- United States

- /

- Commercial Services

- /

- OTCPK:WHLM

Introducing Wilhelmina International (NASDAQ:WHLM), A Stock That Climbed 15% In The Last Five Years

The main point of investing for the long term is to make money. Better yet, you'd like to see the share price move up more than the market average. Unfortunately for shareholders, while the Wilhelmina International, Inc. (NASDAQ:WHLM) share price is up 15% in the last five years, that's less than the market return. Unfortunately the share price is down 4.0% in the last year.

See our latest analysis for Wilhelmina International

Given that Wilhelmina International only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, companies that are not judged on their (small) profits should be growing revenue quickly. The main reason for this is that fast revenue growth can be readily extrapolated into a profitable future, but stagnant revenue cannot.

In the last 5 years Wilhelmina International saw its revenue grow at 1.7% per year. That's not a very high growth rate considering it doesn't make profits. It's probably fair to say that the modest growth is reflected in the modest share price gain of 2.8% per year. If profitability is likely in the near term, then this might be one to add to your watchlist.

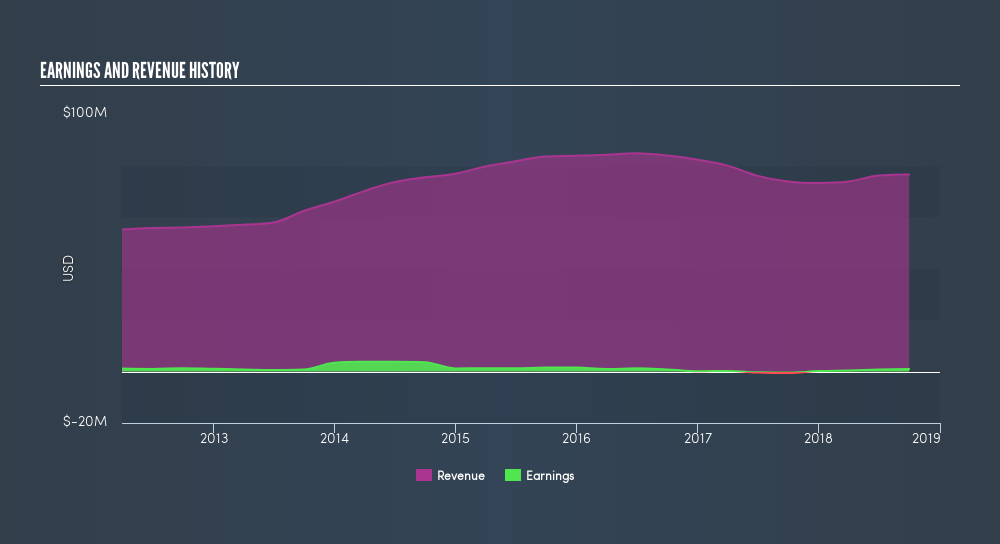

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

If you are thinking of buying or selling Wilhelmina International stock, you should check out this FREEdetailed report on its balance sheet.

A Different Perspective

Investors in Wilhelmina International had a tough year, with a total loss of 4.0%, against a market gain of about 0.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 2.8%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this freelist of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OTCPK:WHLM

Wilhelmina International

Primarily engages in the fashion model management business.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives