- United States

- /

- Professional Services

- /

- NasdaqGM:WLDN

Three Undiscovered Gems with Strong Financial Foundations

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has shown a robust 32% rise over the past 12 months with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying stocks with strong financial foundations can be key to uncovering potential opportunities amidst market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Tiptree (NasdaqCM:TIPT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tiptree Inc. operates through its subsidiaries to offer specialty insurance products and related services mainly within the United States, with a market capitalization of approximately $844.50 million.

Operations: Tiptree generates revenue primarily from its insurance segment, which accounts for $1.92 billion, and a smaller contribution from its mortgage operations at $57.18 million. The company's financial performance is significantly driven by the insurance sector's output within the U.S.

Tiptree, a nimble player in the insurance sector, showcases impressive earnings growth of 411.5% over the past year, outpacing the industry average of 33.2%. The company's net debt to equity ratio stands at a satisfactory 5.1%, reflecting prudent financial management as it reduced from 80.9% to 66% over five years. Recent financial results highlight revenue of US$494 million for Q3 and net income jumping to US$11.92 million from US$2.15 million year-over-year, with basic earnings per share rising to US$0.32 from US$0.06, indicating robust performance and potential for continued growth in its niche market space.

- Dive into the specifics of Tiptree here with our thorough health report.

Examine Tiptree's past performance report to understand how it has performed in the past.

Willdan Group (NasdaqGM:WLDN)

Simply Wall St Value Rating: ★★★★★★

Overview: Willdan Group, Inc. offers professional, technical, and consulting services mainly in the United States with a market capitalization of approximately $617.40 million.

Operations: Willdan Group generates revenue primarily from its Energy segment, which accounts for $487.28 million, and its Engineering and Consulting segment, contributing $90.13 million.

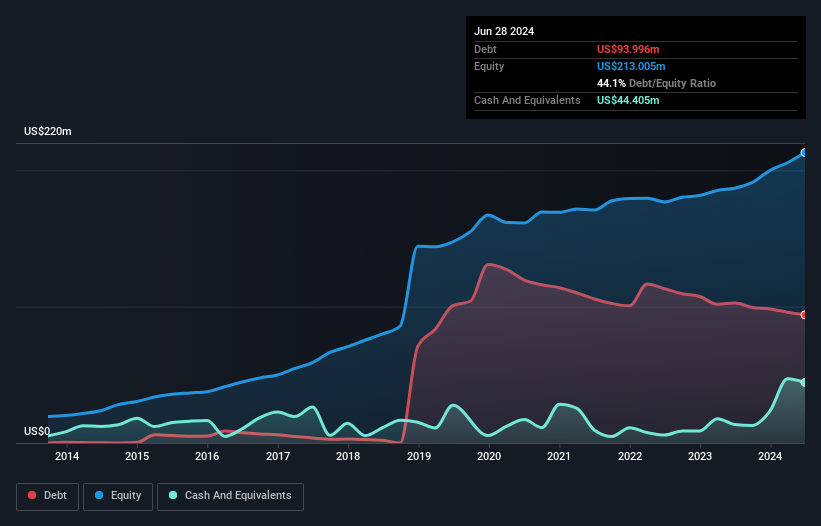

Willdan Group, a promising player in the professional services industry, has shown remarkable earnings growth of 840.1% over the past year. The company's net debt to equity ratio stands at a satisfactory 17.6%, indicating solid financial health. With interest payments well-covered by EBIT at 3.9 times, Willdan demonstrates robust operational efficiency. However, shareholder dilution occurred in the past year, which might concern some investors. Recent strategic moves include acquiring Enica Engineering and securing significant contracts like a $4.5 million deal with Bellflower City for building operations and fire plan inspections, underscoring its expanding market footprint in energy efficiency services and smart city solutions.

Materialise (NasdaqGS:MTLS)

Simply Wall St Value Rating: ★★★★★★

Overview: Materialise NV is a company that offers additive manufacturing and medical software, along with 3D printing services across the Americas, Europe and Africa, and the Asia-Pacific, with a market cap of approximately $450.68 million.

Operations: Materialise generates revenue primarily from its Materialise Medical (€112.37 million), Materialise Software (€44.03 million), and Materialise Manufacturing (€109.99 million) segments.

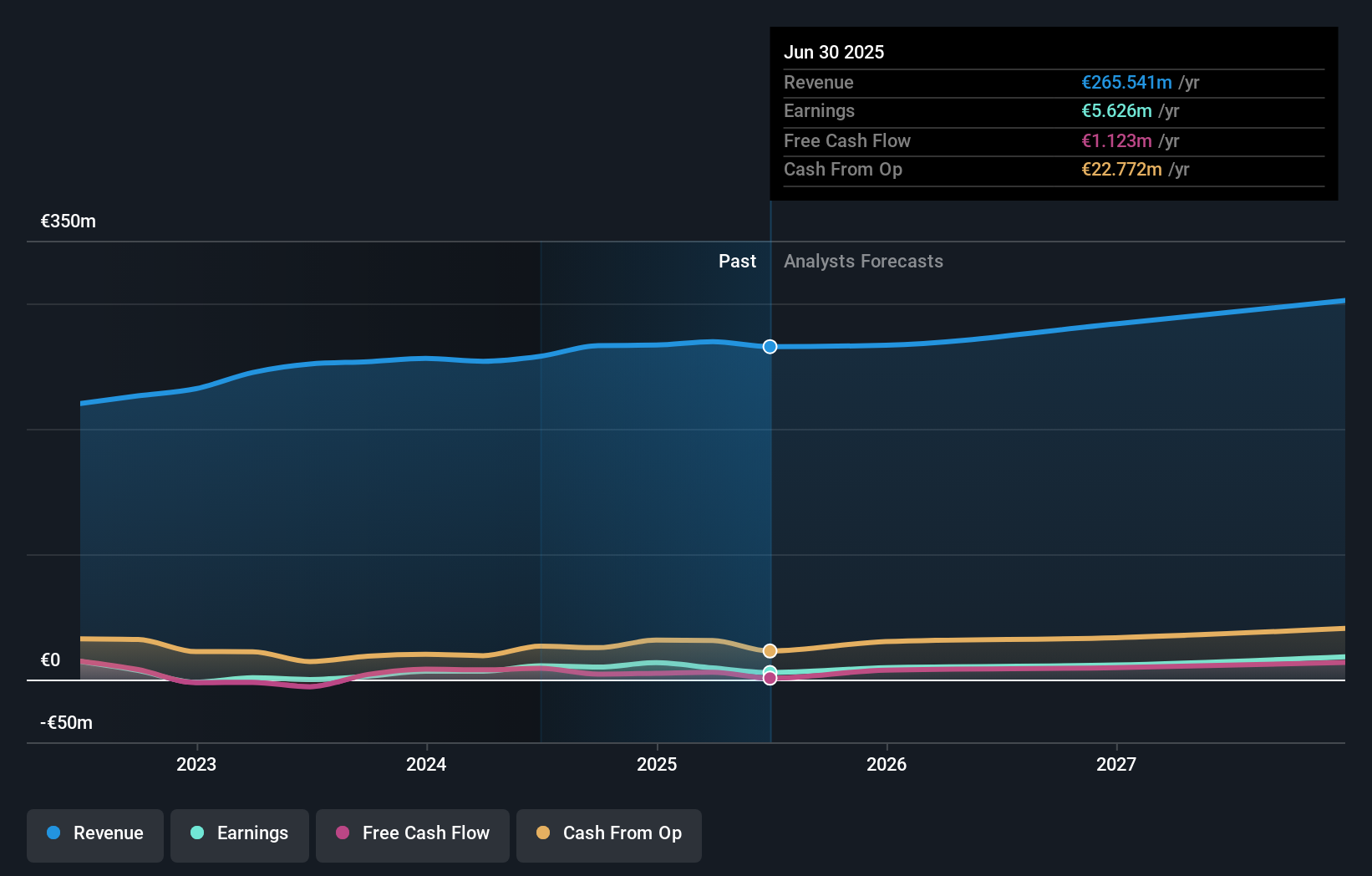

Materialise, a nimble player in the 3D printing industry, has shown impressive growth with earnings soaring 274% over the past year, outpacing the software sector's average. The company reported third-quarter sales of €68.65 million, up from €60.13 million last year, despite a net income dip to €3.05 million due to a significant one-off loss of €9.4 million affecting its annual results. With debt levels reduced significantly from 90% to 18% over five years and more cash than total debt, Materialise seems well-positioned for future expansion supported by robust free cash flow generation and strong interest coverage capabilities.

- Get an in-depth perspective on Materialise's performance by reading our health report here.

Evaluate Materialise's historical performance by accessing our past performance report.

Key Takeaways

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 228 more companies for you to explore.Click here to unveil our expertly curated list of 231 US Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willdan Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WLDN

Willdan Group

Provides professional, technical, and consulting services primarily in the United States.

Flawless balance sheet with solid track record.