative Recap

To own shares in Willdan Group, you need conviction in the growing push for energy efficiency and decarbonization, particularly as local governments expand infrastructure upgrades and sustainability commitments. The recent US$97 million Alameda County contract adds meaningful near-term revenue and demonstrates strong client demand, but does not fully ease the biggest risk: Willdan’s heavy dependence on public sector funding, which remains vulnerable to policy or budget shifts and can affect earnings predictability.

The company's raised earnings guidance for 2025 stands out, as it arrived just days before the Alameda County announcement. This updated outlook, reflecting expected net revenue between US$360 million and US$365 million, suggests management’s confidence in its pipeline and project execution, important context for the revenue impact of large public sector contracts, which can act as visible catalysts for growth and earnings momentum.

Yet, in contrast to the optimism surrounding these wins, investors should pay close attention to lingering risks if government energy priorities shift or if project funding streams become less reliable...

Read the full narrative on Willdan Group (it's free!)

Willdan Group's projections suggest $867.2 million in revenue and $76.9 million in earnings by 2028. This outlook is based on an annual revenue growth rate of 11.3% and a $41.7 million increase in earnings from the current level of $35.2 million.

Uncover how Willdan Group's forecasts yield a $132.50 fair value, a 38% upside to its current price.

Exploring Other Perspectives

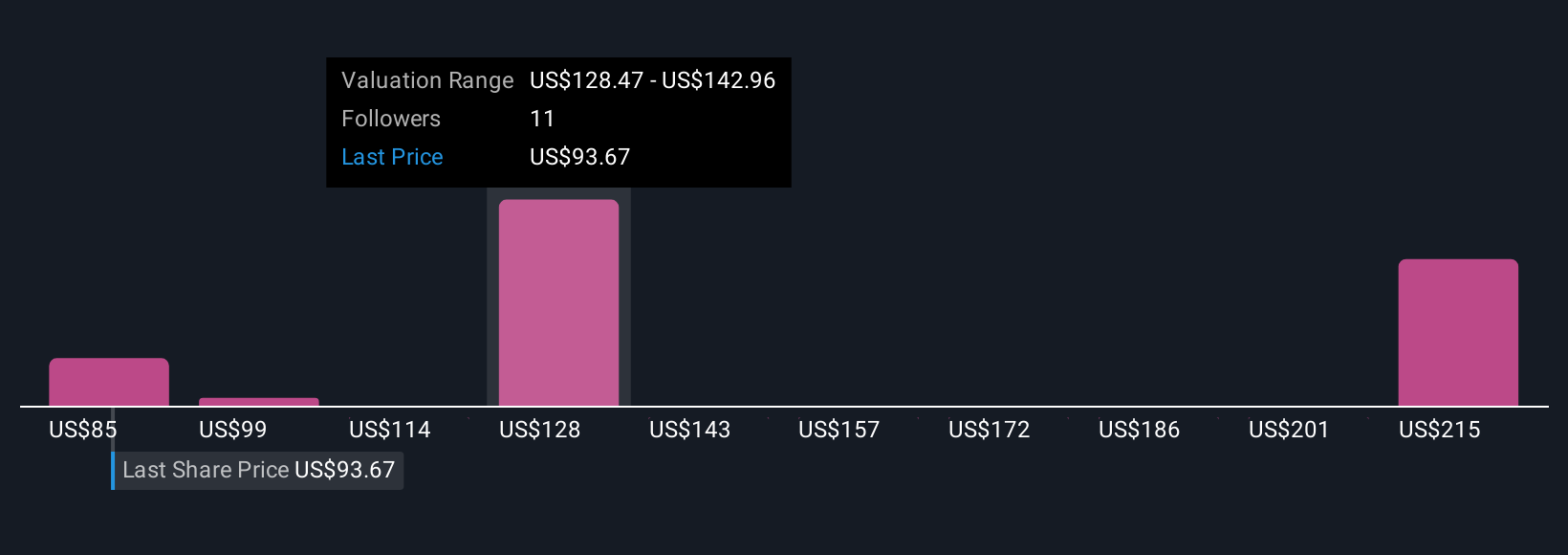

Retail investors in the Simply Wall St Community assessed Willdan’s fair value from US$85 to US$191.63 across four estimates before the latest contract win. With such a wide spread of views, and given the company’s sensitivity to public sector funding, you can see how opinions may sharply diverge around future performance.

Explore 4 other fair value estimates on Willdan Group - why the stock might be worth 11% less than the current price!

Build Your Own Willdan Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Willdan Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Willdan Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Willdan Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willdan Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WLDN

Willdan Group

Provides professional, technical, and consulting services primarily in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives