- United States

- /

- Professional Services

- /

- NasdaqGM:WLDN

Willdan Group (WLDN): How a Major Massachusetts Contract Shapes the Company’s Valuation Outlook

Reviewed by Simply Wall St

Willdan Group (WLDN) has been chosen by National Grid to deliver energy efficiency solutions to small businesses in Massachusetts. This two-year agreement opens the door to a new market for Willdan and strengthens its regional reach.

See our latest analysis for Willdan Group.

Willdan Group’s recent move into Massachusetts comes on the back of extraordinary momentum, with the stock notching a year-to-date share price return of 171.68% and a 125.78% one-year total shareholder return. Strong contract wins, ongoing demand for energy efficiency solutions, and investor optimism around sustainability-linked infrastructure have all played a part in propelling both short-term and long-term performance.

If you’re keen to discover where the next wave of growth stories might be found, now is a great time to explore fast growing stocks with high insider ownership.

With such impressive returns and expanding contracts, the key question now is whether Willdan Group’s success is already reflected in the share price, or if there is still a window for investors to benefit from further upside.

Most Popular Narrative: 22.7% Undervalued

According to the most widely followed narrative, Willdan Group’s fair value sits well above the last close at $102.37, revealing a major gap between market expectations and future potential. This setup highlights optimism around growth drivers not yet fully recognized in the current share price.

“Strategic acquisitions that deepen technical capabilities and expand Willdan's geographic and sector footprint are accelerating organic growth via cross-selling and enabling entry into larger, more complex energy and infrastructure projects. This is driving both revenue and earnings expansion. Long-term and increasing utility and municipal contracts, typically 3-5 years in duration and funded through stable sources, are contributing to recurring revenue and improved earnings visibility. These contracts are also reducing earnings volatility and supporting higher net margins.”

Want to see what’s powering this premium price target? The real story is about bold growth bets, high-margin plays, and ambitious financial forecasts that most investors wouldn’t expect from an engineering firm. Curious about the numbers turning heads on Wall Street? Dive into the narrative to see what’s driving this outsized valuation.

Result: Fair Value of $132.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated reliance on policy-driven energy contracts and rising compensation costs could pose earnings risks and potentially slow Willdan’s otherwise robust growth trajectory.

Find out about the key risks to this Willdan Group narrative.

Another View: Multiples Tell a Different Story

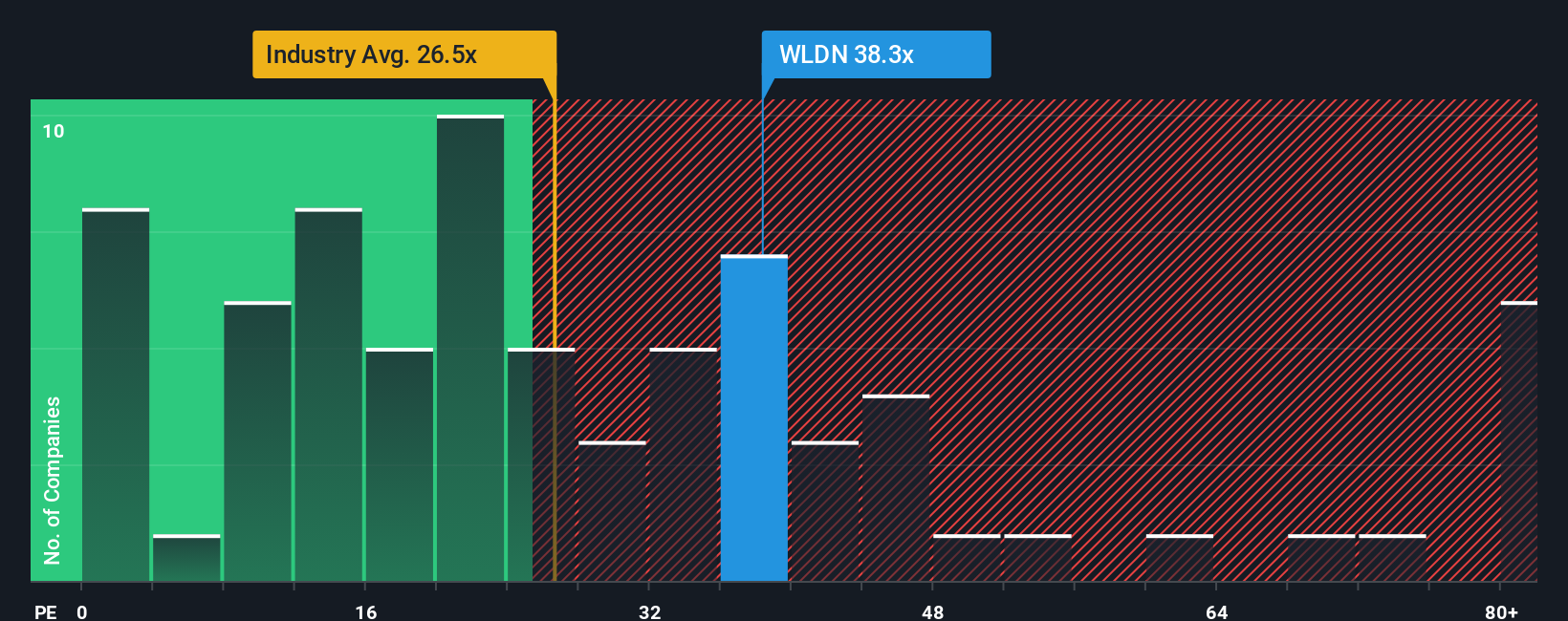

Looking through the lens of earnings multiples, Willdan Group is trading at a price-to-earnings ratio of 42.7x. This is far higher than the US Professional Services industry average of 26.5x and the peer group average of 31.4x, and even above the stock’s own fair ratio of 29.5x. That significant premium suggests that the market is already pricing in much of the expected growth. The key question is whether there is still room for upside if everything goes as planned.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Willdan Group Narrative

If you see things differently or want to dig into the numbers yourself, you can easily build your own view in just a few minutes. Do it your way.

A great starting point for your Willdan Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

The investing world is full of opportunities beyond Willdan Group. Take the lead in your portfolio and spot the next breakout winner before the rest get there.

- Start tapping into the future of healthcare by finding emerging breakthroughs with these 33 healthcare AI stocks as innovations in medical technology and artificial intelligence gain momentum.

- Begin your search for breakthrough value by targeting these 877 undervalued stocks based on cash flows stocks that are trading at a discount and show solid fundamentals and strong cash flow potential.

- Unlock potentially significant gains by seeking out these 3566 penny stocks with strong financials to find explosive growth in unique and often overlooked industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willdan Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WLDN

Willdan Group

Provides professional, technical, and consulting services primarily in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives