Narratives are currently in beta

Key Takeaways

- Growing demand in regions like Florida and Texas, along with strategic acquisitions, suggests strong potential for future revenue and margin growth for Willdan.

- Expansion in energy efficiency services and advanced technologies, including AI, positions Willdan for increased market penetration and revenue opportunities.

- Willdan’s focus on state policies and high dependency on utility and government clients could lead to earnings volatility if market dynamics change.

Catalysts

About Willdan Group- Provides professional, technical, and consulting services primarily in the United States.

- Willdan's growing capabilities and demand in regions like Florida and Texas suggest strong future organic revenue growth opportunities, particularly in municipal engineering and rebuilding efforts after natural disasters. This is likely to positively impact revenue growth.

- The acquisition of Enica Engineering is aimed at enhancing Willdan's commercial capabilities, particularly for data centers, which could generate significant future revenue and margin growth. The acquisition is expected to be accretive to 2025 earnings and EPS.

- Rising demand for energy efficiency services, especially in states with high electricity prices like California, positions Willdan to capitalize on more cost-effective solutions, possibly leading to higher margins and boosting earnings.

- The expansion of advanced technologies, including AI integration in LoadSEER grid planning software, offers Willdan the chance to penetrate new markets, enhancing revenue channels and potentially increasing EBIT margins due to higher-value offerings.

- Continued strong multi-year utility contracts and expansion in sectors driven by AI and data center energy requirements suggest sustained revenue growth and higher EPS, as these sectors represent robust and expanding revenue streams for Willdan.

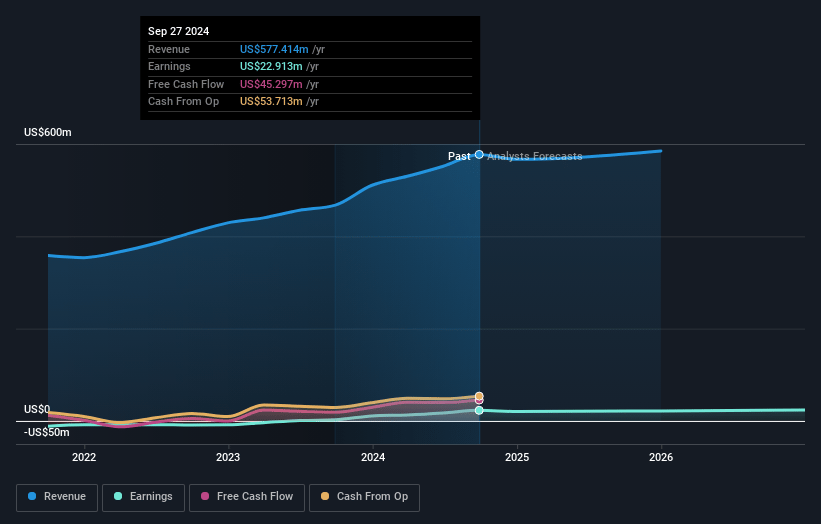

Willdan Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Willdan Group's revenue will grow by 1.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 4.0% today to 3.9% in 3 years time.

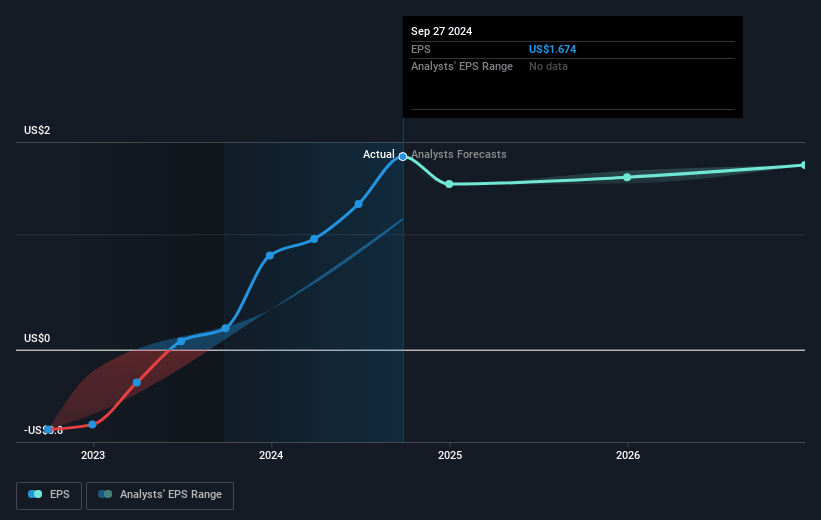

- Analysts expect earnings to reach $23.6 million (and earnings per share of $1.56) by about November 2027, up from $22.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 42.2x on those 2027 earnings, up from 26.8x today. This future PE is greater than the current PE for the US Professional Services industry at 27.4x.

- Analysts expect the number of shares outstanding to grow by 2.3% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 6.44%, as per the Simply Wall St company report.

Willdan Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Willdan’s reliance on state policies rather than federal ones could present a vulnerability if states change their stance on energy efficiency programs, which could impact their revenue and client engagements.

- Rising electricity costs in major markets like California could affect the cost savings advantage that drives demand for Willdan’s services, potentially impacting future revenue growth.

- High exposure to utility and government clients (93% of revenue) may result in earnings volatility due to changing priorities or budget constraints in these sectors.

- Some growth areas, such as work in Texas and Florida, are relatively smaller and might not scale quickly enough to significantly impact overall revenue, potentially dampening earnings projections.

- Acquisitions like Enica are expected to boost commercial sector contributions from a modest level, but integration challenges or slower-than-expected growth could impact net margins and anticipated synergies.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $55.0 for Willdan Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $599.4 million, earnings will come to $23.6 million, and it would be trading on a PE ratio of 42.2x, assuming you use a discount rate of 6.4%.

- Given the current share price of $43.41, the analyst's price target of $55.0 is 21.1% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives